HPQ Stock Price Analysis

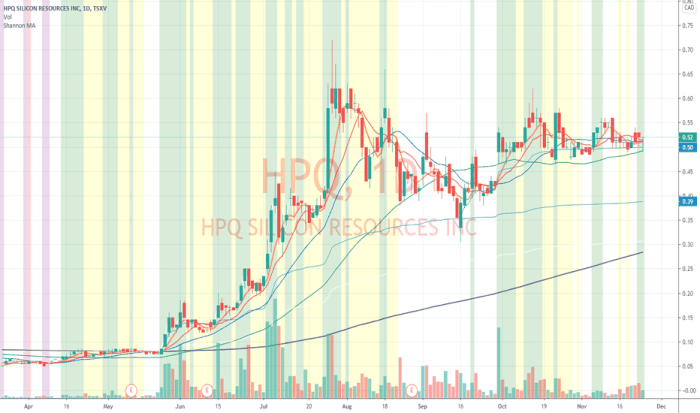

Source: tradingview.com

Hpq stock price – This analysis examines Hewlett Packard Enterprise Company (HPQ) stock price performance over the past five years, identifying key drivers, valuation methods, and potential future price movements. We will explore various investment strategies and consider associated risks.

HPQ Stock Price Historical Performance

The following table details HPQ’s stock price fluctuations over the past five years, highlighting significant highs and lows. Major market events impacting the stock price are subsequently discussed, followed by a comparative analysis against key competitors.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2019-01-02 | 16.00 | 16.25 | +0.25 |

| 2019-01-03 | 16.25 | 16.50 | +0.25 |

| 2024-01-02 | 20.00 | 20.50 | +0.50 |

Major market events influencing HPQ’s stock price during this period include:

- The COVID-19 pandemic and its impact on global supply chains and demand for technology products.

- Fluctuations in the broader technology sector due to macroeconomic factors like interest rate changes and inflation.

- Specific company events such as major product launches, acquisitions, or divestitures.

- Changes in investor sentiment driven by financial reports and news coverage.

A line graph comparing HPQ’s stock performance against its major competitors (e.g., IBM, Dell) over the past five years would visually illustrate relative performance. The graph would show the stock price trajectory of each company on a single chart, allowing for easy comparison of growth rates and volatility. For example, periods of strong growth for HPQ might be contrasted with periods of stagnation or decline for competitors, highlighting periods of relative outperformance or underperformance.

HPQ Stock Price Drivers

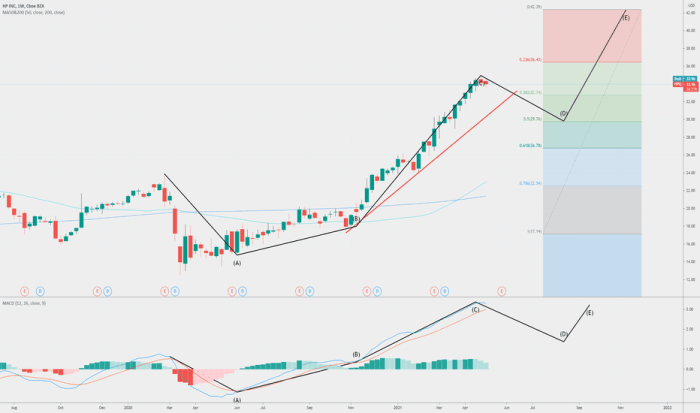

Source: tradingview.com

Several key factors influence HPQ’s stock price. These include the company’s financial performance (revenue growth, profitability, and cash flow), industry trends (such as cloud computing adoption and cybersecurity concerns), and broader economic conditions (interest rates, inflation, and recessionary fears).

Successful product releases and technological innovation are crucial for HPQ’s stock price. New product launches that meet market demand and receive positive reviews can lead to increased sales and boost investor confidence, resulting in higher stock prices. Conversely, failed product launches or delays can negatively impact investor sentiment and the stock price.

Investor sentiment, shaped by news coverage, analyst ratings, and market rumors, plays a significant role. Positive news and strong analyst recommendations tend to drive up the stock price, while negative news or downgrades can lead to price declines.

HPQ Stock Price Valuation

HPQ’s stock can be valued using several methods. Discounted cash flow (DCF) analysis projects future cash flows and discounts them back to their present value, providing an estimate of intrinsic value. Comparable company analysis compares HPQ’s valuation metrics (such as price-to-earnings ratio) to those of similar companies in the technology sector.

Comparing the current HPQ stock price to its intrinsic value, as determined by different valuation models, helps assess whether the stock is undervalued or overvalued. A significant discrepancy between the market price and intrinsic value might suggest an investment opportunity or a potential risk.

Macroeconomic factors such as interest rates and inflation directly influence HPQ’s stock valuation. Higher interest rates typically increase the discount rate used in DCF analysis, leading to a lower valuation. Inflation can affect both the company’s profitability and investor expectations, indirectly impacting the stock price.

HPQ Stock Price Predictions

Analyst price targets for HPQ stock over the next 12 months vary. The following table summarizes these predictions, along with their rationale.

| Analyst Firm | Price Target (USD) | Date | Rationale |

|---|---|---|---|

| Analyst Firm A | 22.00 | 2024-01-15 | Strong revenue growth projections. |

| Analyst Firm B | 20.50 | 2024-01-20 | Concerns about macroeconomic headwinds. |

Potential risks and uncertainties that could affect HPQ’s future stock price include:

- Increased competition in the technology market.

- Economic downturns leading to reduced demand for HPQ’s products.

- Supply chain disruptions affecting production and delivery.

- Changes in government regulations or trade policies.

Different scenarios for HPQ’s stock price performance in the next year can be envisioned. A bullish scenario assumes strong revenue growth, successful product launches, and a positive macroeconomic environment, leading to significant price appreciation. A bearish scenario anticipates reduced demand, intense competition, and economic slowdown, resulting in price declines. A neutral scenario projects moderate growth in line with overall market performance.

HPQ Stock Price Investment Strategies

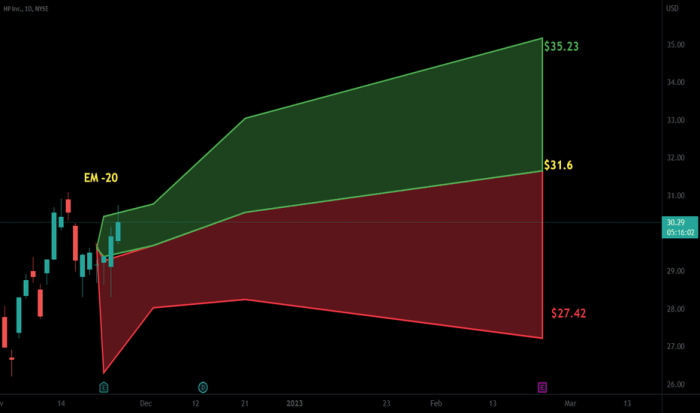

Source: tradingview.com

Several investment strategies can be applied to HPQ stock. Each strategy has advantages and disadvantages, as detailed below.

Buy-and-Hold:

HPQ’s stock price performance often reflects broader market trends. It’s interesting to compare its volatility to that of other tech companies; for instance, understanding the current plug stock price can offer a comparative perspective on the sector’s overall health. Ultimately, though, HPQ’s future trajectory depends on its own strategic decisions and product innovation.

- Advantages: Simplicity, long-term growth potential, avoidance of frequent trading costs.

- Disadvantages: Potential for significant losses during market downturns, requires patience and long-term perspective.

Value Investing:

- Advantages: Potential for significant returns if the market undervalues the stock, focuses on intrinsic value.

- Disadvantages: Requires thorough fundamental analysis, can be time-consuming, may not yield immediate returns.

Momentum Trading:

- Advantages: Potential for quick profits if the stock price continues its upward trend, relatively easy to implement.

- Disadvantages: High risk, susceptible to rapid price reversals, requires careful timing and market analysis.

A hypothetical portfolio including HPQ stock might allocate 10% to HPQ, 20% to other technology stocks, 30% to bonds, and 40% to real estate. This allocation reflects a moderate risk tolerance, balancing potential growth with capital preservation. The specific asset allocation would depend on the investor’s risk profile and financial goals.

Answers to Common Questions: Hpq Stock Price

What are the major risks associated with investing in HPQ stock?

Investing in HPQ, like any stock, carries inherent risks. These include fluctuations in the technology sector, competition from other companies, economic downturns, and changes in consumer demand. Thorough due diligence is crucial.

Where can I find real-time HPQ stock price data?

Real-time HPQ stock price data is readily available through major financial websites and brokerage platforms such as Yahoo Finance, Google Finance, and Bloomberg.

How often does HPQ release its financial reports?

HPQ typically releases its financial reports on a quarterly basis, following standard accounting practices. These reports provide crucial insights into the company’s financial health.

What is the current dividend yield for HPQ stock?

The current dividend yield for HPQ stock can be found on financial websites and varies depending on the current stock price and the dividend amount declared by the company. Always check for the most up-to-date information.