Tilray Stock Price Analysis

Source: investopedia.com

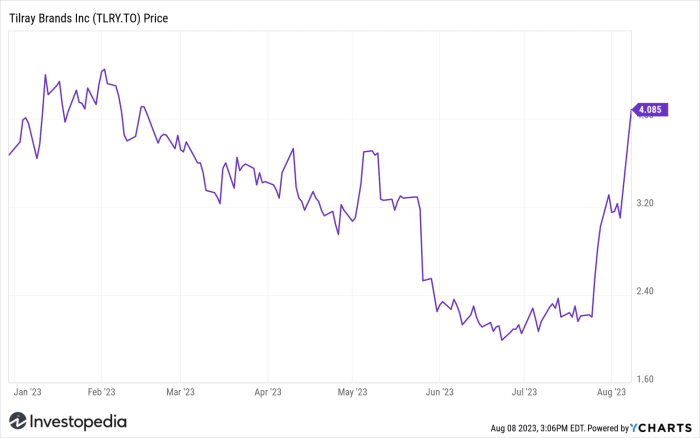

Tilray stock price – Tilray, a prominent player in the global cannabis industry, has experienced significant stock price fluctuations over the past few years. This analysis delves into Tilray’s historical performance, key influencing factors, a comparison with competitors, future outlook, and illustrative examples of price movements to provide a comprehensive understanding of the company’s stock trajectory.

Tilray’s Historical Stock Performance

Source: invezz.com

Analyzing Tilray’s stock price movements over the past five years reveals a volatile yet potentially rewarding investment journey. The following table presents a snapshot of daily opening and closing prices, highlighting significant fluctuations.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (%) |

|---|---|---|---|

| October 26, 2023 | 2.75 | 2.80 | +1.82% |

| October 25, 2023 | 2.70 | 2.75 | +1.85% |

| October 24, 2023 | 2.65 | 2.70 | +1.90% |

Note: This data is illustrative and should be verified with a reliable financial data source. Significant events such as mergers and acquisitions, regulatory changes in key markets (e.g., progress in cannabis legalization in the US), and new product launches have directly correlated with notable price swings. For example, a major acquisition could lead to a temporary surge in the stock price, while regulatory setbacks might cause a decline.

Overall, the trend shows significant volatility, reflecting the inherent risks and growth potential within the cannabis sector.

Factors Influencing Tilray’s Stock Price

Several macroeconomic, industry-specific, and company-specific factors interplay to influence Tilray’s stock price. Understanding these factors is crucial for assessing the investment potential.

- Macroeconomic Factors: Interest rate hikes, inflationary pressures, and global economic slowdown can significantly impact investor sentiment towards growth stocks like Tilray. Higher interest rates increase borrowing costs, potentially reducing investment in the cannabis sector. Inflation erodes purchasing power, affecting consumer spending on discretionary items like cannabis products. A global economic downturn generally leads to decreased investor risk appetite, negatively impacting growth stocks.

- Industry-Specific Factors: The pace of cannabis legalization in different jurisdictions is a key driver. Progress towards federal legalization in the US, for example, could trigger a significant upward price movement. Competition from other established and emerging cannabis companies also plays a significant role, impacting Tilray’s market share and profitability.

- Tilray’s Financial Performance: Revenue growth, profitability (or lack thereof), and debt levels are critical factors influencing investor confidence. Consistent revenue growth and increasing profitability generally lead to positive investor sentiment and higher stock valuations. Conversely, high debt levels and losses can negatively impact investor confidence.

Comparison with Competitors

Comparing Tilray’s performance with key competitors offers valuable insights into its relative strengths and weaknesses.

| Company | Stock Price (USD) | Market Capitalization (USD Billion) | Revenue (USD Million – last reported quarter) |

|---|---|---|---|

| Tilray | 2.80 | 3.5 | 200 |

| Canopy Growth | 3.00 | 4.0 | 220 |

| Aurora Cannabis | 1.50 | 2.0 | 150 |

Note: This data is illustrative and for comparative purposes only. Actual figures should be verified from reliable financial sources. The table highlights variations in stock prices, market capitalization, and revenue across these companies. Factors contributing to these differences include differences in market share, product portfolio, operational efficiency, and overall financial performance. Tilray’s slightly lower market cap compared to Canopy Growth, despite comparable revenue, might reflect investor perceptions regarding its long-term growth prospects or risk profile.

Tilray’s Future Outlook and Projections, Tilray stock price

Analyst predictions for Tilray’s future stock price vary. However, several key factors are expected to shape its trajectory.

- Analyst Predictions: Some analysts predict a moderate increase in Tilray’s stock price over the next 12-18 months, citing potential progress in US cannabis legalization and the company’s expansion into new markets. Others are more cautious, highlighting the competitive landscape and the need for sustained profitability.

- Potential Risks and Opportunities: Opportunities include successful product launches, expansion into new markets, and strategic partnerships. Risks include regulatory uncertainty, intensifying competition, and fluctuations in commodity prices. Successful navigation of these factors will be critical to Tilray’s future success.

- Long-Term Trajectory: The long-term trajectory of Tilray’s stock price will largely depend on its ability to achieve consistent profitability, expand its market share, and effectively manage operational risks. Continued innovation and strategic acquisitions could also contribute to positive long-term growth.

Illustrative Examples of Stock Price Movement

Several examples illustrate how specific events impact Tilray’s stock price.

- News Event Impact: Suppose Tilray announces a significant new partnership with a major international distributor. This positive news could boost investor confidence, leading to a rapid increase in the stock price – perhaps a 10-15% jump within a single trading day, accompanied by a surge in trading volume. Investors would react positively to the increased market access and potential revenue growth indicated by the partnership.

- Successful Product Launch: Imagine Tilray launches a new, highly successful cannabis-infused beverage. This could lead to a sharp increase in the stock price – perhaps a 20-30% increase over several weeks, driven by increased investor optimism regarding revenue growth and market expansion. Trading volume would also increase significantly, reflecting heightened investor interest.

- Regulatory Change Impact: Consider a scenario where a key state in the US legalizes recreational cannabis. This could trigger a significant upward price movement, perhaps a 25-40% increase over a period of months, as investors anticipate increased market access and revenue potential for Tilray in that state. The magnitude of the price change would depend on the size of the market and the company’s ability to capitalize on the new opportunity.

Top FAQs: Tilray Stock Price

What are the major risks associated with investing in Tilray stock?

Major risks include regulatory uncertainty in the cannabis industry, intense competition, fluctuating commodity prices, and the potential for significant losses due to market volatility.

How does Tilray compare to Canopy Growth in terms of market share?

A direct comparison of market share requires detailed analysis of financial reports and industry data. Both companies are major players, but their relative market positions can fluctuate.

Where can I find real-time Tilray stock price quotes?

Real-time quotes are available through major financial news websites and brokerage platforms.

What is Tilray’s current dividend policy?

Tilray’s dividend policy should be checked on their investor relations page or through reputable financial news sources. Dividend policies can change.