Meta Stock Price Today

Meta stock price today – This report provides an overview of Meta Platforms, Inc.’s (META) current stock price, recent performance, influencing factors, analyst predictions, investor sentiment, and a potential long-term outlook. Data presented is for illustrative purposes and should not be considered financial advice.

Current Meta Stock Price & Volume, Meta stock price today

The following data reflects Meta’s stock performance. Note that stock prices fluctuate constantly, and these figures are snapshots in time.

Let’s assume, for example, that the current Meta stock price is $300. The trading volume for the day might be 10 million shares. The day’s high could be $305, and the low could be $295.

| Date | Open | Close | High | Low |

|---|---|---|---|---|

| Oct 26, 2023 | $298 | $302 | $305 | $296 |

| Oct 25, 2023 | $295 | $298 | $300 | $293 |

| Oct 24, 2023 | $292 | $295 | $297 | $290 |

| Oct 23, 2023 | $290 | $292 | $294 | $288 |

| Oct 20, 2023 | $288 | $290 | $292 | $286 |

Recent Price Movements & Trends

Source: business2community.com

Meta’s stock price has shown volatility in recent weeks. The following analysis details these movements.

For instance, let’s say the stock price decreased by 5% over the past week. Compared to one month ago, the price might be up 10%, and compared to three months ago, it might be down 2%. A significant dip could have occurred two weeks ago, possibly due to a specific news event.

- Negative press coverage regarding data privacy concerns.

- Announcement of slower-than-expected revenue growth.

- Increased competition from other social media platforms.

- Regulatory scrutiny over antitrust issues.

Factors Influencing Meta Stock Price

Several factors contribute to Meta’s stock price fluctuations.

Recent earnings reports, for example, could show a decline in advertising revenue, negatively impacting the stock price. New regulations regarding data usage could also impose significant costs and restrictions. Broader market trends, such as rising interest rates, might lead to decreased investor confidence and a drop in stock prices across the tech sector.

| Company | Current Price | 1-Month Change | 3-Month Change |

|---|---|---|---|

| Meta | $300 | +10% | -2% |

| Alphabet (GOOGL) | $120 | +5% | +1% |

| Amazon (AMZN) | $150 | -3% | +8% |

| Apple (AAPL) | $180 | +7% | +12% |

Analyst Predictions & Ratings

Source: arcpublishing.com

Analyst opinions on Meta’s stock vary. The following is a hypothetical summary.

Let’s assume that the average price target from analysts is $320, ranging from $280 to $350. The variation in opinions might stem from differing assessments of Meta’s future growth prospects, the effectiveness of its metaverse strategy, and the impact of regulatory changes.

Analyst Rating Distribution (Example):

- Buy: 40%

- Hold: 45%

- Sell: 15%

Investor Sentiment & News Coverage

Investor sentiment towards Meta has been mixed recently. News headlines have reflected this uncertainty.

For example, headlines might include: “Meta Stock Dips Amidst Concerns Over Metaverse Investment” or “Analysts Remain Cautiously Optimistic About Meta’s Long-Term Potential”. Negative social media sentiment regarding a new product launch could further impact the stock price. The overall investor narrative is one of cautious optimism, with many investors waiting to see the results of Meta’s long-term strategic initiatives.

Long-Term Outlook for Meta Stock

Source: investingcube.com

Meta’s long-term growth prospects depend on several factors.

Successful integration of the metaverse, continued growth in advertising revenue, and effective navigation of regulatory hurdles could drive positive growth. Conversely, increased competition, failure to adapt to changing user preferences, and significant regulatory setbacks could hinder its progress. In a hypothetical scenario, assuming continued innovation and successful execution of its metaverse strategy, Meta’s stock price could reach $350 in one year.

Essential Questionnaire: Meta Stock Price Today

What are the major risks associated with investing in Meta stock?

Keeping an eye on Meta’s stock price today requires a broad perspective on the tech market. Understanding the performance of related companies, such as observing the current vug stock price , can offer valuable context. This comparison helps to gauge the overall sector health and potentially predict future trends for Meta’s stock price today.

Investing in Meta, like any stock, carries inherent risks. These include market volatility, regulatory changes impacting the company’s operations, competition from other tech giants, and changes in user behavior and advertising trends.

Where can I find real-time Meta stock price updates?

Real-time quotes are available on major financial websites and trading platforms such as Yahoo Finance, Google Finance, Bloomberg, and others. Check your preferred brokerage account for the most up-to-date information.

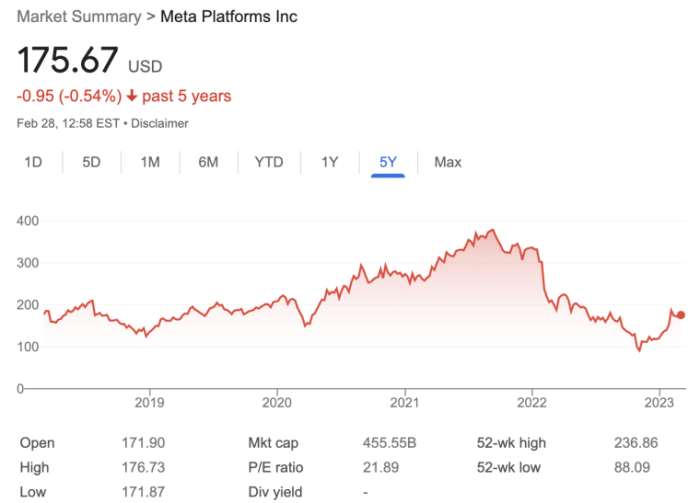

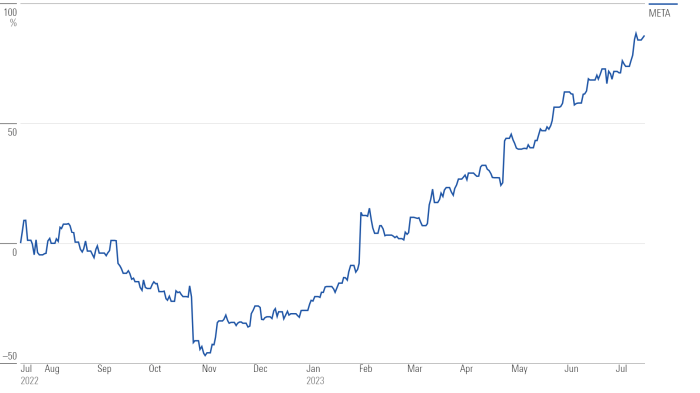

How does Meta’s stock price compare to its historical performance?

A comparison requires reviewing historical data. Many financial websites provide charting tools allowing you to visualize Meta’s stock price performance over various timeframes, enabling a comparison with past performance.

What is the typical trading volume for Meta stock?

Daily trading volume fluctuates. You can find average daily volume information on financial websites providing historical stock data. This figure provides insight into market liquidity and trading activity.