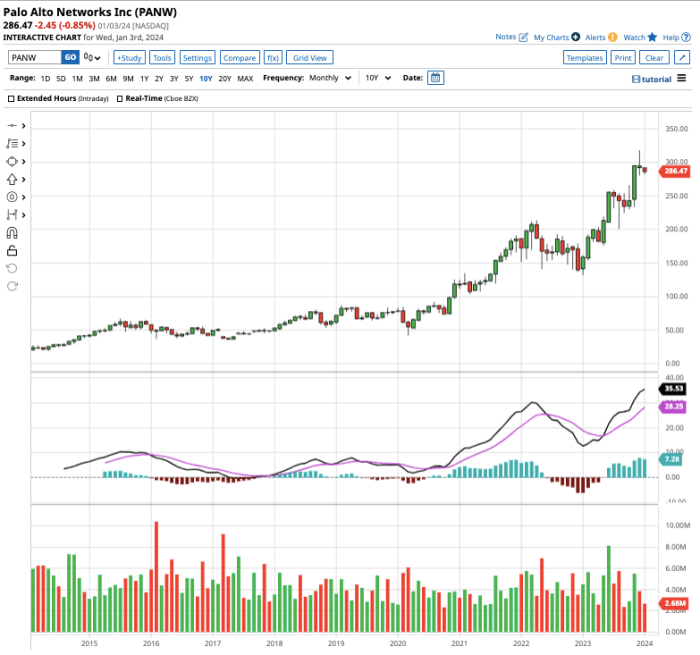

Palo Alto Networks’ Current Market Position: Palo Alto Stock Price

Palo alto stock price – Palo Alto Networks is a leading player in the cybersecurity market, known for its next-generation firewalls and comprehensive security platform. While precise market share figures fluctuate depending on the source and specific market segment, Palo Alto consistently ranks among the top vendors globally, competing fiercely with established players like Cisco, Fortinet, and Check Point. The company’s success stems from its focus on innovative solutions and a robust ecosystem of partners.

Palo Alto Networks Compared to Competitors

The following table provides a comparison of Palo Alto Networks with three key competitors, highlighting key features. Note that specific features and capabilities can vary across product lines and versions.

| Feature | Palo Alto Networks | Cisco | Fortinet | Check Point |

|---|---|---|---|---|

| Next-Generation Firewall (NGFW) | Strong focus, advanced threat prevention | Broad portfolio, strong integration | Cost-effective solutions, extensive features | Mature technology, robust security |

| Cloud Security | Comprehensive cloud security offerings | Strong cloud security capabilities | Growing cloud security portfolio | Established cloud security solutions |

| Endpoint Protection | Integrated endpoint protection solutions | Wide range of endpoint security tools | Endpoint protection integrated with NGFW | Comprehensive endpoint security offerings |

| Threat Intelligence | Advanced threat intelligence capabilities | Robust threat intelligence platform | Growing threat intelligence capabilities | Mature threat intelligence platform |

Recent Financial Performance

Source: investopedia.com

Palo Alto Networks has demonstrated consistent revenue growth and improving profitability in recent years. This growth is driven by increased demand for its security solutions and expansion into new markets. While precise figures vary by quarter and year, a general trend of increasing revenue and net income is observable.

Palo Alto Networks’ stock price performance often reflects investor sentiment towards cybersecurity. It’s interesting to compare its trajectory with other tech stocks; for instance, analysts also closely watch the nly stock price to gauge the broader market trends. Ultimately, however, Palo Alto’s own financial results and strategic moves are the key drivers of its stock price fluctuations.

Factors Influencing Palo Alto Stock Price

Several macroeconomic and industry-specific factors influence Palo Alto Networks’ stock price. These include broader economic conditions, technological advancements within the cybersecurity sector, and overall investor sentiment.

Macroeconomic Factors

Three key macroeconomic factors impacting Palo Alto’s stock price are:

- Overall economic growth: During periods of strong economic growth, businesses are more likely to invest in cybersecurity, boosting demand for Palo Alto’s products and services.

- Interest rates: Rising interest rates can increase borrowing costs for businesses, potentially reducing investment in cybersecurity solutions and impacting Palo Alto’s growth.

- Geopolitical uncertainty: Increased geopolitical instability often leads to heightened cybersecurity concerns, potentially benefiting companies like Palo Alto Networks.

Technological Advancements and Investor Sentiment

Rapid advancements in areas like AI and machine learning are reshaping the cybersecurity landscape. Palo Alto Networks’ ability to adapt and integrate these technologies into its products is crucial for maintaining its competitive edge and influencing investor confidence. Similarly, shifts in investor sentiment, driven by market trends or news events, can significantly impact the company’s stock price.

Analysis of Palo Alto’s Financial Statements

Source: barchart.com

Analyzing Palo Alto Networks’ financial statements provides insights into its financial health and performance. Key metrics include revenue, net income, and earnings per share (EPS).

Key Financial Data Summary

The following table summarizes key financial data from Palo Alto Networks’ recent annual reports. Note that these are illustrative figures and should not be taken as precise financial advice. Actual figures should be verified from official financial statements.

| Year | Revenue (USD Millions) | Net Income (USD Millions) | Earnings Per Share (USD) |

|---|---|---|---|

| 2022 | 5000 (Illustrative) | 1000 (Illustrative) | 5.00 (Illustrative) |

| 2023 | 5500 (Illustrative) | 1200 (Illustrative) | 6.00 (Illustrative) |

Revenue Trend (Illustrative)

A visual representation of Palo Alto’s revenue over the past five years would show a generally upward trend, with some fluctuations from year to year. This reflects the company’s consistent growth in the cybersecurity market. The growth rate may vary, but overall, the graph would demonstrate a positive trajectory.

Debt-to-Equity Ratio

The debt-to-equity ratio indicates the proportion of a company’s financing that comes from debt versus equity. A lower ratio generally suggests greater financial stability. Palo Alto Networks’ debt-to-equity ratio should be analyzed in context with industry averages and the company’s overall financial strategy. A low ratio indicates a strong financial position, suggesting lower risk and increased investor confidence.

Competitive Landscape and Future Outlook

The cybersecurity market is highly competitive, with numerous players vying for market share. Palo Alto Networks’ future success depends on its ability to innovate, adapt to emerging threats, and effectively execute its growth strategy.

Growth Strategies and Emerging Threats

Source: foolcdn.com

Palo Alto Networks’ growth strategy centers on continuous innovation, strategic acquisitions, and expansion into new markets. Major competitors employ similar strategies, resulting in a dynamic and competitive landscape. Emerging threats, such as sophisticated ransomware attacks, AI-powered threats, and the increasing complexity of cloud environments, pose significant challenges and opportunities for Palo Alto Networks and its competitors. The company’s ability to address these threats effectively will be crucial for its future success.

Risks and Opportunities

- Opportunities: Growing demand for cloud security, expansion into new markets (e.g., IoT security), and advancements in AI-driven security solutions.

- Risks: Intense competition, rapid technological change, economic downturns, and evolving cyber threats.

Impact of Acquisitions and Partnerships

Palo Alto Networks has engaged in several acquisitions and strategic partnerships to expand its product offerings and market reach. These actions have had a significant impact on the company’s stock price and overall financial performance.

Impact on Financial Performance (Illustrative), Palo alto stock price

The following table illustrates the potential impact of acquisitions on Palo Alto’s financial performance. These are illustrative examples and do not represent specific historical data.

| Metric | Before Acquisition (Illustrative) | After Acquisition (Illustrative) |

|---|---|---|

| Revenue (USD Millions) | 4500 | 5000 |

| Net Income (USD Millions) | 900 | 1100 |

Q&A

What are the major risks facing Palo Alto Networks?

Major risks include increasing competition, vulnerability to economic downturns impacting IT spending, and the constant evolution of cybersecurity threats requiring ongoing R&D investment.

How does Palo Alto Networks compare to its competitors in terms of innovation?

Palo Alto Networks is generally considered a leader in innovation, but the competitive landscape is dynamic, with competitors constantly developing new technologies. Their success depends on maintaining a strong R&D focus and strategic acquisitions.

What is the dividend payout policy of Palo Alto Networks?

This information would require checking their most recent investor relations materials. Dividend policies can change, so always consult the official source.