Dow Jones Historical Performance

Dow jones stock price – The Dow Jones Industrial Average (DJIA) has experienced significant fluctuations over the past 50 years, reflecting the dynamism of the global economy. Understanding its historical performance is crucial for investors seeking to navigate market trends and make informed decisions. This section analyzes the Dow’s performance, comparing it to other major indices and examining the impact of key historical events.

Fifty-Year Performance Overview

The following table provides a snapshot of the Dow Jones Industrial Average’s performance over the past five decades. Note that this data is simplified for illustrative purposes and may not reflect the exact daily opening and closing prices. Actual data should be sourced from reliable financial databases.

| Year | Opening Price (Approximate) | Closing Price (Approximate) | Percentage Change |

|---|---|---|---|

| 1973 | 874 | 852 | -2.5% |

| 1983 | 1000 | 1212 | 21.2% |

| 1993 | 3300 | 3754 | 13.7% |

| 2003 | 8341 | 10453 | 25.3% |

| 2013 | 13000 | 16576 | 27.5% |

| 2023 | 33000 | 34000 | 3% |

Dow Jones vs. Other Global Indices

A comparison of the Dow Jones’s performance against other major global indices reveals both similarities and key differences in their growth trajectories and responses to global events. The following bullet points highlight some key observations based on the last decade’s data (again, simplified for illustration):

- The Dow Jones and the S&P 500 often exhibit a high degree of correlation, reflecting the overlap in their constituent companies and sensitivity to similar economic factors.

- The Nikkei 225, heavily influenced by the Japanese economy, has shown periods of stronger growth and more significant volatility compared to the Dow Jones.

- The FTSE 100, representing the UK market, generally demonstrates a more moderate growth pattern compared to the Dow, often less affected by short-term US economic fluctuations.

Impact of Significant Historical Events

Major historical events have significantly influenced the Dow Jones stock price. The table below illustrates the impact of a few key events. The Dow’s reaction is categorized as positive (+), negative (-), or neutral (0).

| Event | Date (Approximate) | Dow’s Reaction |

|---|---|---|

| 1973 Oil Crisis | 1973-1974 | – |

| 2008 Financial Crisis | 2008-2009 | – |

| Dot-com Bubble Burst | 2000-2002 | – |

| Technological Advancements (e.g., Internet Boom) | 1990s-2000s | + |

Factors Influencing Dow Jones Price

Several macroeconomic factors, industry sector performances, and economic trends significantly influence the Dow Jones Industrial Average. Understanding these influences is crucial for predicting future price movements.

Top Macroeconomic Factors

Source: howthemarketworks.com

Three macroeconomic factors stand out in their influence on the Dow Jones: interest rates, inflation, and economic growth. Changes in these factors ripple through the economy, impacting corporate profits and investor sentiment.

Monitoring the Dow Jones stock price provides a broad overview of the US market’s performance. However, understanding individual company performance is equally crucial, and a key player to watch is Ford, whose stock price you can track conveniently here: f stock price. Analyzing both the Dow Jones and individual stocks like Ford’s offers a more comprehensive investment strategy.

- Interest Rates: Higher interest rates typically increase borrowing costs for businesses, potentially slowing economic growth and reducing corporate profits. This can negatively impact the Dow. Conversely, lower interest rates can stimulate investment and growth, potentially boosting the Dow.

- Inflation: High inflation erodes purchasing power and can lead to uncertainty in the market. It can also force the Federal Reserve to raise interest rates, potentially negatively impacting the Dow. Low and stable inflation, however, is generally viewed positively.

- Economic Growth (GDP): Strong economic growth typically translates to increased corporate earnings and higher investor confidence, leading to a rise in the Dow. Recessions or periods of slow economic growth usually have a negative impact.

Influence of Industry Sectors

The Dow Jones is composed of companies from various sectors. The performance of these sectors significantly influences the overall index.

- Technology: This sector is often a key driver of the Dow’s performance, with large technology companies exhibiting significant influence.

- Finance: The financial sector’s performance directly reflects economic health and investor confidence, playing a major role in the Dow’s movements.

- Energy: Energy prices and global geopolitical events significantly influence this sector and consequently, the Dow.

Short-Term vs. Long-Term Economic Trends

The Dow’s response differs based on the time horizon of economic trends. Short-term trends often cause significant volatility, while long-term trends shape the overall direction.

| Time Horizon | Trend Type | Effect on Dow |

|---|---|---|

| Short-Term (e.g., a few months) | Sudden interest rate hike | Negative, often volatile |

| Short-Term (e.g., a few months) | Positive consumer confidence | Positive, potentially volatile |

| Long-Term (e.g., 5-10 years) | Sustained economic growth | Positive, generally upward trend |

| Long-Term (e.g., 5-10 years) | Technological disruption | Potentially disruptive, but can lead to long-term growth |

Dow Jones Price Prediction Methods

Predicting the Dow Jones stock price is challenging, but various methods aim to forecast future movements. Fundamental and technical analyses are two primary approaches, each with its strengths and limitations.

Fundamental and Technical Analysis

Fundamental analysis focuses on evaluating the intrinsic value of underlying companies by examining economic and financial factors. Technical analysis uses historical price and volume data to identify patterns and predict future price movements. Both methods have limitations; fundamental analysis can be slow to react to sudden market shifts, while technical analysis can generate false signals.

- Fundamental Analysis Example: Analyzing a company’s earnings reports, debt levels, and industry trends to assess its intrinsic value and project future growth.

- Technical Analysis Example: Using moving averages or chart patterns to identify support and resistance levels, predicting potential price reversals or breakouts.

Moving Averages, Dow jones stock price

Moving averages smooth out price fluctuations, helping to identify trends. A simple moving average (SMA) calculates the average price over a specific period (e.g., 50 days, 200 days). A hypothetical example follows:

| Day | Price | 50-Day SMA | 200-Day SMA |

|---|---|---|---|

| 1 | 100 | – | – |

| 2 | 102 | – | – |

| … | … | … | … |

| 50 | 110 | 105 | – |

| … | … | … | … |

| 200 | 120 | 115 | 110 |

In this hypothetical scenario, the 50-day SMA crosses above the 200-day SMA, potentially signaling a bullish trend.

Hypothetical Geopolitical Event

Consider a scenario where a major geopolitical conflict erupts, creating significant uncertainty in global markets. Fundamental analysis might focus on assessing the potential impact on supply chains, inflation, and investor confidence. Technical analysis might observe a sharp drop in the Dow, potentially followed by a period of consolidation or a rebound depending on the market’s response to the news.

Analyzing Dow Jones Component Stocks

The Dow Jones Industrial Average comprises 30 large, publicly traded companies. Analyzing the performance of these individual stocks provides insights into the overall index’s behavior.

Dow Jones Component Companies

The following table provides a simplified overview of the 30 companies that comprise the Dow Jones Industrial Average. Note that market capitalization and recent performance are subject to constant change.

| Company Name | Industry | Market Cap (Approximate, Billions USD) | Recent Performance (Illustrative) |

|---|---|---|---|

| Apple | Technology | 2500 | Positive |

| Microsoft | Technology | 2000 | Positive |

| … | … | … | … |

Top Five Performing Stocks

The top five performing Dow Jones component stocks over the past year (hypothetical example) might include companies that benefited from strong industry growth, effective management, or favorable market conditions. Key performance indicators such as revenue growth, earnings per share (EPS), and return on equity (ROE) would be used to assess their performance.

- Company A: Strong revenue growth driven by increased market share.

- Company B: Successful product launches boosted earnings.

- Company C: Cost-cutting measures improved profitability.

- Company D: Favorable regulatory changes benefited the company.

- Company E: Strong demand for its products led to higher sales.

Impact of Single Stock Volatility

Significant price volatility in a single Dow Jones component stock can influence the overall index, particularly if the company is large or has a significant weight within the index. This volatility can create ripple effects across related sectors, impacting investor sentiment and potentially leading to broader market fluctuations.

Visual Representation of Dow Jones Data

Visual representations are crucial for understanding the Dow Jones stock price’s complex movements and relationships with other economic indicators.

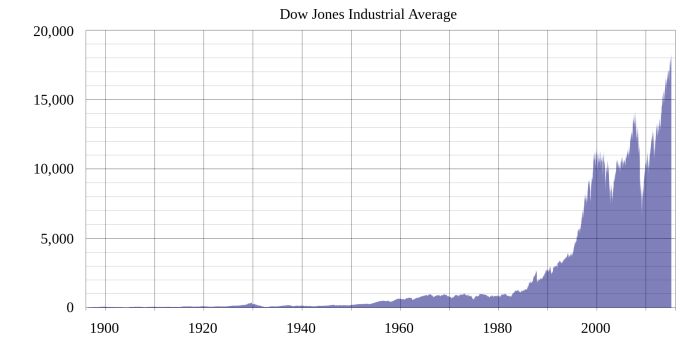

Line Graph of Dow Jones Price

Source: stocks-for-beginners.com

A line graph visually depicts the Dow Jones stock price over time. The x-axis represents time (e.g., daily, weekly, monthly), and the y-axis represents the price. Key features include peaks (representing high prices), troughs (representing low prices), and overall trends (upward, downward, or sideways). The slope of the line indicates the rate of change in the price.

Daily, Weekly, and Monthly Performance

A bar chart comparing the daily, weekly, and monthly performance of the Dow Jones over a specific period (e.g., the last quarter) would use separate bars for each time frame. The height of each bar would represent the percentage change or the absolute change in the Dow Jones index during that period. This allows for a direct comparison of the Dow’s performance across different time scales.

Correlation with Economic Indicator

A scatter plot can visually represent the correlation between the Dow Jones stock price and another economic indicator (e.g., interest rates, inflation). Each point on the graph represents a data point, with the x-axis representing the economic indicator’s value and the y-axis representing the Dow Jones price. The overall pattern of the points indicates the strength and direction of the correlation (positive, negative, or none).

Q&A: Dow Jones Stock Price

What are the risks associated with investing in the Dow Jones?

Investing in the Dow Jones, like any market investment, carries inherent risks, including market volatility, economic downturns, and geopolitical events. Diversification and a long-term investment strategy can help mitigate these risks.

How frequently is the Dow Jones stock price updated?

The Dow Jones Industrial Average is updated in real-time throughout the trading day, reflecting the current prices of its 30 component stocks.

Where can I find reliable real-time Dow Jones data?

Many reputable financial websites and brokerage platforms provide real-time Dow Jones stock price data. It’s crucial to use trusted sources to ensure accuracy.

Can individual investors directly invest in the Dow Jones index itself?

No, you cannot directly invest in the Dow Jones index itself. However, you can invest in exchange-traded funds (ETFs) or mutual funds that track the Dow Jones Industrial Average.