Chevron Stock Price Today

Chevron stock price today – This article provides a comprehensive overview of Chevron Corporation’s (CVX) current stock price, influencing factors, historical performance, financial health, analyst sentiment, and future prospects. We will analyze various aspects to give you a well-rounded understanding of Chevron’s stock performance and potential investment opportunities.

Current Chevron Stock Price

As of [Insert Date and Time], Chevron’s stock price is [Insert Current Price]. This represents a [Insert Percentage Change] change from the previous closing price of [Insert Previous Closing Price]. The current trading volume is [Insert Trading Volume], indicating [Insert Interpretation of Trading Volume – e.g., high, low, average activity]. Today’s high and low prices for Chevron stock are [Insert High Price] and [Insert Low Price], respectively.

Factors Influencing Chevron Stock Price

Several key factors significantly impact Chevron’s stock price. These include the price of oil, global economic conditions, company-specific news, and the performance of its competitors.

Monitoring the Chevron stock price today requires considering broader market trends. For instance, understanding the inverse performance of the S&P 500, often reflected in the sqqq stock price , can offer valuable insight into potential Chevron price movements. Ultimately, however, a thorough analysis of Chevron’s specific performance indicators is crucial for accurate predictions of its stock price today.

- Oil Prices: Chevron’s profitability is directly tied to oil prices. Higher oil prices generally lead to increased revenue and higher stock prices, while lower oil prices have the opposite effect. For example, the sharp increase in oil prices in [Year] significantly boosted Chevron’s stock performance.

- Global Economic Conditions: Global economic growth or recession significantly influences demand for energy, impacting Chevron’s sales and profitability. Strong global economic growth usually translates to higher energy demand and a positive effect on Chevron’s stock price. Conversely, economic downturns can reduce demand, putting downward pressure on the stock.

- Recent News and Events: Significant news events, such as major oil discoveries, geopolitical instability in oil-producing regions, or changes in environmental regulations, can have a considerable impact on Chevron’s stock price. For instance, the [Specific News Event, e.g., announcement of a new major oil field discovery] in [Location] caused a [Positive or Negative] impact on the stock price.

- Competitor Performance: Chevron’s performance relative to its competitors in the energy sector (e.g., ExxonMobil, BP, Shell) also influences its stock price. If competitors outperform Chevron, it could put downward pressure on Chevron’s stock.

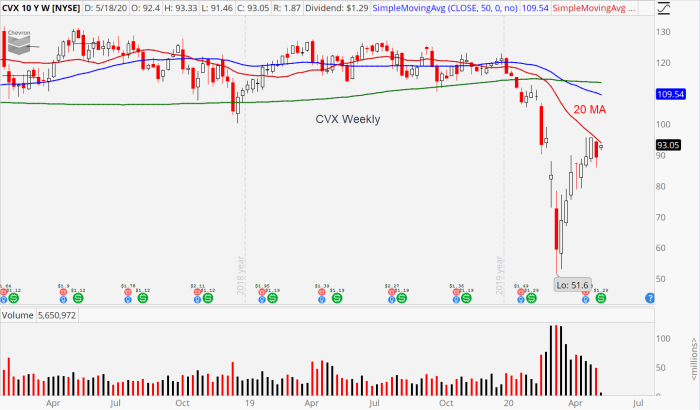

Historical Chevron Stock Price Data

Source: investorplace.com

Analyzing Chevron’s historical stock price provides valuable insights into its volatility and long-term trends. The following table displays the stock’s performance over the past week, month, and year.

| Date | Open | High | Close |

|---|---|---|---|

| [Date 1] | [Open Price 1] | [High Price 1] | [Close Price 1] |

| [Date 2] | [Open Price 2] | [High Price 2] | [Close Price 2] |

| [Date 3] | [Open Price 3] | [High Price 3] | [Close Price 3] |

| [Date 4] | [Open Price 4] | [High Price 4] | [Close Price 4] |

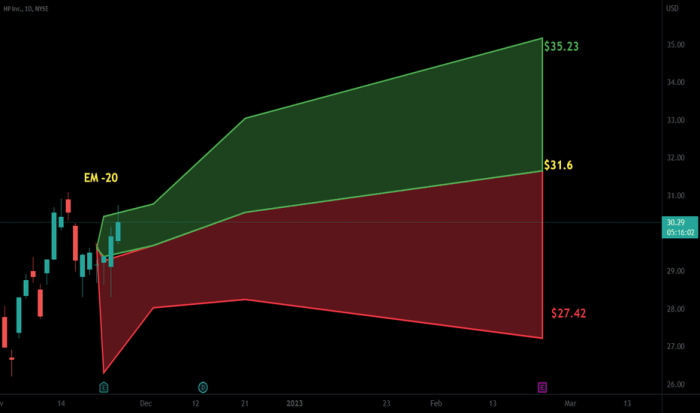

A visual representation of Chevron’s stock price over the past five years would show [Description of the Graph, e.g., a generally upward trend with significant fluctuations, highlighting key highs and lows during specific periods, such as the periods of high oil prices and subsequent price corrections]. The graph would illustrate the volatility inherent in the energy sector and Chevron’s exposure to fluctuating oil prices and global economic conditions.

For example, the period between [Year] and [Year] shows a significant upward trend, while the period between [Year] and [Year] illustrates a period of considerable price volatility.

Chevron’s Financial Performance, Chevron stock price today

Chevron’s financial performance directly impacts its stock price. Key metrics such as revenue, earnings per share (EPS), and profit margins are crucial indicators of the company’s health.

- Revenue: Chevron’s revenue for [Year] was [Revenue Amount].

- Earnings Per Share (EPS): The company’s EPS for [Year] was [EPS Amount].

- Profit Margins: Chevron’s profit margins have [Increased/Decreased] in recent years due to [Reasons].

Chevron’s recent financial reports indicate [Summary of Financial Reports, e.g., strong performance driven by higher oil prices, increased production, or cost-cutting measures]. These results have [Positive/Negative] impacted investor confidence and the stock price.

Analyst Ratings and Predictions

Financial analysts provide ratings and price targets for Chevron stock, offering insights into market sentiment and future expectations.

- Consensus Rating: The consensus rating for Chevron stock among analysts is currently [Consensus Rating – e.g., Buy, Hold, Sell].

- Price Targets: Analyst price targets for Chevron stock range from [Low Price Target] to [High Price Target], with a median target of [Median Price Target].

Positive analyst sentiment generally leads to higher stock prices, while negative sentiment can put downward pressure on the stock. Changes in analyst ratings and price targets often reflect shifts in market expectations regarding Chevron’s future performance.

Investor Sentiment and Trading Activity

Source: investopedia.com

Investor sentiment and trading activity significantly influence Chevron’s stock price.

- Investor Sentiment: Current investor sentiment towards Chevron stock is [Bullish/Bearish/Neutral], primarily driven by [Reasons].

- Trading Volume: Recent trading volume for Chevron stock has been [High/Low/Average], suggesting [Interpretation of Trading Volume].

High trading volume often indicates strong investor interest and can amplify price movements. Changes in investor sentiment, whether positive or negative, can significantly impact trading activity and the stock price.

Risks and Opportunities for Chevron

Chevron faces various risks and opportunities that could influence its stock price.

- Risks: Geopolitical instability in oil-producing regions, stricter environmental regulations, increased competition from renewable energy sources, and fluctuations in oil prices represent significant risks to Chevron’s business and stock price.

- Opportunities: Technological advancements in oil and gas extraction, expansion into new markets, and strategic acquisitions present opportunities for growth and increased profitability, potentially boosting Chevron’s stock price.

The current stock price reflects the market’s assessment of these risks and opportunities. A higher stock price suggests investors are more optimistic about Chevron’s future prospects, while a lower price reflects greater concern about potential risks.

Q&A

What are the main risks associated with investing in Chevron stock?

Key risks include fluctuating oil prices, geopolitical instability impacting energy markets, increased regulatory scrutiny of the energy industry, and competition from renewable energy sources.

How does Chevron compare to its major competitors?

A comparison requires examining metrics like market capitalization, revenue, profit margins, and exploration and production activities relative to companies such as ExxonMobil, Shell, and BP. Performance varies depending on the specific metric and time period.

Where can I find real-time Chevron stock price updates?

Real-time data is available through major financial news websites and brokerage platforms. These sources typically provide live quotes, charts, and other relevant market information.

What is the long-term outlook for Chevron’s stock price?

Long-term predictions are speculative and depend on numerous unpredictable factors. Analyst forecasts offer potential future price targets, but these should be considered alongside broader market trends and company-specific developments.