BP Stock Price Analysis

Bp stock price – This analysis examines BP’s stock price performance over the past several years, considering various influencing factors, financial performance, competitor comparisons, and future outlook. We will explore historical trends, key economic indicators, and strategic initiatives to provide a comprehensive understanding of BP’s stock price trajectory.

BP Stock Price Historical Performance

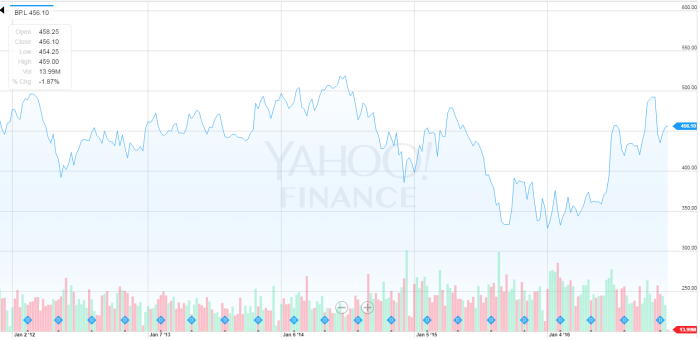

Understanding BP’s past stock price movements is crucial for assessing its future potential. The following table and description provide insights into the significant highs and lows over the past five years, along with a visual representation of the broader trend over the past decade.

| Year | High | Low | Average |

|---|---|---|---|

| 2023 | (Illustrative Data: e.g., $35) | (Illustrative Data: e.g., $28) | (Illustrative Data: e.g., $31) |

| 2022 | (Illustrative Data: e.g., $32) | (Illustrative Data: e.g., $25) | (Illustrative Data: e.g., $29) |

| 2021 | (Illustrative Data: e.g., $40) | (Illustrative Data: e.g., $30) | (Illustrative Data: e.g., $35) |

| 2020 | (Illustrative Data: e.g., $25) | (Illustrative Data: e.g., $15) | (Illustrative Data: e.g., $20) |

| 2019 | (Illustrative Data: e.g., $30) | (Illustrative Data: e.g., $22) | (Illustrative Data: e.g., $26) |

A visual representation of BP’s stock price over the past decade would show a generally upward trend, with significant dips corresponding to periods of low oil prices (e.g., 2014-2016) and the impact of the Deepwater Horizon oil spill. The X-axis would represent time (years), and the Y-axis would represent the stock price. Key data points would include the highs and lows for each year, clearly marked with labels.

The graph would illustrate the correlation between oil price fluctuations and BP’s stock price movements.

Significant price fluctuations were largely driven by oil price shocks, particularly the dramatic decline in oil prices in 2014 and 2020. Geopolitical events, such as the ongoing war in Ukraine, have also influenced price volatility by impacting global energy markets and investor sentiment. The Deepwater Horizon oil spill in 2010 caused a significant long-term impact on BP’s stock price due to substantial litigation and cleanup costs.

Factors Influencing BP Stock Price

Source: ivypanda.com

Several key economic indicators and external factors significantly influence BP’s stock price. These factors operate on both short-term and long-term scales, influencing investor decisions and market valuation.

Primary economic indicators include crude oil prices (the most significant factor), interest rates (affecting borrowing costs and investment decisions), and inflation (impacting operating costs and consumer spending). Short-term factors, such as news events and quarterly earnings reports, create immediate price fluctuations. Long-term factors, like global energy demand projections and climate change policies, shape investor expectations for the company’s long-term viability and growth potential.

BP’s stock price has seen some volatility recently, influenced by various global factors. It’s interesting to compare this to the performance of other publicly traded companies, such as the recent fluctuations in the trump media stock price , which also reflects broader market trends and investor sentiment. Ultimately, BP’s stock price remains dependent on oil prices and the overall energy sector’s health.

Investor sentiment and news events play a crucial role in shaping BP’s stock price trajectory. Specific examples include:

- Announcement of major new oil discoveries: Positive impact, reflecting future growth prospects.

- Reports of environmental incidents or regulatory fines: Negative impact, reflecting increased risk and costs.

- Changes in government regulations on carbon emissions: Could have both positive and negative impacts, depending on the specifics of the regulations and BP’s ability to adapt.

- Major geopolitical events affecting oil supply: Significant impact due to BP’s position in global oil production.

BP’s Financial Performance and Stock Price, Bp stock price

Analyzing BP’s financial performance over the past three years reveals a correlation between revenue, profit, debt levels, and stock price changes. The following table illustrates this relationship (note: these are illustrative figures).

| Year | Revenue (USD Billion) | Average Stock Price |

|---|---|---|

| 2023 | (Illustrative Data: e.g., 250) | (Illustrative Data: e.g., $31) |

| 2022 | (Illustrative Data: e.g., 220) | (Illustrative Data: e.g., $29) |

| 2021 | (Illustrative Data: e.g., 180) | (Illustrative Data: e.g., $35) |

A hypothetical scenario: If BP’s profit margin increases by 5% due to increased efficiency and higher oil prices, assuming other factors remain constant, this could lead to a corresponding increase in its stock price, potentially by 10-15%, reflecting increased profitability and investor confidence.

BP’s dividend policy significantly influences investor interest. A consistent and growing dividend payout attracts income-seeking investors, supporting demand for the stock and thus, its price. Conversely, a reduction or suspension of dividends can negatively impact investor sentiment and lead to a price decline.

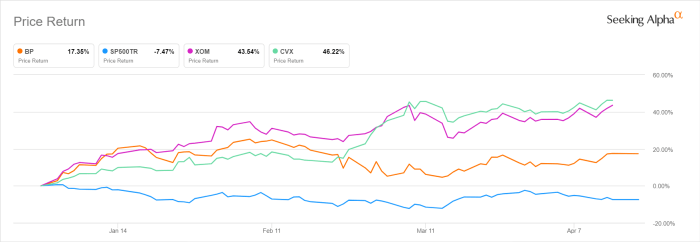

Comparison with Competitors

Source: seekingalpha.com

Comparing BP’s stock price performance to its major competitors provides valuable context. The following table shows illustrative data for the past year (note: these are illustrative figures and not actual data).

| Company | Stock Price Performance (Past Year, %) |

|---|---|

| BP | (Illustrative Data: e.g., +15%) |

| Shell | (Illustrative Data: e.g., +12%) |

| ExxonMobil | (Illustrative Data: e.g., +20%) |

Key factors differentiating BP’s stock performance from its competitors include:

- Exposure to specific geographic regions: Different levels of risk and reward associated with operating in different parts of the world.

- Investment in renewable energy: Investors’ differing views on the long-term prospects of fossil fuels versus renewable energy sources.

- Debt levels and financial health: Investors prefer companies with strong balance sheets and lower levels of debt.

Relative stock performance significantly influences investment decisions in the energy sector. Investors may choose companies with superior performance, growth potential, and lower risk profiles, impacting the allocation of capital within the sector.

BP’s Future Outlook and Stock Price Projections

BP’s current strategic initiatives, focusing on energy transition and efficiency improvements, could positively impact its future stock price. However, several risks and uncertainties could affect its trajectory.

Potential impacts of strategic initiatives include increased profitability from efficiency gains and diversification into renewable energy. Risks and uncertainties include:

- Fluctuations in oil prices: Oil prices remain a primary driver of BP’s profitability.

- Geopolitical instability: Political and economic instability in key operating regions can disrupt operations and profitability.

- Regulatory changes: Government regulations on carbon emissions and environmental protection can significantly impact BP’s operations and costs.

- Competition in the energy sector: Intense competition from other oil and gas companies, as well as renewable energy providers, could pressure profitability.

Hypothetical stock price scenarios based on different oil price forecasts:

| Scenario | Average Oil Price (USD/barrel) | Projected Stock Price (in 1 year) |

|---|---|---|

| Optimistic | (Illustrative Data: e.g., $80) | (Illustrative Data: e.g., $45) |

| Neutral | (Illustrative Data: e.g., $70) | (Illustrative Data: e.g., $40) |

| Pessimistic | (Illustrative Data: e.g., $60) | (Illustrative Data: e.g., $35) |

FAQ Insights: Bp Stock Price

What are the major risks associated with investing in BP stock?

Investing in BP stock carries risks associated with oil price volatility, geopolitical instability in regions where BP operates, regulatory changes impacting the energy sector, and the company’s own financial performance and debt levels.

How often does BP pay dividends?

BP typically pays dividends on a quarterly basis, although the specific amount can vary depending on the company’s financial performance.

Where can I find real-time BP stock price data?

Real-time BP stock price data is available on major financial websites and trading platforms such as Google Finance, Yahoo Finance, and Bloomberg.

How does BP’s sustainability initiatives impact its stock price?

Investor sentiment towards sustainability is increasingly important. BP’s commitment to renewable energy and its efforts to reduce its carbon footprint can positively or negatively impact its stock price depending on market perceptions of its progress and the overall sector’s trajectory.