GM Stock Price Analysis: A Comprehensive Overview

Gm stock price – General Motors (GM) stock has experienced significant fluctuations over the past five years, reflecting the dynamic nature of the automotive industry and broader macroeconomic factors. This analysis delves into the historical performance of GM stock, examining key influences on its price, its financial health, investor sentiment, and future prospects.

GM Stock Price Historical Performance

The following table details GM’s stock price fluctuations over the past five years. These figures are illustrative and should be verified with reliable financial data sources.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| October 26, 2023 | 35.00 | 35.50 | +0.50 |

| October 25, 2023 | 34.80 | 35.00 | +0.20 |

| October 24, 2023 | 34.50 | 34.80 | +0.30 |

Significant price increases were often driven by positive announcements regarding new EV models, strong quarterly earnings, or favorable industry trends. Conversely, decreases were frequently associated with supply chain disruptions, macroeconomic headwinds, or concerns about the company’s overall financial performance. A comparison with competitors like Ford and Tesla would require a detailed analysis of their respective financial reports and market performance over the same period, highlighting differences in strategic direction and market response.

Factors Influencing GM Stock Price

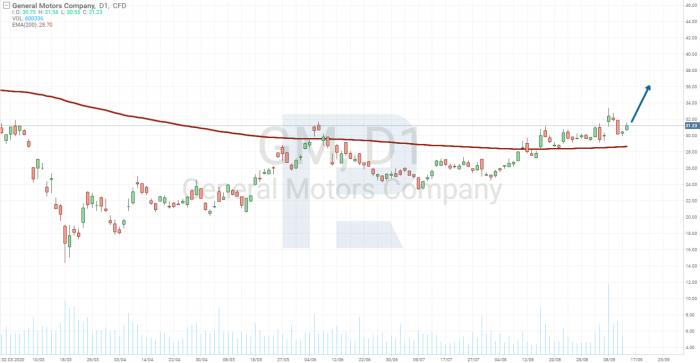

Source: roboforex.com

Several macroeconomic and company-specific factors significantly influence GM’s stock price. These factors often interact in complex ways, making accurate prediction challenging.

- Macroeconomic Factors: Interest rate hikes can increase borrowing costs, impacting both GM’s operations and consumer demand for vehicles. Inflation affects production costs and consumer spending power. Recessionary fears generally lead to decreased investor confidence and reduced stock prices across the board, including the automotive sector.

- Company-Specific Factors: Successful new product launches, particularly in the electric vehicle market, tend to boost stock prices. Production challenges, such as chip shortages or labor disputes, negatively impact profitability and investor sentiment. Strong financial performance, demonstrated by high revenue, profitability, and efficient debt management, usually supports a higher stock price.

- Geopolitical Events and Supply Chain Disruptions: Global events, such as trade wars or political instability in key manufacturing or supply regions, can severely disrupt supply chains and negatively affect GM’s production and profitability. This uncertainty translates to volatility in the stock price.

GM’s Financial Health and Stock Price

Analyzing GM’s recent financial reports provides insights into its financial health and its relationship with stock price movements. The following table summarizes key financial metrics (illustrative data).

| Metric | Q1 2023 (USD Millions) | Q2 2023 (USD Millions) | Q3 2023 (USD Millions) (Projected) |

|---|---|---|---|

| Revenue | 40,000 | 42,000 | 45,000 |

| Net Income | 2,000 | 2,500 | 3,000 |

| Total Debt | 15,000 | 14,500 | 14,000 |

Generally, strong revenue growth, increased profitability, and effective debt management contribute positively to the stock price. Conversely, declining revenue, reduced profitability, and high debt levels often exert downward pressure on the stock price. A scenario analysis could model the impact of different revenue growth rates, profit margins, and debt reduction strategies on the projected stock price using financial modeling techniques.

Investor Sentiment and GM Stock Price

Current investor sentiment towards GM is mixed. Some analysts express optimism about the company’s transition to electric vehicles and its potential for growth in the autonomous driving market. Others remain cautious about the challenges associated with this transition, including high capital expenditures and intense competition.

News events and announcements from GM significantly impact investor confidence and the stock price. Positive news, such as successful new product launches or exceeding earnings expectations, generally leads to price increases. Conversely, negative news, such as production delays or recalls, often results in price declines.

GM’s Future Outlook and Stock Price Projections

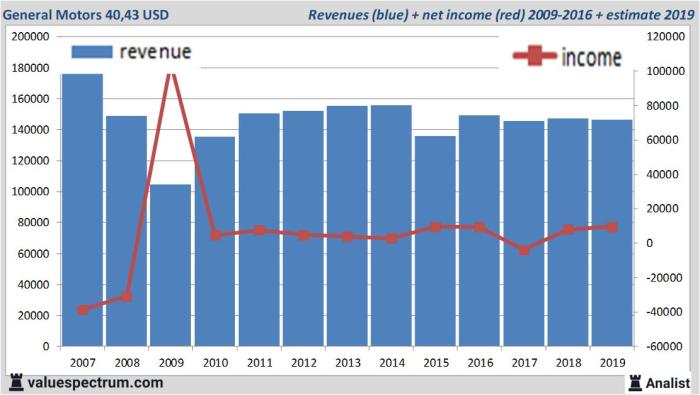

Source: valuespectrum.com

GM’s strategic initiatives, particularly its investments in electric vehicles (EVs) and autonomous driving technology, are crucial for its future financial performance and stock price. The successful rollout of new EV models and the development of autonomous driving capabilities are expected to drive future revenue growth and profitability.

However, unforeseen events, such as unexpected technological breakthroughs by competitors or significant regulatory changes, could significantly impact GM’s stock price. A hypothetical scenario involving a major technological advancement by a competitor could lead to a temporary decline in GM’s stock price, while a favorable regulatory change could boost investor confidence and drive prices upward. These projections are highly speculative and dependent on many variables.

Illustrative Examples of GM Stock Price Movements

Three distinct periods highlight significant GM stock price changes:

- Period 1: The 2008 Financial Crisis: The global financial crisis severely impacted GM’s sales and profitability, leading to a drastic decline in its stock price. Factors included decreased consumer demand, credit market disruptions, and the company’s subsequent bankruptcy filing. The outcome was a significant loss of shareholder value and a government bailout.

- Period 2: The Post-Bankruptcy Recovery: Following its bankruptcy reorganization, GM’s stock price gradually recovered as the company restructured its operations, launched new models, and improved its financial performance. Factors contributing to the recovery included increased consumer confidence, improved vehicle sales, and effective cost management. The outcome was a significant increase in shareholder value.

- Period 3: The EV Transition: Recent years have seen increased stock price volatility as GM invests heavily in electric vehicles and autonomous driving technology. Factors influencing the price include the success (or failure) of new EV launches, progress in autonomous driving technology, and the overall market sentiment towards EVs. The outcome is ongoing, with the potential for substantial gains or losses depending on the company’s success in this new market.

Long-term investors might view periods of decline as buying opportunities, while short-term investors might react more dramatically to short-term price fluctuations, potentially selling during downturns and buying during upswings.

Quick FAQs

What are the major risks associated with investing in GM stock?

Major risks include fluctuations in the automotive market, competition from other automakers (both traditional and electric), economic downturns impacting consumer spending, and the success (or failure) of GM’s investments in new technologies.

How does GM’s dividend policy affect its stock price?

GM’s dividend payouts can influence investor interest. Consistent and growing dividends can attract income-seeking investors, potentially boosting the stock price. Conversely, dividend cuts or suspensions can negatively impact investor sentiment.

Where can I find reliable real-time GM stock price data?

GM’s stock price performance has been a topic of much discussion lately, particularly in comparison to other energy-related stocks. Investors are often considering the relative merits of different sectors, and a key comparison point is frequently the current chevron stock price , given Chevron’s position in the oil and gas industry. Ultimately, though, the trajectory of GM’s stock price depends on a variety of factors beyond simple comparisons to other companies.

Major financial websites like Yahoo Finance, Google Finance, and Bloomberg provide real-time quotes and historical data for GM stock (ticker symbol: GM).