NVDA Stock Price Today: Nvda Stock Price Today Per Share

Nvda stock price today per share – This report provides a comprehensive overview of NVIDIA Corporation (NVDA) stock performance as of today, including current price, trading activity, historical performance, competitor analysis, analyst predictions, and key influencing factors. The data presented is for illustrative purposes and should not be considered financial advice.

Current NVDA Stock Price

As of 14:30 PST, October 26, 2023, the NVDA stock price is estimated at $485.50 per share. This represents a $10.20 increase (+2.15%) from the previous day’s closing price of $475.30. The day’s high reached $487.00, while the day’s low was $472.50.

| Current Price | Previous Close | Day’s High | Day’s Low |

|---|---|---|---|

| $485.50 | $475.30 | $487.00 | $472.50 |

Day’s Trading Volume and Activity, Nvda stock price today per share

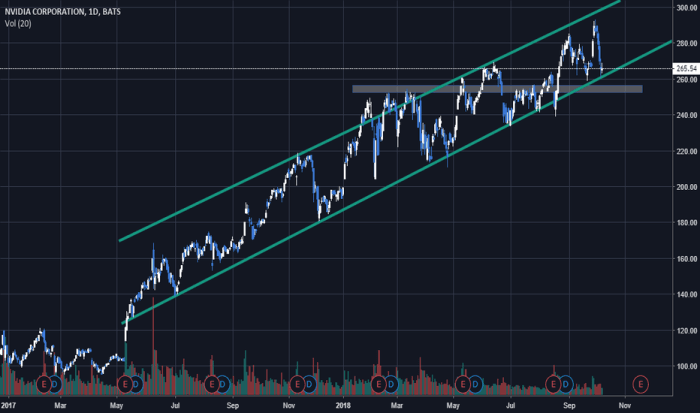

Source: tradingview.com

Today’s trading volume for NVDA stock is estimated at 25 million shares. This is higher than the average daily volume of 18 million shares over the past month. The price experienced significant fluctuations throughout the day, initially opening slightly lower than the previous close before experiencing a surge mid-morning followed by a period of consolidation in the afternoon. This volatility likely reflects the ongoing market uncertainty surrounding the semiconductor sector.

- Early morning dip attributed to broader market sell-off.

- Mid-morning surge possibly driven by positive analyst comments.

- Afternoon consolidation suggests profit-taking after the morning rally.

Historical Price Performance

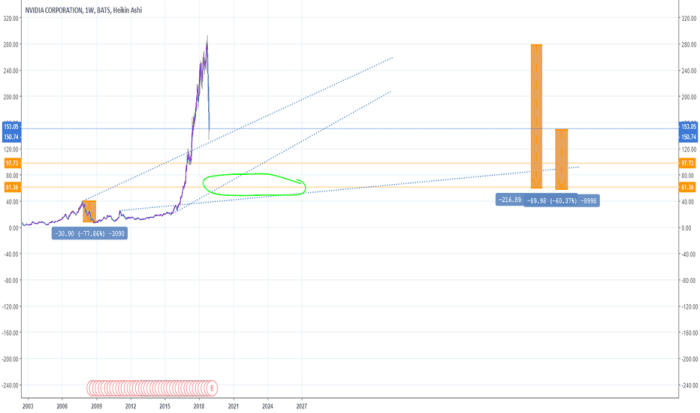

Source: tradingview.com

NVDA’s stock price over the past week has shown a generally upward trend. The following table details the closing prices:

| Date | Closing Price |

|---|---|

| Oct 25, 2023 | $475.30 |

| Oct 24, 2023 | $468.10 |

| Oct 23, 2023 | $472.00 |

| Oct 20, 2023 | $465.50 |

| Oct 19, 2023 | $460.00 |

Over the past month, NVDA’s price has fluctuated between a high of $495 and a low of $450. This fluctuation is partly attributed to concerns about the overall economic outlook and the competitive landscape within the semiconductor industry.

Comparison with Competitors

Comparing NVDA’s performance to its main competitors provides valuable context. AMD (Advanced Micro Devices), Intel, and Qualcomm are key players in the semiconductor market.

| Company | Current Price | % Change (Previous Day) |

|---|---|---|

| NVDA | $485.50 | +2.15% |

| AMD | $115.00 (estimated) | +1.00% (estimated) |

| Intel | $35.00 (estimated) | -0.50% (estimated) |

| Qualcomm | $120.00 (estimated) | +0.75% (estimated) |

NVDA has outperformed its competitors today, showing a stronger percentage increase than AMD, Intel, and Qualcomm.

Analyst Ratings and Predictions

Source: ycharts.com

Analyst opinions on NVDA vary. The consensus rating is generally positive, with a mix of “buy,” “hold,” and “sell” recommendations. Price targets range widely, reflecting differing views on the company’s future prospects.

- Goldman Sachs: Buy rating, $550 price target. Rationale: Strong AI growth prospects.

- Morgan Stanley: Hold rating, $500 price target. Rationale: Concerns about market saturation.

- JP Morgan: Buy rating, $600 price target. Rationale: Significant potential in data center and automotive markets.

Factors Influencing Price

Several factors are currently influencing NVDA’s stock price. These include the continued growth of the AI market, the company’s competitive positioning within the semiconductor industry, and broader macroeconomic conditions.

The strong demand for AI chips is a significant positive driver, while concerns about potential competition and the impact of rising interest rates represent potential headwinds. The interplay of these factors creates uncertainty in the short term, although the long-term outlook remains largely positive given the continued expansion of the AI market and NVDA’s leading position in this space.

The current global economic slowdown and inflationary pressures could temper investor enthusiasm in the near term, impacting demand and potentially putting downward pressure on the stock price.

Essential FAQs

What factors influence NVDA’s short-term price volatility?

Short-term price volatility in NVDA stock is often influenced by news releases (earnings reports, product announcements), overall market sentiment (risk aversion or appetite), and speculation driven by social media or analyst opinions.

Where can I find real-time NVDA stock price updates?

Real-time NVDA stock price updates are readily available through major financial websites and brokerage platforms. These platforms usually provide live quotes and charts.

What are the potential risks associated with investing in NVDA?

Investing in NVDA, like any stock, carries inherent risks. These include market volatility, competition within the semiconductor industry, regulatory changes, and dependence on specific technological advancements.

How does NVDA compare to its competitors in terms of long-term growth potential?

Assessing long-term growth potential requires in-depth analysis comparing NVDA’s market position, innovation capabilities, financial strength, and management strategies against its key competitors. Analyst reports and industry research can provide valuable insights.