CGC Stock Price Analysis: A Comprehensive Overview

Cgc stock price – This analysis provides a detailed examination of Canopy Growth Corporation (CGC) stock, considering its current price, financial performance, competitive landscape, analyst sentiment, and potential risks. We will explore the factors influencing CGC’s stock valuation and offer a hypothetical investment scenario to illustrate potential outcomes.

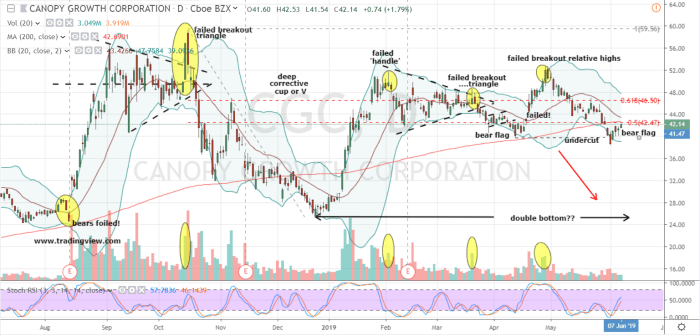

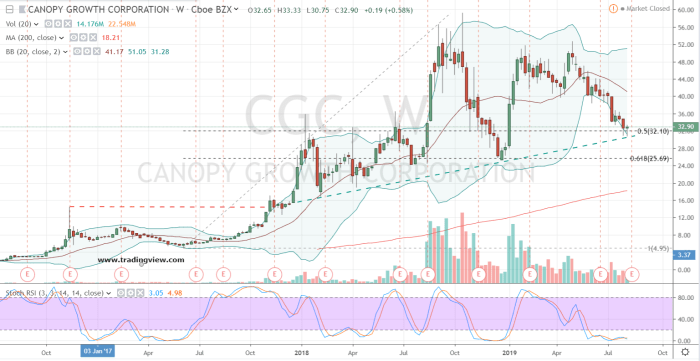

Current CGC Stock Price & Market Trends

Source: investorplace.com

CGC’s stock price fluctuates significantly based on market sentiment and company performance. Tracking its historical performance, recent news, and comparing it to competitors provides a clearer picture of its current standing. Note that stock prices are dynamic and the data presented here represents a snapshot in time. Always consult up-to-date financial sources for the most current information.

Over the past year, CGC stock experienced considerable volatility, reaching both highs and lows influenced by various market events, including shifts in investor confidence, regulatory changes in the cannabis industry, and the company’s own financial reports. Significant events such as announcements of new product lines, partnerships, or regulatory updates often trigger price movements.

| Company | Last Quarter Price (USD) | High (USD) | Low (USD) | % Change (Last Quarter) |

|---|---|---|---|---|

| Canopy Growth (CGC) | [Insert Data] | [Insert Data] | [Insert Data] | [Insert Data] |

| Competitor 1 | [Insert Data] | [Insert Data] | [Insert Data] | [Insert Data] |

| Competitor 2 | [Insert Data] | [Insert Data] | [Insert Data] | [Insert Data] |

| Competitor 3 | [Insert Data] | [Insert Data] | [Insert Data] | [Insert Data] |

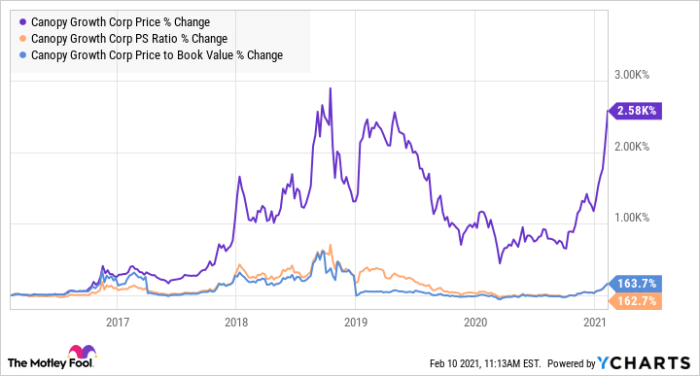

CGC’s Financial Performance & Stock Valuation

Source: investorplace.com

Analyzing CGC’s financial reports, including revenue, earnings, and debt, provides insights into its financial health and potential for future growth. The Price-to-Earnings (P/E) ratio is a key metric used to evaluate the company’s valuation relative to its earnings and compared to industry averages.

CGC’s growth prospects are heavily influenced by factors such as market expansion, product innovation, and operational efficiency. Future profitability depends on the company’s ability to navigate the evolving regulatory landscape and effectively compete in a dynamic market.

Key factors affecting CGC’s stock valuation include:

- Revenue growth and profitability

- Market share and competitive landscape

- Regulatory changes in the cannabis industry

- Debt levels and financial health

- Investor sentiment and market conditions

CGC’s P/E ratio should be compared to the average P/E ratio of its competitors within the cannabis industry to gain a better understanding of its relative valuation.

CGC’s Business Operations & Competitive Landscape

Canopy Growth operates in the cannabis industry, focusing on cultivation, production, and distribution of cannabis products. Its competitive landscape is characterized by a number of key players vying for market share. A comparison of CGC’s product offerings, market strategies, and overall strengths and weaknesses against its main competitors offers a comprehensive view of its position in the market.

Analyzing CGC’s stock price requires considering broader market trends. A key factor influencing investor sentiment across the tech sector is the performance of major players like Google, whose stock price you can monitor here: googl stock price. Therefore, understanding the fluctuations in the googl stock price can offer valuable insight into potential future movements in CGC, given their interconnectedness within the overall market landscape.

| Feature | CGC | Competitor 1 | Competitor 2 |

|---|---|---|---|

| Strengths | [Insert Data – e.g., Brand recognition, international presence] | [Insert Data] | [Insert Data] |

| Weaknesses | [Insert Data – e.g., High debt levels, profitability concerns] | [Insert Data] | [Insert Data] |

Analyst Ratings & Investor Sentiment, Cgc stock price

Source: ycharts.com

Analyst ratings and price targets provide valuable insights into the market’s expectations for CGC’s future performance. Investor sentiment, a combination of bullish and bearish perspectives, influences the stock’s price movements. Recent news articles and reports significantly shape this sentiment.

| Analyst Firm | Rating | Price Target (USD) | Date |

|---|---|---|---|

| [Insert Data] | [Insert Data] | [Insert Data] | [Insert Data] |

| [Insert Data] | [Insert Data] | [Insert Data] | [Insert Data] |

| [Insert Data] | [Insert Data] | [Insert Data] | [Insert Data] |

Risk Factors & Potential Challenges

Several factors could negatively impact CGC’s stock price. The regulatory environment for the cannabis industry is constantly evolving, posing both opportunities and challenges. Legal and financial risks, such as lawsuits or difficulties in securing financing, could also affect the company’s performance. Changes in consumer preferences and increased competition further contribute to the inherent risks in this sector.

Illustrative Example: Hypothetical Investment Scenario

Let’s consider a hypothetical investment of $10,000 in CGC stock over a five-year period. Under a bullish scenario (assuming consistent growth), the investment could potentially yield significant returns, depending on the stock’s price appreciation. However, a bearish scenario (accounting for potential setbacks) might lead to losses. Various factors, such as regulatory changes or increased competition, could drastically alter the outcome.

This hypothetical scenario demonstrates the potential range of outcomes and emphasizes the importance of considering both upside and downside risks before making any investment decisions. It is crucial to remember that past performance is not indicative of future results, and all investments carry risk.

FAQ Resource: Cgc Stock Price

What are the main risks associated with investing in CGC stock?

Investing in CGC carries risks associated with the volatility of the cannabis industry, regulatory uncertainty, competition, and overall market conditions. These factors can significantly impact the stock’s price.

Where can I find real-time CGC stock price data?

Real-time CGC stock price data is readily available through major financial websites and brokerage platforms such as Google Finance, Yahoo Finance, Bloomberg, and others.

How does CGC compare to its main competitors in terms of market capitalization?

A comparison of CGC’s market capitalization to its main competitors requires referencing current market data from reputable financial sources. Market capitalization fluctuates constantly.

What is the long-term outlook for CGC stock according to analysts?

Analyst opinions on CGC’s long-term outlook vary widely. It’s crucial to consult multiple sources and consider their individual biases before making investment decisions based on such predictions.