NVDA Premarket Price Movement: Factors and Analysis: Nvda Premarket Stock Price

Source: investorplace.com

Nvda premarket stock price – NVIDIA (NVDA) stock, a prominent player in the semiconductor industry, experiences significant premarket price fluctuations influenced by various factors. Understanding these dynamics is crucial for investors seeking to capitalize on premarket trading opportunities. This analysis delves into the key elements driving NVDA’s premarket price movements, examining trading volume, predictive modeling, global event impacts, and visual representations of the data.

NVDA Premarket Price Fluctuations and Influencing Factors

Source: investorplace.com

NVDA’s premarket price typically exhibits volatility, reacting to news releases, economic indicators, and competitive dynamics. News regarding product launches, earnings reports, or partnerships can significantly impact premarket trading. Three key economic indicators affecting NVDA include the Semiconductor Industry Association’s (SIA) monthly sales figures, the Purchasing Managers’ Index (PMI) for the technology sector, and overall US GDP growth. Comparing NVDA’s premarket behavior to a competitor like AMD reveals differences in sensitivity to specific news events and economic data.

| Factor | Description | Impact | Example |

|---|---|---|---|

| News Releases | Announcements regarding earnings, product launches, partnerships, or regulatory changes. | Significant positive or negative price swings depending on the news sentiment. | A positive earnings surprise could lead to a substantial premarket price increase. |

| Economic Indicators | Data reflecting overall economic health (e.g., GDP growth, inflation, interest rates). | Influences investor sentiment and risk appetite, affecting the entire market, including NVDA. | Strong GDP growth might lead to increased investor confidence and higher NVDA premarket prices. |

| Competitor Performance | Performance and news related to key competitors (e.g., AMD, Intel). | Impacts relative valuation and market share perceptions. | AMD’s strong product launch might negatively impact NVDA’s premarket price. |

| Geopolitical Events | Major global events (e.g., wars, trade disputes, pandemics). | Creates uncertainty and risk aversion, potentially impacting NVDA’s price. | A major international conflict could trigger a decline in NVDA’s premarket price. |

Analyzing Premarket Trading Volume for NVDA

NVDA’s premarket trading volume varies significantly depending on the anticipated news or events. Unusually high volume suggests increased investor interest and potential for larger price swings. Conversely, unusually low volume may indicate a lack of conviction in either direction. Premarket volume often correlates with subsequent price movements during regular trading hours. High volume often foreshadows significant intraday price changes.

- High Premarket Volume Scenario: A significant earnings announcement is expected. High premarket volume reflects strong investor interest. The price could move significantly up or down depending on the outcome of the announcement.

- Low Premarket Volume Scenario: No major news is anticipated. Low premarket volume suggests a lack of strong buying or selling pressure. The price may remain relatively stable during the day.

Predictive Modeling of NVDA Premarket Price

A simplified model could predict NVDA’s premarket price using the previous day’s closing price and news sentiment (positive, negative, or neutral). Premarket futures data, if available, can improve the model’s accuracy by incorporating information on expected price movements. However, this model has limitations; it ignores other factors like economic indicators and competitor actions. Potential sources of error include inaccurate news sentiment analysis and unexpected events.

Hypothetical Scenario: If the previous day’s closing price was $400, and news sentiment is positive due to a successful product demo, the model might predict a premarket price of $410. If the actual premarket price is $408, the model’s accuracy is relatively high (approximately 97%).

Impact of Global Events on NVDA Premarket Price

Major geopolitical events and unexpected global economic news significantly influence NVDA’s premarket price. For instance, trade wars might disrupt supply chains, affecting NVDA’s production and sales. Unexpected economic downturns can lead to decreased investor confidence and lower demand for technology products.

Example: The COVID-19 pandemic initially caused a significant drop in NVDA’s premarket price due to widespread market uncertainty. However, as the pandemic accelerated the shift towards remote work and digitalization, NVDA’s premarket price subsequently recovered and even increased, reflecting the increased demand for its products.

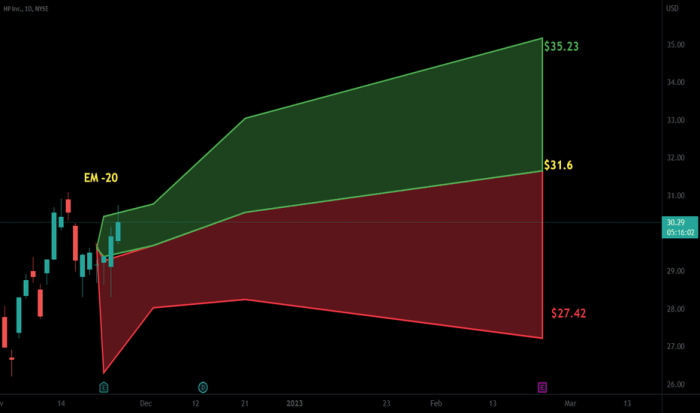

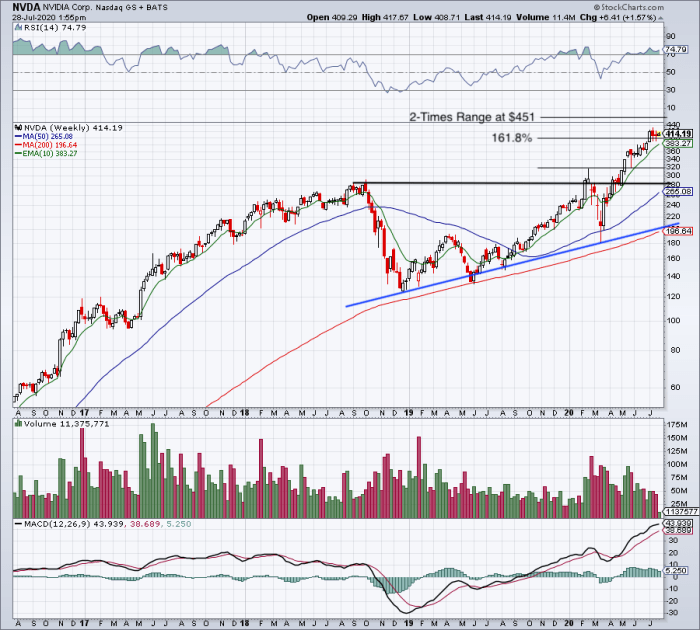

Visual Representation of NVDA Premarket Data, Nvda premarket stock price

A line chart visualizing NVDA’s premarket price and volume over a one-month period would have the date on the x-axis and price/volume on the y-axis. Significant price movements could be highlighted using different line colors (e.g., green for increases, red for decreases). Volume could be represented by a secondary y-axis and displayed as bars. This chart could reveal trends, such as consistent premarket price increases or periods of high volatility.

A second chart comparing NVDA’s premarket performance to a benchmark index (e.g., the Nasdaq 100) would illustrate NVDA’s relative performance. A hypothetical scenario showing a significant premarket price drop (e.g., 5%) could be depicted visually with a sharp downward spike in the price line, accompanied by a high volume bar, indicating a significant sell-off. This visual representation would clearly demonstrate the impact of the premarket drop on investor sentiment.

Top FAQs

What are the typical trading hours for NVDA premarket?

Generally, NVDA premarket trading occurs from approximately 4:00 AM to 9:30 AM ET.

How liquid is the premarket for NVDA?

Liquidity is generally lower during premarket hours compared to regular trading sessions, meaning price spreads may be wider.

Are premarket price movements always indicative of the day’s performance?

No, premarket price action is not always a reliable predictor of the full day’s price movement. Other factors influence the price throughout the day.

Where can I find reliable real-time NVDA premarket data?

Many reputable financial websites and brokerage platforms provide real-time premarket data for NVDA.