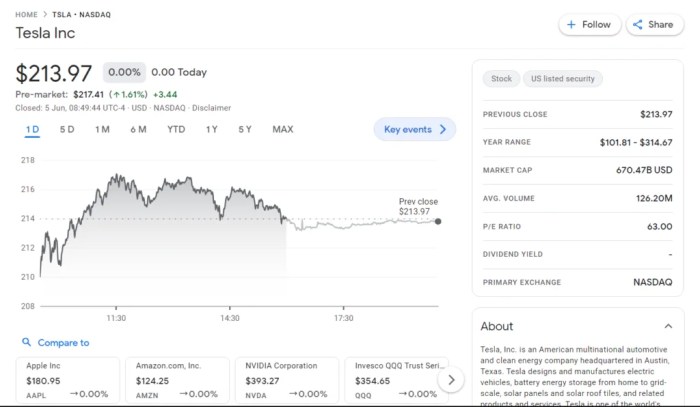

Tesla’s Stock Price Prediction: A 2030 Outlook: Tesla Stock Price Prediction 2030

Tesla stock price prediction 2030 – Predicting Tesla’s stock price in 2030 requires a multifaceted analysis, considering its current market position, financial health, technological advancements, and the broader economic and regulatory landscape. This analysis will explore key factors influencing Tesla’s trajectory, potential risks and challenges, and various predictive modeling techniques to arrive at a reasoned forecast.

Tesla’s Current Market Position and Financial Health

Tesla currently holds a significant position in the electric vehicle (EV) market, though its market share varies depending on the region and vehicle segment. The competitive landscape is rapidly evolving, with established automakers aggressively investing in their own EV offerings and new entrants emerging. Tesla’s recent financial performance has shown periods of strong revenue growth, but profitability has fluctuated, influenced by factors like production scaling, supply chain issues, and pricing strategies.

Debt levels have also been a point of discussion among analysts. Tesla’s ambitious production capacity expansion plans, including new Gigafactories, are aimed at increasing output and meeting growing demand, which will significantly impact future earnings. However, successfully executing these plans presents significant operational challenges.

| Metric | Tesla | Competitor A (e.g., Volkswagen) | Competitor B (e.g., Ford) |

|---|---|---|---|

| Revenue (USD Billion) | [Insert Data] | [Insert Data] | [Insert Data] |

| Net Income (USD Billion) | [Insert Data] | [Insert Data] | [Insert Data] |

| Debt-to-Equity Ratio | [Insert Data] | [Insert Data] | [Insert Data] |

| EV Sales (Units) | [Insert Data] | [Insert Data] | [Insert Data] |

Factors Influencing Tesla’s Stock Price

Numerous factors beyond Tesla’s internal operations significantly impact its stock price. Macroeconomic conditions, such as interest rate fluctuations, inflation levels, and global economic growth, influence investor sentiment and risk appetite, directly affecting Tesla’s valuation. Technological advancements within the EV industry, including battery technology improvements and autonomous driving capabilities, constantly reshape the competitive landscape. Regulatory changes and government policies, particularly those related to EV subsidies, emissions standards, and charging infrastructure, have a profound impact on Tesla’s operational environment and profitability.

Consumer sentiment and demand for electric vehicles, influenced by factors such as fuel prices, environmental concerns, and technological advancements, directly drive Tesla’s sales and therefore its stock price.

Technological Advancements and Innovation at Tesla

Tesla’s continued success hinges on its ongoing research and development efforts. Key areas of focus include advancements in battery technology (e.g., higher energy density, faster charging), autonomous driving capabilities (e.g., Full Self-Driving technology), and the development of new vehicle models (e.g., Cybertruck, Roadster). These advancements are crucial for maintaining Tesla’s competitive edge and driving future revenue streams. Compared to competitors, Tesla often boasts a technological lead in certain areas, particularly in battery technology and software integration, but the competitive landscape is constantly shifting.

- Battery Technology: Improved battery chemistry and cell design are expected to lead to significant cost reductions and range improvements by 2030, potentially impacting market share and profitability.

- Autonomous Driving: The successful deployment of Full Self-Driving (FSD) technology could revolutionize the automotive industry and unlock new revenue streams through robotaxis and autonomous delivery services. However, regulatory hurdles and safety concerns remain significant challenges.

- New Vehicle Models: The introduction of new models like the Cybertruck and Roadster could tap into new market segments and drive sales growth, further impacting the stock price.

Potential Risks and Challenges Facing Tesla

Source: bestdoctorsadvise.com

Despite its success, Tesla faces several potential risks and challenges. Supply chain disruptions, production bottlenecks, and fluctuations in raw material costs (e.g., lithium, cobalt) can significantly impact production volumes and profitability. The competitive landscape is becoming increasingly crowded, with established automakers and new entrants posing a significant threat. Scaling production to meet growing demand while maintaining quality and efficiency presents a major operational challenge.

A scenario analysis could explore the impact of different combinations of these challenges on Tesla’s stock price. For example, a significant supply chain disruption coupled with intense competition could lead to a substantial drop in stock price, while successful navigation of these challenges could lead to continued growth.

Predictive Modeling and Forecasting Techniques

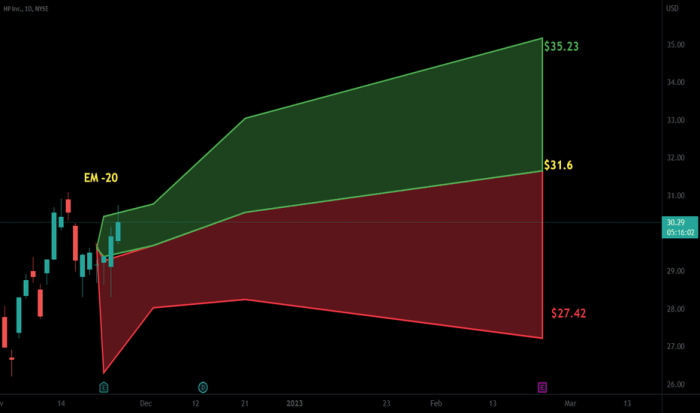

Source: invezz.com

Several quantitative methods can be used to predict Tesla’s stock price in 2030. Time series analysis can identify patterns and trends in historical stock price data to extrapolate future values. Discounted cash flow (DCF) models forecast future cash flows and discount them back to present value to estimate the intrinsic value of the stock. Each method has its assumptions and limitations.

Time series analysis relies on historical data and may not accurately capture unexpected events or paradigm shifts. DCF models are highly sensitive to the assumptions made about future growth rates and discount rates. Sensitivity analysis helps assess the impact of changes in key assumptions on the predicted stock price. By comparing the results of different forecasting methods, a range of potential outcomes can be established, providing a more comprehensive picture.

Illustrative Scenarios for Tesla’s Future, Tesla stock price prediction 2030

Source: ccn.com

Several scenarios can illustrate potential outcomes for Tesla by 2030. A positive scenario could see Tesla maintaining its current growth trajectory, driven by successful execution of its production expansion plans, continued technological leadership, and robust consumer demand. This scenario would likely lead to a significantly higher stock price. A negative scenario could involve significant challenges, such as persistent supply chain disruptions, increased competition, or regulatory setbacks, leading to slower growth or even market share loss, resulting in a lower stock price.

A disruptive scenario could involve the emergence of a revolutionary technology (e.g., solid-state batteries with significantly higher energy density and lower cost) that challenges Tesla’s technological leadership, potentially impacting its market position and stock price. The specifics of these scenarios and their impact on the stock price would depend on the magnitude and timing of the various factors involved.

Answers to Common Questions

What are the biggest risks to Tesla’s future growth?

Significant risks include intense competition from established and emerging automakers, supply chain disruptions, production bottlenecks, and the potential for unforeseen technological disruptions.

How reliable are these stock price predictions?

Long-term stock price predictions are inherently uncertain. These projections are based on current information and assumptions, and unexpected events could significantly alter the outcome.

What role does consumer sentiment play?

Consumer demand for electric vehicles is a critical factor. Positive consumer sentiment and strong demand contribute to higher stock valuations, while negative sentiment can have the opposite effect.

Predicting Tesla’s stock price in 2030 involves considering numerous factors, including technological advancements and overall market trends. It’s interesting to compare this to the volatility seen in other tech sectors; for instance, understanding the current performance of companies like Riot Blockchain, by checking out their riot stock price , offers a glimpse into the potential risks and rewards within the broader tech investment landscape.

Ultimately, however, Tesla’s future valuation hinges on its continued innovation and market dominance.

What about the impact of government regulations?

Government policies regarding emissions standards, subsidies for EVs, and other regulations can significantly influence Tesla’s operations and profitability, ultimately impacting its stock price.