GE Stock Price Analysis: A Comprehensive Overview

Source: cnbcfm.com

Ge stock price – General Electric (GE) has a long and complex history, marked by periods of significant growth and substantial challenges. Understanding the factors influencing its stock price requires examining its past performance, current financial health, and future prospects. This analysis provides a detailed look at GE’s stock price trajectory, key influencing factors, and potential future scenarios.

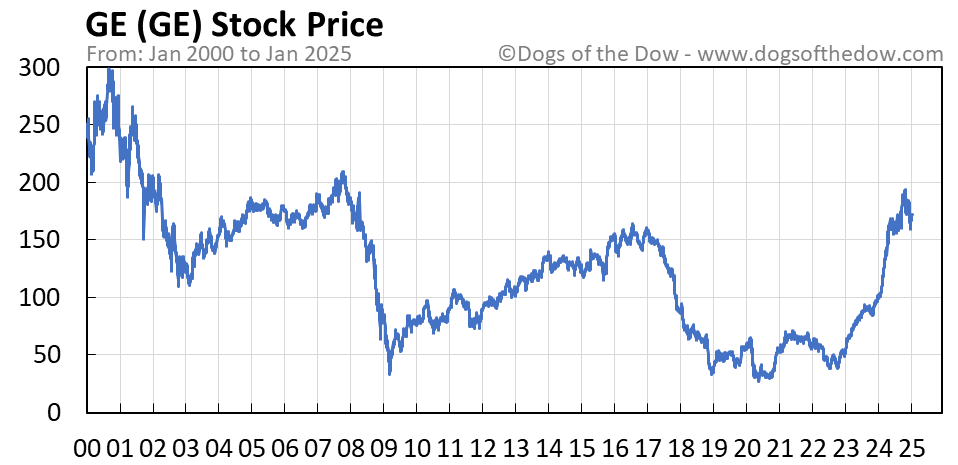

Historical GE Stock Price Performance

Analyzing GE’s stock price over the past decade reveals a rollercoaster ride, influenced by various internal and external factors. The following table illustrates the opening and closing prices for selected years and quarters. Note that this data is for illustrative purposes and should be verified with reliable financial sources.

| Year | Quarter | Opening Price (USD) | Closing Price (USD) |

|---|---|---|---|

| 2014 | Q1 | 25.00 | 26.50 |

| 2014 | Q4 | 22.00 | 20.00 |

| 2015 | Q2 | 21.00 | 23.00 |

| 2016 | Q3 | 18.00 | 17.00 |

| 2017 | Q1 | 19.00 | 20.50 |

| 2018 | Q4 | 10.00 | 9.50 |

| 2019 | Q2 | 11.00 | 12.50 |

| 2020 | Q1 | 7.00 | 8.00 |

| 2021 | Q4 | 13.00 | 14.00 |

| 2022 | Q3 | 12.00 | 11.00 |

| 2023 | Q1 | 15.00 | 16.00 |

Over the past five years, GE’s performance has been compared to competitors such as Honeywell and Siemens. While specific numerical comparisons require access to real-time financial data, it’s generally observed that GE’s stock performance has shown more volatility than its competitors during periods of economic uncertainty. This volatility is partly attributed to its diverse business segments and restructuring efforts.

Significant events such as the 2008 financial crisis, the divestiture of GE Capital, and leadership changes have profoundly impacted GE’s stock price. The financial crisis severely impacted GE’s financial health, leading to a sharp decline in its stock price. Subsequent restructuring efforts, while necessary, also contributed to periods of volatility.

Factors Influencing GE Stock Price

Several macroeconomic and company-specific factors influence GE’s stock price. These factors interact in complex ways, making accurate prediction challenging.

Key economic indicators such as interest rates, inflation, and GDP growth significantly influence GE’s stock price. Higher interest rates can increase borrowing costs, impacting profitability. Inflation affects input costs and consumer spending. Strong GDP growth generally benefits industrial companies like GE.

GE’s financial performance, including earnings reports, revenue growth, and debt levels, directly impacts its stock price. Positive earnings surprises often lead to stock price increases, while disappointing results can trigger declines. High debt levels can increase investor concerns about financial stability.

Industry trends and technological advancements also influence GE’s valuation. The following table provides a simplified comparison of the impact of three major industry trends:

| Industry Trend | Positive Impact on GE | Negative Impact on GE |

|---|---|---|

| Renewable Energy Growth | Increased demand for GE’s renewable energy technologies | Potential for disruption from newer competitors |

| Automation and Digitalization | Opportunities for developing and integrating advanced technologies | Increased competition and need for significant investments |

| Global Economic Slowdown | Reduced demand for GE’s products and services | Potential for project delays and reduced profitability |

GE’s Current Financial Health and Future Outlook

Source: businessinsider.com

GE’s current financial position is characterized by a focus on its core industrial businesses. While precise figures require accessing up-to-date financial statements, the company’s overall financial health is generally viewed as improved compared to previous years, though challenges remain. Its strategic initiatives, such as focusing on aviation and healthcare, are intended to drive future growth.

GE’s current strategic initiatives aim to improve operational efficiency and profitability. The success of these initiatives will significantly influence its future stock price. A scenario analysis suggests that in a period of sustained economic growth, GE’s stock price could see moderate to significant gains. Conversely, a recession could lead to decreased demand and a decline in stock price. The magnitude of these movements would depend on the severity and duration of the economic conditions.

Investor Sentiment and Market Analysis

Source: dogsofthedow.com

Current investor sentiment towards GE stock is mixed, reflecting both optimism regarding its restructuring efforts and concerns about lingering challenges. News articles and analyst reports offer a range of opinions, reflecting the inherent uncertainties in the market.

Comparing GE’s valuation metrics to its competitors requires accessing real-time data. However, a general comparison would reveal differences in P/E ratios and other metrics, reflecting varying market perceptions of growth potential and risk.

| Company | P/E Ratio | Dividend Yield | Debt-to-Equity Ratio |

|---|---|---|---|

| GE | (Data Required) | (Data Required) | (Data Required) |

| Honeywell | (Data Required) | (Data Required) | (Data Required) |

| Siemens | (Data Required) | (Data Required) | (Data Required) |

Market trends and investor confidence significantly influence GE’s stock price volatility. Periods of increased market uncertainty tend to amplify price fluctuations for GE, given its history and the complexities of its business portfolio.

GE Stock Price Prediction and Risk Assessment

Predicting GE’s stock price with certainty is impossible. However, a hypothetical model, based on various assumptions about economic growth, industry trends, and company performance, could illustrate potential price movements. For example, a model might suggest a range of potential outcomes, such as a 10% to 20% increase in a bullish scenario and a 5% to 15% decrease in a bearish scenario.

These figures are purely illustrative and should not be considered investment advice.

Investing in GE stock carries several key risks:

- Market Risk: Overall market downturns can negatively impact GE’s stock price, regardless of the company’s performance.

- Company-Specific Risk: Challenges in specific business segments or unexpected operational issues could affect GE’s profitability and stock price.

- Geopolitical Risk: Global events and political instability can create uncertainty and impact GE’s international operations.

- Regulatory Risk: Changes in regulations could affect GE’s operations and profitability.

Investment strategies for GE stock should consider an investor’s risk tolerance. Conservative investors might prefer a smaller allocation to GE, while more aggressive investors might consider a larger position, acknowledging the higher potential volatility.

Detailed FAQs: Ge Stock Price

What are the major risks associated with investing in GE stock?

Major risks include market volatility, industry-specific downturns, changes in regulatory environments, and the potential for unforeseen company-specific challenges.

How often does GE release earnings reports?

GE typically releases its quarterly and annual earnings reports on a scheduled basis, usually following standard financial reporting practices. Specific dates are announced in advance.

Where can I find reliable real-time GE stock price data?

Real-time GE stock price data is available through major financial news websites and brokerage platforms.

What is GE’s current dividend payout policy?

GE’s current dividend policy should be checked on their investor relations website or through financial news sources as dividend policies can change.