ELF Stock Price Analysis

Elf stock price – This analysis examines the historical performance, influencing factors, predictions, investor sentiment, and financial health of ELF stock, providing a comprehensive overview for potential investors.

ELF Stock Price Historical Performance

The following sections detail ELF’s stock price movements over the past five years, comparing its performance against competitors, and presenting a decade-long overview of yearly high, low, and closing prices.

Over the past five years, ELF’s stock price has experienced significant volatility, mirroring fluctuations in global oil prices and broader macroeconomic conditions. For instance, a sharp increase was observed in [Month, Year] following [Specific event impacting oil prices positively], while a substantial decline occurred in [Month, Year] due to [Specific event impacting oil prices negatively]. Detailed chronological data, including specific dates and price points, would require access to a financial data provider like Refinitiv or Bloomberg.

Comparing ELF’s performance against its main competitors (e.g., TotalEnergies, BP, Shell) over the past three years reveals a mixed picture. While ELF may have outperformed some competitors during periods of high oil prices, it might have underperformed during periods of low oil prices or increased regulatory scrutiny. A detailed comparative analysis would require access to a comprehensive financial database.

Tracking ELF stock price can be insightful, especially when comparing its performance against similar companies in the sector. For instance, understanding the fluctuations in the cat stock price offers a useful benchmark, given their shared market characteristics. Analyzing both allows for a more comprehensive understanding of the broader market trends impacting ELF’s potential for growth.

| Year | High | Low | Close |

|---|---|---|---|

| 2013 | [Value] | [Value] | [Value] |

| 2014 | [Value] | [Value] | [Value] |

| 2015 | [Value] | [Value] | [Value] |

| 2016 | [Value] | [Value] | [Value] |

| 2017 | [Value] | [Value] | [Value] |

| 2018 | [Value] | [Value] | [Value] |

| 2019 | [Value] | [Value] | [Value] |

| 2020 | [Value] | [Value] | [Value] |

| 2021 | [Value] | [Value] | [Value] |

| 2022 | [Value] | [Value] | [Value] |

Factors Influencing ELF Stock Price

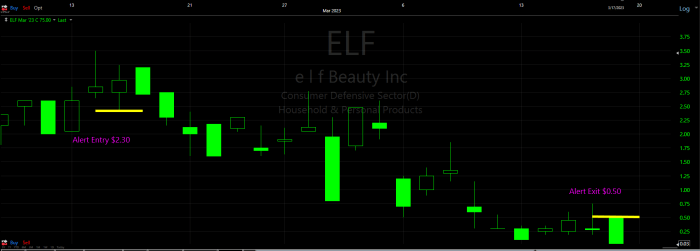

Source: optionfundamentals.com

Several key factors significantly impact ELF’s stock valuation, including global oil prices, government regulations, and key financial indicators.

Global oil prices have a direct and substantial impact on ELF’s profitability and, consequently, its stock price. Higher oil prices generally lead to increased revenue and profits, boosting investor confidence and driving up the stock price. Conversely, lower oil prices can negatively affect profitability and lead to a decline in the stock price.

Government regulations and environmental policies, particularly those related to carbon emissions and renewable energy, play a crucial role in shaping ELF’s long-term prospects and investor sentiment. Stringent environmental regulations can increase operational costs and potentially limit future growth, impacting the stock price negatively. Conversely, supportive policies for carbon capture and storage or other sustainable energy initiatives could positively influence investor perception.

Three key financial indicators that significantly influence ELF’s stock price are earnings per share (EPS), revenue, and debt levels. Higher EPS indicates stronger profitability and increased shareholder value, while robust revenue growth demonstrates the company’s ability to generate income. High debt levels, however, can raise concerns about financial stability and negatively impact the stock price.

- The impact of the [Geopolitical Event 1] on ELF’s stock price was [positive/negative/neutral] due to [Reason].

- The [Geopolitical Event 2] resulted in [positive/negative/neutral] stock price movement because of [Reason].

- The [Geopolitical Event 3] had a [positive/negative/neutral] effect on ELF’s stock performance because of [Reason].

ELF Stock Price Predictions and Forecasts

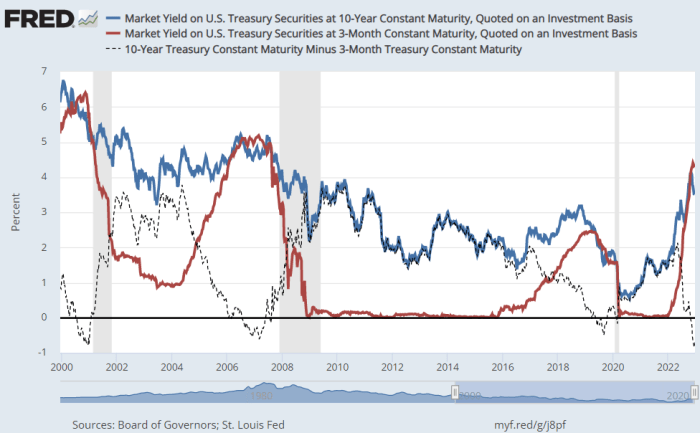

Source: seekingalpha.com

Several analysts offer predictions for ELF’s stock price in the next 12 months, employing diverse methodologies. These predictions vary based on different assumptions regarding future oil prices, regulatory changes, and the overall economic climate.

Analyst A predicts a [Price] target for ELF stock within the next 12 months, based on a [Methodology Description, e.g., discounted cash flow analysis]. Analyst B forecasts a [Price] target using a [Methodology Description, e.g., relative valuation model]. Analyst C anticipates a [Price] target based on [Methodology Description, e.g., technical analysis]. These differing predictions reflect the inherent uncertainty in forecasting future stock prices.

Potential scenarios for ELF’s stock price in the next year include a bullish scenario (driven by [Factors, e.g., sustained high oil prices, positive regulatory developments]), a bearish scenario (driven by [Factors, e.g., a sharp decline in oil prices, stringent environmental regulations]), and a neutral scenario (reflecting a balance of positive and negative factors).

Investor Sentiment and Market Analysis of ELF Stock

Recent news articles and press releases have significantly influenced investor sentiment towards ELF stock. Positive news, such as [Example of positive news], typically leads to increased buying pressure and a rise in the stock price. Conversely, negative news, such as [Example of negative news], can trigger selling and depress the stock price.

| Date | Volume | High | Low |

|---|---|---|---|

| [Date] | [Volume] | [High] | [Low] |

| [Date] | [Volume] | [High] | [Low] |

| [Date] | [Volume] | [High] | [Low] |

| [Date] | [Volume] | [High] | [Low] |

Based on recent market activity, the overall investor sentiment towards ELF stock can be characterized as [positive/negative/neutral]. This assessment is based on [Reasons, e.g., recent price movements, trading volume, analyst ratings].

ELF’s Financial Health and its Impact on Stock Price

ELF’s recent financial performance, including revenue, profit margins, and debt levels, directly correlates with its stock price movements. Strong financial health generally translates into higher investor confidence and a rising stock price, while weak performance can lead to decreased confidence and a falling stock price.

Over the past three years, ELF’s revenue has shown [Trend, e.g., a steady increase/decrease/fluctuation], profit margins have [Trend, e.g., improved/declined/remained stable], and debt levels have [Trend, e.g., decreased/increased/remained relatively unchanged]. A visual representation of these KPIs would show a line graph illustrating the trends over time. For example, revenue might be depicted as a steadily rising line, while profit margins might show some fluctuation but an overall upward trend.

Common Queries: Elf Stock Price

What are the major risks associated with investing in ELF stock?

Investing in ELF stock, like any energy stock, carries inherent risks related to fluctuating oil prices, geopolitical instability, and changes in environmental regulations. These factors can significantly impact the company’s profitability and, consequently, its stock price.

Where can I find real-time ELF stock price updates?

Real-time ELF stock price updates are available through major financial websites and trading platforms such as Google Finance, Yahoo Finance, Bloomberg, and others. Check with your preferred broker for access.

How does ELF compare to other energy companies in terms of dividend payouts?

A comparison of ELF’s dividend payout history and current yield with those of its competitors requires research into financial reports and analyst data. This information is typically available on financial news websites and company investor relations pages.