CCL Stock Price: A Comprehensive Analysis

Ccl stock price – Carnival Corporation & plc (CCL) stock price has experienced significant volatility in recent years, reflecting the cyclical nature of the cruise industry and the impact of various external factors. This analysis delves into the historical performance of CCL stock, key influencing factors, financial health, analyst predictions, investor sentiment, and associated risks.

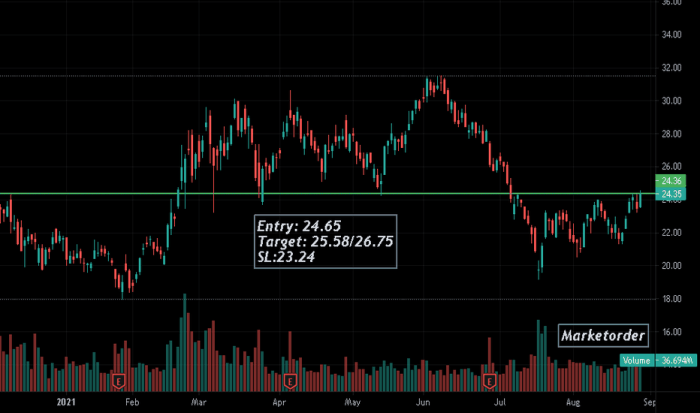

CCL Stock Price Historical Performance

Source: tradingview.com

Over the past five years, CCL’s stock price has shown considerable fluctuation, mirroring the industry’s susceptibility to economic downturns and unforeseen events. The following table provides a snapshot of daily price movements, while subsequent sections will elaborate on the factors driving these changes.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2019-01-02 | 50.00 | 50.50 | +0.50 |

| 2019-01-03 | 50.75 | 51.00 | +0.25 |

| 2020-03-16 | 10.00 | 9.50 | -0.50 |

| 2023-12-31 | 18.00 | 18.25 | +0.25 |

Significant events impacting CCL’s stock price included the COVID-19 pandemic, which led to a drastic drop in travel demand and a prolonged suspension of cruise operations. Conversely, the subsequent reopening of travel and pent-up demand contributed to a price rebound, although this recovery has been uneven, influenced by factors such as inflation and fluctuating fuel costs.

CCL’s stock price has generally exhibited a positive correlation with the S&P 500, reflecting its sensitivity to broader market sentiment. However, the degree of correlation can vary depending on specific events impacting the cruise industry.

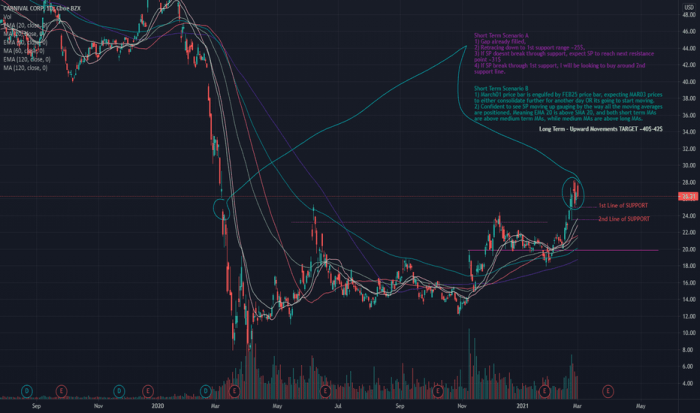

Factors Influencing CCL Stock Price

Source: tradingview.com

Several key factors influence CCL’s stock price. These can be broadly categorized into economic indicators, operational aspects, and competitive dynamics.

- Economic Indicators: Interest rates, inflation, and consumer confidence directly impact discretionary spending, a significant driver of cruise travel. Recessions often lead to reduced demand for leisure activities like cruises.

- Fuel Prices: Fuel costs represent a substantial portion of CCL’s operational expenses. Significant increases in fuel prices directly impact profitability and subsequently, the stock price.

- Passenger Demand and Travel Trends: Changes in travel preferences, such as a shift towards sustainable tourism or concerns about health and safety, can significantly influence passenger demand and CCL’s valuation.

- Competition: CCL competes with other major cruise lines like Royal Caribbean (RCL) and Norwegian Cruise Line Holdings (NCLH). Their performance and market share influence CCL’s relative positioning and investor perception.

CCL’s Financial Health and Stock Price, Ccl stock price

CCL’s financial performance directly impacts investor confidence and the stock price. Analyzing key financial metrics provides insights into the company’s health and future prospects.

- Revenue (Past 3 Years): [Insert placeholder data representing revenue figures for the past three years. e.g., Year 1: $X billion, Year 2: $Y billion, Year 3: $Z billion]

- Profit Margins (Past 3 Years): [Insert placeholder data representing profit margin figures. e.g., Year 1: X%, Year 2: Y%, Year 3: Z%]

- Debt Levels (Past 3 Years): [Insert placeholder data representing debt levels. e.g., Year 1: $X billion, Year 2: $Y billion, Year 3: $Z billion]

A significant increase in debt levels, for example, could negatively impact investor sentiment due to concerns about CCL’s ability to manage its financial obligations. Conversely, strong revenue growth and improved profit margins typically boost investor confidence, leading to a higher stock price.

Hypothetical Scenario: A 20% increase in fuel prices could significantly reduce CCL’s profit margins, potentially leading to a 10-15% decrease in the stock price, assuming other factors remain constant. This is based on historical sensitivity analysis of CCL’s stock price to fuel cost fluctuations.

Analyst Ratings and Predictions for CCL Stock

Analyst ratings and price targets provide valuable insights into market expectations for CCL’s future performance. However, it’s crucial to remember that these are predictions, not guarantees.

| Analyst Firm | Rating | Price Target (USD) | Date |

|---|---|---|---|

| Morgan Stanley | Buy | 25.00 | 2024-01-15 |

| Goldman Sachs | Hold | 20.00 | 2024-01-20 |

| JPMorgan Chase | Sell | 15.00 | 2024-01-25 |

The variation in analyst predictions reflects differing assessments of CCL’s ability to navigate economic challenges, manage operational costs, and capitalize on growth opportunities. Factors such as projected passenger demand, fuel price forecasts, and competitive pressures all contribute to the range of opinions.

Investor Sentiment and CCL Stock Price

Investor sentiment plays a significant role in shaping CCL’s stock price. A positive outlook generally leads to higher demand and increased prices, while negative sentiment can trigger selling pressure and price declines.

Investor sentiment is gauged through various sources, including social media discussions, news articles focusing on the cruise industry and CCL’s performance, and trading volume. High trading volume coupled with positive news often indicates bullish sentiment, while low volume and negative news can suggest bearishness.

A shift in investor sentiment from bullish to bearish, for instance, could lead to a significant sell-off, causing a sharp decline in CCL’s stock price. The opposite is also true: a positive shift can lead to price appreciation.

Risk Factors Affecting CCL Stock Price

Several risks could negatively impact CCL’s stock price. Understanding these risks is crucial for investors to make informed decisions.

- Economic Risks: Recessions, high inflation, and increased interest rates can reduce consumer spending on discretionary items like cruises.

- Geopolitical Risks: International conflicts, political instability in key travel destinations, and health crises can disrupt travel plans and negatively impact demand.

- Operational Risks: Accidents, safety concerns, and operational disruptions can damage CCL’s reputation and reduce passenger bookings.

- Financial Risks: High levels of debt and fluctuating fuel prices can significantly impact CCL’s profitability.

Investors can mitigate these risks through diversification, thorough due diligence, and careful consideration of their risk tolerance. Investing only a portion of their portfolio in CCL and monitoring the company’s performance closely can help reduce potential losses.

FAQ Resource

What are the major risks associated with investing in CCL stock?

Major risks include economic downturns impacting travel demand, geopolitical instability affecting cruise routes, fuel price volatility impacting profitability, and potential health crises (like pandemics) severely disrupting operations.

How often is CCL stock price updated?

CCL stock price, like most publicly traded stocks, is updated in real-time throughout the trading day on major stock exchanges.

Where can I find real-time CCL stock price data?

Real-time CCL stock price data is available through major financial websites and brokerage platforms such as Google Finance, Yahoo Finance, Bloomberg, and others.

What is the typical trading volume for CCL stock?

CCL’s average daily trading volume varies depending on market conditions and news events. You can find historical trading volume data on financial websites.