Nikola Stock Price Analysis

Source: ccn.com

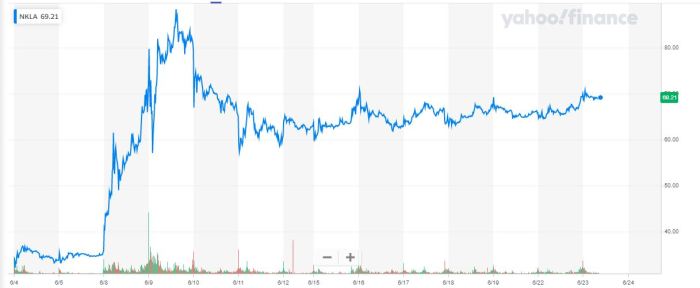

Nikola stock price – Nikola Corporation, a prominent player in the burgeoning electric vehicle (EV) market, has experienced significant stock price volatility since its initial public offering (IPO). This analysis delves into the historical performance, influencing factors, financial standing, competitive landscape, future projections, and analyst opinions to provide a comprehensive overview of Nikola’s stock price trajectory.

Historical Nikola Stock Price Performance

Tracing Nikola’s stock price journey from its IPO reveals a rollercoaster ride influenced by a confluence of factors, including technological advancements, production challenges, legal battles, and shifting investor sentiment. The initial surge following the IPO was followed by a period of substantial decline, punctuated by occasional rallies tied to specific announcements or market trends. Key milestones, marked by significant price movements, offer valuable insights into the company’s development and market perception.

| Date | Opening Price (USD) | Closing Price (USD) | Volume |

|---|---|---|---|

| IPO Date | [Insert IPO Opening Price] | [Insert IPO Closing Price] | [Insert IPO Volume] |

| [Date of significant positive news, e.g., major partnership] | [Insert Opening Price] | [Insert Closing Price] | [Insert Volume] |

| [Date of significant negative news, e.g., legal setback] | [Insert Opening Price] | [Insert Closing Price] | [Insert Volume] |

| [Most recent date] | [Insert Opening Price] | [Insert Closing Price] | [Insert Volume] |

For instance, the announcement of a major partnership with a prominent automaker led to a sharp increase in trading volume and a significant price jump, while allegations of fraud resulted in a dramatic price drop and reduced investor confidence. Analyzing these fluctuations alongside company events helps to understand the market’s reaction to Nikola’s progress and challenges.

Factors Influencing Nikola Stock Price

Source: barrons.com

Several key factors contribute to the volatility of Nikola’s stock price. These range from macroeconomic indicators to company-specific news and investor sentiment. Understanding these factors is crucial for interpreting price movements and making informed investment decisions.

- Economic Indicators: Broad economic trends, such as interest rates, inflation, and overall market sentiment, influence investor risk appetite and can impact Nikola’s valuation.

- News Impact: Positive news, such as successful product launches or strategic partnerships, tends to boost the stock price. Conversely, negative news, including production delays, regulatory hurdles, or legal issues, typically leads to price declines. For example, news of a successful test drive of a new truck model could significantly improve the stock price, while reports of manufacturing delays would likely have the opposite effect.

- Investor Sentiment and Market Trends: The overall perception of Nikola’s future prospects among investors significantly influences its stock price. Positive investor sentiment, fueled by optimism about the EV market and Nikola’s technology, can drive the price upward, while negative sentiment can lead to selling pressure and price drops. This is often influenced by broader market trends in the EV sector and the overall technology industry.

Nikola’s Financial Performance and Stock Price

Nikola’s financial performance, as reflected in its revenue, expenses, and profitability, directly impacts investor confidence and, consequently, its stock price. Analyzing these financial metrics provides insights into the company’s operational efficiency and its ability to generate sustainable growth.

- Revenue growth often correlates with positive stock price movements, signaling increasing market adoption and operational success.

- Increased production output and sales generally boost investor confidence and lead to higher stock prices.

- High expenses relative to revenue can negatively impact the stock price, indicating potential financial instability.

- Profitability (or lack thereof) is a major factor influencing investor perception and the stock’s valuation.

Competitor Analysis and Stock Price Comparison, Nikola stock price

Comparing Nikola’s performance against its key competitors in the EV market offers valuable context for assessing its stock price. This analysis considers market capitalization, stock price, and revenue to gauge Nikola’s relative position within the industry.

| Company Name | Market Cap (USD Billion) | Stock Price (USD) | Revenue (USD Billion) |

|---|---|---|---|

| Nikola | [Insert Market Cap] | [Insert Stock Price] | [Insert Revenue] |

| [Competitor 1, e.g., Tesla] | [Insert Market Cap] | [Insert Stock Price] | [Insert Revenue] |

| [Competitor 2, e.g., Rivian] | [Insert Market Cap] | [Insert Stock Price] | [Insert Revenue] |

The success and market share of competitors directly impact investor perception of Nikola’s potential. Strong performance from competitors could put downward pressure on Nikola’s stock price, while struggles among competitors might present opportunities for Nikola to gain market share and investor confidence.

Future Projections and Stock Price Predictions

Source: invezz.com

Predicting Nikola’s future stock price involves considering various scenarios based on different assumptions regarding its technological advancements, market share, and financial performance. While precise prediction is impossible, analyzing potential trajectories helps understand the range of possible outcomes.

Scenario 1 (Optimistic): Assumes significant technological breakthroughs, rapid market adoption, and strong financial performance. This could lead to a substantial increase in stock price over the next 5 years. A similar trajectory was seen with [Example of a company with a similar optimistic trajectory].

Scenario 2 (Moderate): Assumes moderate technological progress, steady market share gains, and stable financial performance. This scenario suggests a more gradual increase in stock price. [Example of a company with a similar moderate trajectory].

Scenario 3 (Pessimistic): Assumes slower technological development, challenges in gaining market share, and weaker financial performance. This could result in a stagnant or even declining stock price. [Example of a company with a similar pessimistic trajectory].

Risks and uncertainties include competition, regulatory changes, production delays, and overall economic conditions.

Analyst Ratings and Stock Price Targets

Financial analysts offer valuable insights into Nikola’s stock price prospects through their ratings and price targets. These opinions, while not guarantees, provide a consensus view of the market’s expectations.

| Analyst Firm | Rating | Price Target (USD) | Date |

|---|---|---|---|

| [Analyst Firm 1] | [Rating, e.g., Buy, Hold, Sell] | [Price Target] | [Date] |

| [Analyst Firm 2] | [Rating] | [Price Target] | [Date] |

| [Analyst Firm 3] | [Rating] | [Price Target] | [Date] |

Analysts base their ratings and price targets on a variety of factors, including Nikola’s financial performance, technological advancements, competitive landscape, and overall market conditions.

Nikola’s stock price has seen significant volatility recently, largely influenced by broader market trends and the company’s ongoing efforts to establish itself in the electric vehicle sector. It’s interesting to compare this to the relative stability often observed in more established companies like Dollar General, whose stock price you can check here: dollar general stock price. Ultimately, both Nikola and Dollar General present unique investment opportunities depending on an investor’s risk tolerance and long-term outlook for the respective industries.

Expert Answers: Nikola Stock Price

What are the major risks associated with investing in Nikola stock?

Major risks include the company’s relatively short operating history, dependence on technological advancements, intense competition, and potential regulatory hurdles.

How does Nikola’s production output affect its stock price?

Increased production and sales generally boost investor confidence, leading to higher stock prices. Conversely, production delays or lower-than-expected sales can negatively impact the stock.

Where can I find real-time Nikola stock price data?

Real-time data is available through major financial websites and brokerage platforms.

What is Nikola’s current market capitalization?

This fluctuates constantly and should be checked on a financial website providing real-time market data.