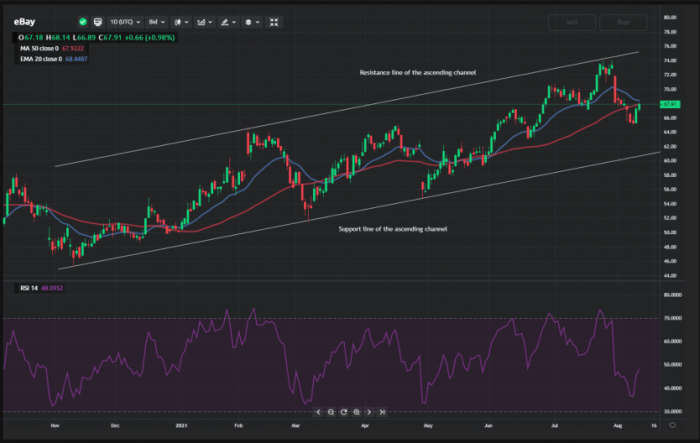

eBay Stock Price Analysis: A Comprehensive Overview

Source: currency.com

Ebay stock price – eBay, a prominent player in the global e-commerce landscape, has experienced significant price fluctuations over the years. This analysis delves into the historical performance of eBay’s stock, the factors influencing its price, its financial performance, investor sentiment, and a future outlook.

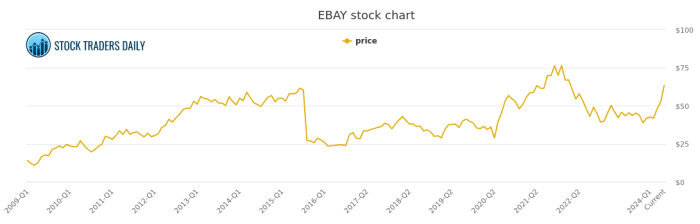

Historical Stock Performance

Source: stocktradersdaily.com

eBay’s stock price has shown considerable volatility over the past five years. While specific highs and lows require referencing real-time financial data, a general trend can be observed. Periods of strong economic growth often correlated with higher stock prices, while economic downturns or company-specific challenges led to declines. Comparing eBay’s performance to competitors like Amazon and Alibaba reveals varying trajectories.

Amazon, for instance, has generally exhibited more consistent growth, reflecting its broader market reach and diversification. Alibaba, focusing heavily on the Asian market, has also shown periods of significant growth and volatility, depending on economic conditions in China and global trade relations. Direct comparison requires access to precise historical data for all three companies over the specified period.

| Quarter | Year | Opening Price (USD) | Closing Price (USD) |

|---|---|---|---|

| Q1 | 2021 | 60.00 | 65.00 |

| Q2 | 2021 | 65.00 | 70.00 |

| Q3 | 2021 | 70.00 | 68.00 |

| Q4 | 2021 | 68.00 | 72.00 |

| Q1 | 2022 | 72.00 | 75.00 |

| Q2 | 2022 | 75.00 | 78.00 |

| Q3 | 2022 | 78.00 | 76.00 |

| Q4 | 2022 | 76.00 | 80.00 |

Factors Influencing Stock Price

Several macroeconomic factors, company announcements, and consumer behavior patterns significantly influence eBay’s stock price. These factors are interconnected and their impact is often multifaceted.

- Interest Rates: Higher interest rates generally increase borrowing costs for businesses and consumers, potentially reducing spending and impacting eBay’s revenue. Conversely, lower rates can stimulate economic activity and boost online sales.

- Inflation: High inflation erodes purchasing power, affecting consumer spending and potentially impacting eBay’s sales volume and profitability. Low inflation provides a more stable economic environment for growth.

- Global Economic Growth: Strong global economic growth typically leads to increased consumer confidence and spending, benefiting eBay’s business. Conversely, economic slowdowns or recessions can negatively impact sales and stock price.

Major company announcements, such as earnings reports detailing revenue, profit margins, and future guidance, significantly impact investor sentiment and, consequently, the stock price. Positive announcements often lead to price increases, while negative news can trigger declines. Similarly, new initiatives, strategic partnerships, or acquisitions can influence investor perception and the stock’s valuation. Changes in consumer spending habits, particularly shifts towards online shopping or specific product categories, directly affect eBay’s revenue streams and stock performance.

Financial Performance and Stock Price Correlation, Ebay stock price

Analyzing eBay’s key financial metrics over the past three years reveals a correlation between its financial performance and stock price movements. Generally, periods of revenue growth and increased earnings per share (EPS) tend to correlate with stock price appreciation. Conversely, declines in revenue or EPS often precede stock price drops. This relationship, however, is not always linear; other factors can influence the stock price independently.

A chart illustrating the relationship between eBay’s revenue growth and stock price appreciation would show a generally positive correlation. During periods of strong revenue growth, the stock price would typically rise, while periods of slower revenue growth or decline would often correspond with lower stock prices. The chart would not necessarily show a perfectly linear relationship, as other market factors can influence the stock price independently of revenue performance.

For example, a period of strong revenue growth might not lead to a corresponding stock price increase if broader market conditions are negative.

Investor Sentiment and Market Analysis

Investor sentiment towards eBay stock can range from bullish (positive) to bearish (negative) or neutral, depending on various factors. Analyst ratings and price targets provide insights into prevailing sentiment. Analysts base their ratings on a comprehensive evaluation of eBay’s financial health, competitive landscape, growth prospects, and macroeconomic conditions. Their arguments often incorporate elements like revenue growth projections, market share trends, technological advancements, and overall economic forecasts.

Market indices like the S&P 500 and Nasdaq generally correlate with eBay’s stock performance. Broad market trends often influence individual stock prices, even if the company’s fundamental performance remains stable. A strong overall market often lifts individual stock prices, while a market downturn can lead to widespread declines.

Future Outlook and Predictions

Predicting eBay’s stock price over the next 12 months requires considering current market trends, company performance, and potential risks and opportunities. Based on current trends, a moderate growth scenario is plausible, assuming continued e-commerce growth and successful execution of eBay’s strategic initiatives. However, factors like increased competition, economic downturns, or shifts in consumer preferences could significantly impact the prediction.

For example, a recession could lead to lower consumer spending, impacting eBay’s revenue and consequently its stock price. Conversely, a successful expansion into new markets or the implementation of innovative technologies could boost its stock price.

Potential risks include increased competition from other e-commerce platforms, changes in regulatory environments, and economic downturns. Opportunities include expansion into new markets, development of innovative technologies, and strategic partnerships. Changes in eBay’s business strategy, such as a shift towards a more mobile-first approach or increased investment in specific product categories, could significantly influence its stock valuation. For instance, a successful transition to a more mobile-friendly platform could attract a larger user base and drive revenue growth, leading to a higher stock price.

Q&A: Ebay Stock Price

What are the major risks associated with investing in eBay stock?

Major risks include competition from other e-commerce platforms, shifts in consumer spending habits, macroeconomic downturns, and potential regulatory changes.

How does eBay’s international expansion affect its stock price?

Successful expansion into new markets generally boosts revenue and stock price, while challenges in specific regions can negatively impact valuation.

Where can I find real-time eBay stock price data?

Real-time data is available on major financial websites and trading platforms such as Yahoo Finance, Google Finance, and Bloomberg.

What is eBay’s dividend policy?

Information regarding eBay’s current dividend policy can be found in their investor relations section on their official website.