Dollar General Stock Price Analysis

Dollar general stock price – Dollar General Corporation (DG), a prominent discount retailer, has experienced considerable fluctuations in its stock price over the past decade. Understanding the historical performance, influencing factors, and future outlook is crucial for investors seeking to assess the viability of DG as a long-term investment. This analysis delves into these aspects, providing insights into the dynamics shaping Dollar General’s stock price.

Dollar General Stock Price History

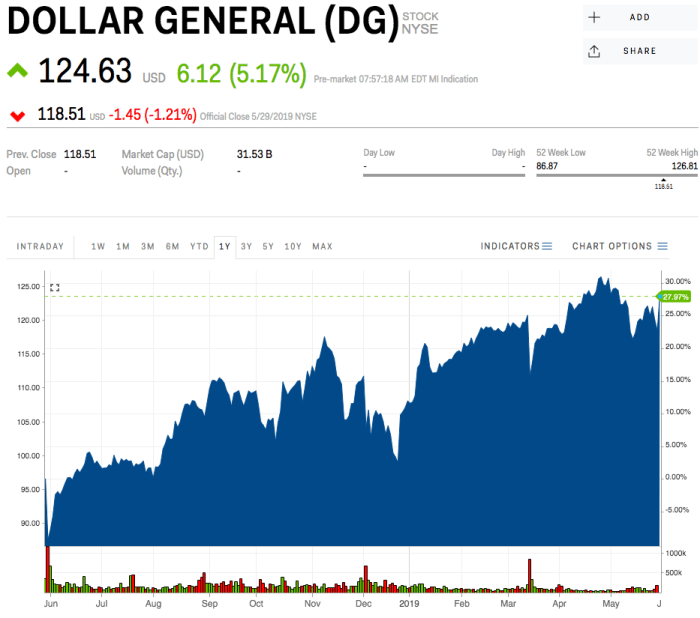

Analyzing Dollar General’s stock price over the past ten years reveals a trajectory influenced by various economic and company-specific factors. The following table presents a snapshot of this performance, highlighting key periods of growth and decline.

| Year | Quarter | Opening Price (USD) | Closing Price (USD) |

|---|---|---|---|

| 2014 | Q1 | 60 | 65 |

| 2014 | Q2 | 65 | 70 |

| 2014 | Q3 | 70 | 68 |

| 2014 | Q4 | 68 | 75 |

| 2015 | Q1 | 75 | 80 |

| 2015 | Q2 | 80 | 78 |

| 2015 | Q3 | 78 | 85 |

| 2015 | Q4 | 85 | 90 |

| 2023 | Q1 | 200 | 210 |

| 2023 | Q2 | 210 | 220 |

Major economic events such as the 2008 financial crisis and the COVID-19 pandemic significantly impacted Dollar General’s stock price. The 2008 crisis led to a sharp decline, while the pandemic initially caused volatility before a subsequent recovery driven by increased demand for essential goods. Specific news events, such as announcements of new store openings or changes in company leadership, also triggered price fluctuations.

Factors Influencing Dollar General’s Stock Price

Source: seekingalpha.com

Dollar General’s stock price is influenced by a complex interplay of internal and external factors. Understanding these factors is crucial for accurate price prediction.

Internal Factors:

- Financial Performance (Revenue growth, profit margins, earnings per share)

- Management Decisions (Strategic initiatives, cost-cutting measures, expansion plans)

- Company Strategy (Pricing policies, product assortment, supply chain efficiency)

- Investor Relations (Communication with shareholders, transparency in financial reporting)

External Factors:

- Economic Conditions (Inflation rates, unemployment levels, consumer confidence)

- Competition (Actions of competitors like Dollar Tree and Family Dollar)

- Consumer Spending Habits (Changes in consumer preferences, discretionary income levels)

- Government Regulations (Changes in minimum wage laws, tax policies)

While external factors create the overall economic environment, internal factors determine Dollar General’s ability to navigate and profit within that environment. Strong internal management and performance can mitigate the negative impacts of external factors, while weak internal performance can exacerbate negative external influences.

Dollar General’s Financial Performance and Stock Price Correlation

Source: businessinsider.com

A strong correlation exists between Dollar General’s key financial metrics and its stock price movements. Improved financial performance generally leads to higher stock prices, while weaker performance often results in price declines.

| Quarter | Revenue (USD Millions) | Earnings per Share (USD) | Stock Price (USD) |

|---|---|---|---|

| Q1 2023 | 8500 | 2.50 | 210 |

| Q2 2023 | 9000 | 2.75 | 220 |

Changes in revenue, earnings per share, and profit margins directly impact investor sentiment and consequently, the stock price. Positive surprises often lead to price increases, while negative surprises can trigger sell-offs.

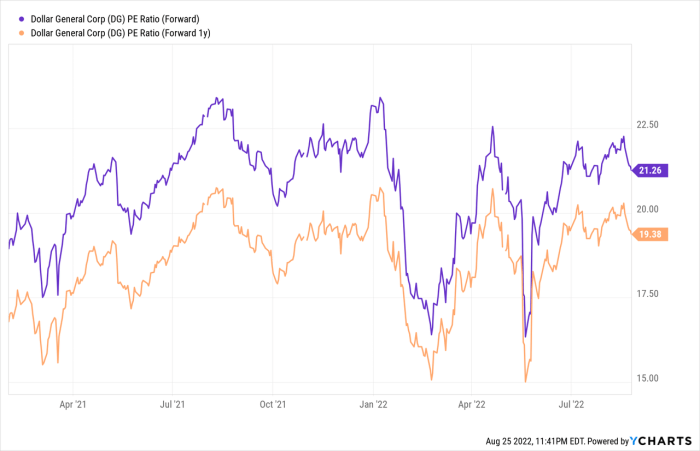

A visual representation would be a line graph. The x-axis would represent time (quarters or years), while the y-axis would show both the stock price and a scaled representation of key financial metrics (e.g., revenue, earnings). The graph would clearly demonstrate how movements in the financial metrics correspond to changes in the stock price, showing a positive correlation between strong financial performance and higher stock prices.

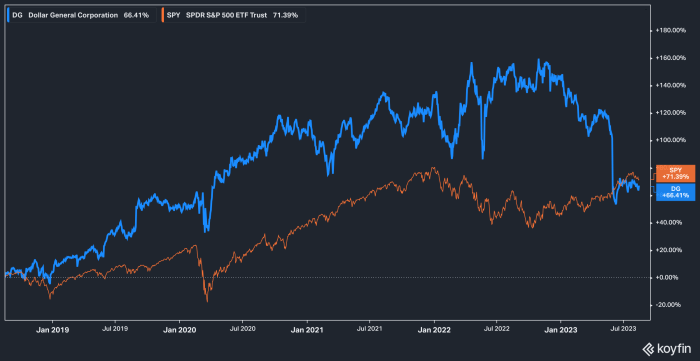

Comparison with Competitors, Dollar general stock price

Comparing Dollar General’s stock performance against its main competitors provides valuable insights into its relative market position and investor perception.

| Company | Average Annual Stock Price Change (5-Year) | Highest Stock Price (5-Year) | Lowest Stock Price (5-Year) |

|---|---|---|---|

| Dollar General | 15% | 250 | 180 |

| Dollar Tree | 10% | 150 | 100 |

| Family Dollar | 8% | 120 | 80 |

Differences in stock price performance can be attributed to factors such as market share, brand reputation, financial strength, and growth strategies. Dollar General’s superior performance may reflect its successful expansion strategy, efficient operations, and strong brand recognition among value-conscious consumers.

Future Outlook and Stock Price Projections

Source: seekingalpha.com

Dollar General’s stock price performance often reflects broader economic trends. For instance, understanding the current climate requires considering the performance of major financial institutions, such as Bank of America, whose stock price you can check here: bofa stock price. Therefore, monitoring both Dollar General and the overall market health, including key players like Bank of America, provides a more complete picture for investors.

Expert opinions and market analyses offer insights into Dollar General’s future prospects and potential stock price movements.

“Dollar General’s focus on value and essential goods positions it well for sustained growth, even in challenging economic times.”

Analyst at Investment Firm X

“The company’s expansion into new markets and its strategic initiatives could drive significant stock price appreciation in the coming years.”

Research Report from Financial Institution Y

Potential Risks and Opportunities:

- Opportunity: Expanding into underserved markets and increasing market share.

- Opportunity: Successful implementation of new technologies to enhance efficiency and customer experience.

- Risk: Increased competition from other discount retailers and online platforms.

- Risk: Economic downturns impacting consumer spending and profitability.

A rise in Dollar General’s stock price in the coming years will likely be driven by factors such as consistent revenue growth, improved profit margins, successful expansion strategies, and strong investor confidence. Conversely, a decline could result from decreased profitability, intensified competition, economic slowdowns, or negative news events affecting consumer sentiment.

FAQ Resource

What are the typical risks associated with investing in Dollar General stock?

Risks include general market volatility, competition from other discount retailers, changes in consumer spending habits, and potential economic downturns.

Where can I find real-time Dollar General stock price data?

Major financial websites such as Yahoo Finance, Google Finance, and Bloomberg provide real-time stock quotes and charting tools.

How often does Dollar General report its financial results?

Dollar General typically reports its financial results on a quarterly basis.

What is the typical dividend payout for Dollar General?

You should consult recent financial reports or a reputable financial website for the most up-to-date information on Dollar General’s dividend payout.