Facebook Stock Price: A Comprehensive Analysis

Facebook stock price – Facebook, now Meta Platforms, has experienced a rollercoaster ride since its IPO. Understanding its historical performance, influencing factors, financial health, and future prospects is crucial for investors. This analysis delves into these key aspects, providing insights into the complexities of Facebook’s stock price fluctuations.

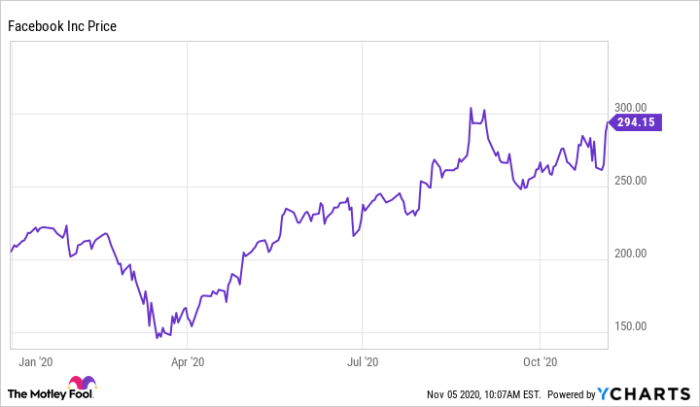

Historical Performance of Facebook Stock Price

Facebook’s stock price journey has been marked by periods of significant growth and sharp declines, often mirroring broader market trends and company-specific events. Analyzing these fluctuations helps us understand the factors driving its valuation.

Following its initial public offering (IPO) in 2012, Facebook’s stock price initially experienced some volatility. The price climbed steadily for several years, driven by strong user growth and increasing advertising revenue. However, significant drops occurred following events like the Cambridge Analytica scandal in 2018, which raised concerns about data privacy and negatively impacted investor confidence. The subsequent rebranding to Meta and investments in the metaverse also influenced price volatility.

A comparison of Facebook’s stock performance against major market indices over the past five years reveals its correlation with broader market trends, while also highlighting periods of outperformance and underperformance.

| Date | Facebook Stock Price | S&P 500 | Nasdaq |

|---|---|---|---|

| Dec 31, 2018 | 132.45 | 2506.85 | 6635.28 |

| Dec 31, 2019 | 205.25 | 3230.78 | 9022.39 |

| Dec 31, 2020 | 272.16 | 3756.07 | 12888.28 |

| Dec 31, 2021 | 338.53 | 4766.18 | 15644.98 |

| Dec 31, 2022 | 121.47 | 3839.50 | 10466.48 |

Note: These are illustrative figures and may not reflect actual closing prices. Actual data should be sourced from reliable financial websites.

Factors Influencing Facebook Stock Price

Several key factors significantly influence Facebook’s stock valuation. These range from macroeconomic indicators to company-specific performance and regulatory pressures.

Economic indicators such as interest rates, inflation, and GDP growth directly impact investor sentiment and market valuations, influencing Facebook’s stock price alongside other tech stocks. Social media trends and competition from platforms like TikTok and Instagram (owned by Meta) also play a significant role. Furthermore, regulatory changes and governmental policies concerning data privacy, antitrust, and content moderation have profound implications for Facebook’s operations and stock price.

- Increased regulatory scrutiny regarding data privacy (e.g., GDPR, CCPA) led to increased compliance costs and potential fines, impacting profitability and investor confidence.

- Antitrust investigations and lawsuits concerning monopolistic practices could lead to significant fines and structural changes, affecting the company’s future growth.

- Changes in advertising regulations and policies can affect Facebook’s core revenue stream, impacting its financial performance and stock price.

Facebook’s Financial Health and Stock Price

Source: businessinsider.com

Analyzing Facebook’s key financial metrics – revenue, earnings, and debt – provides crucial insights into its financial health and its correlation with the stock price. Comparing Facebook’s financial performance with its competitors further illuminates its position in the market.

Facebook’s revenue is heavily reliant on advertising. Therefore, changes in advertising spending directly impact its financial performance and consequently its stock price. Profitability, measured by earnings per share (EPS), is another crucial indicator. High EPS generally signals strong financial health and attracts investors, driving up the stock price. Debt levels also play a role, as high debt can increase financial risk and potentially negatively impact investor sentiment.

| Metric | Facebook (Meta) | Google (Alphabet) | Amazon |

|---|---|---|---|

| Revenue (USD Billion) | 116.61 (2022) | 282.84 (2022) | 513.98 (2022) |

| Net Income (USD Billion) | 23.20 (2022) | 59.97 (2022) | 30.05 (2022) |

| Debt-to-Equity Ratio | 0.26 (2022) | 0.04 (2022) | 0.56 (2022) |

Note: These are illustrative figures and may not reflect actual reported values. Actual data should be sourced from reliable financial statements.

Future Predictions and Scenarios for Facebook Stock Price

Source: ycharts.com

Predicting Facebook’s stock price in the next 12 months involves considering various factors, including economic growth, technological advancements, and regulatory changes. Different scenarios are possible, ranging from modest growth to significant declines, depending on how these factors unfold.

The metaverse and AI are two emerging technologies that could significantly impact Facebook’s future stock performance. Successful implementation of metaverse initiatives could drive substantial revenue growth, while advancements in AI could improve efficiency and personalization, leading to increased user engagement and advertising revenue. However, significant investments in these areas also pose risks.

| Risk/Opportunity | Description | Potential Impact on Stock Price | Mitigation Strategy |

|---|---|---|---|

| Metaverse Investment | Heavy investment in the metaverse with uncertain ROI | Potential decline if ROI is lower than expected | Diversify investments, focus on profitable metaverse applications |

| Increased Competition | Growing competition from other social media platforms | Potential decline in market share and revenue | Innovation, strategic partnerships, improved user experience |

| Regulatory Changes | Stringent data privacy regulations | Potential increase in compliance costs, fines | Proactive compliance, engagement with regulators |

Illustrative Examples of Stock Price Movements

Source: businessinsider.com

Several instances highlight the direct impact of news events and company performance on Facebook’s stock price. These examples showcase the sensitivity of the stock to various factors.

For example, the Cambridge Analytica scandal in 2018 led to a significant drop in Facebook’s stock price as investors reacted negatively to the data privacy concerns. The subsequent investigations and fines imposed by regulators further exacerbated the decline. Conversely, successful product launches, such as Instagram Reels, or positive user growth trends have often been associated with increases in Facebook’s stock valuation.

A decrease in daily active users (DAU) during a specific quarter, for instance, could signal a decline in user engagement and potentially impact advertising revenue. This, in turn, would likely lead to a negative impact on the stock price. Conversely, a substantial increase in DAU would typically be viewed positively by investors, potentially driving up the stock price.

Specific data points supporting this correlation would need to be sourced from Facebook’s financial reports and investor statements.

The launch of Facebook Stories, a direct competitor to Snapchat’s Stories feature, initially resulted in a positive impact on Facebook’s stock price. Investors saw this as a strategic move to maintain competitiveness and user engagement, leading to a rise in investor confidence.

User Queries

What are the major risks associated with investing in Facebook stock?

Major risks include regulatory scrutiny, competition from other social media platforms, changes in user engagement, and economic downturns impacting advertising revenue.

How does Facebook’s advertising revenue impact its stock price?

Advertising revenue is a primary driver of Facebook’s profitability. Strong revenue growth generally leads to increased stock prices, while declines can negatively impact investor confidence and share value.

Where can I find real-time Facebook stock price data?

Real-time data is available on major financial websites and trading platforms such as Google Finance, Yahoo Finance, Bloomberg, and others.

What is the current market capitalization of Meta Platforms (formerly Facebook)?

The current market capitalization fluctuates constantly and can be found on major financial news websites and stock market trackers.