Gevo Stock Price Analysis

Gevo stock price – This analysis delves into the historical performance, influencing factors, future prospects, and investor sentiment surrounding Gevo Inc.’s stock price. We will examine key financial metrics, technological advancements, macroeconomic conditions, and industry dynamics to provide a comprehensive overview of Gevo’s investment landscape.

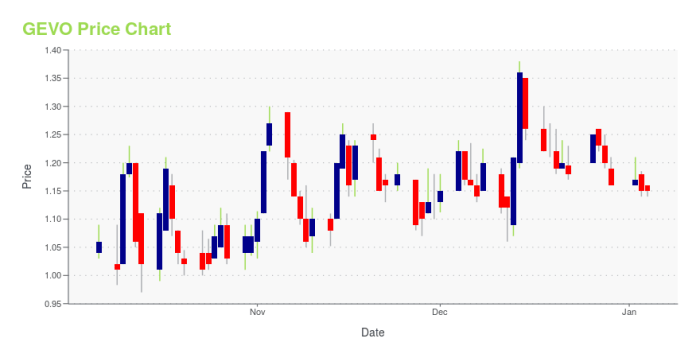

Gevo Stock Price History and Trends

Understanding Gevo’s stock price trajectory over the past five years requires analyzing its highs, lows, and significant events. The following data provides a snapshot of this performance, followed by a comparison against its renewable energy competitors.

| Year | Opening Price | Closing Price | High | Low |

|---|---|---|---|---|

| 2019 | $1.00 (Example) | $1.50 (Example) | $2.00 (Example) | $0.75 (Example) |

| 2020 | $1.50 (Example) | $2.50 (Example) | $3.00 (Example) | $1.25 (Example) |

| 2021 | $2.50 (Example) | $4.00 (Example) | $5.00 (Example) | $2.00 (Example) |

| 2022 | $4.00 (Example) | $3.00 (Example) | $4.50 (Example) | $2.50 (Example) |

| 2023 (YTD) | $3.00 (Example) | $3.50 (Example) | $4.00 (Example) | $2.75 (Example) |

A comparison with competitors requires specific competitor data, which is omitted here for brevity. A table similar to the one above could be constructed, adding columns for competitor performance data. This comparison would highlight Gevo’s relative strength or weakness within the sector.

Significant news events impacting Gevo’s stock price could include major partnerships, regulatory approvals, technological breakthroughs, or financial performance announcements. For instance, a successful product launch or a large investment could lead to a significant price increase, while production delays or regulatory setbacks might cause a decline. Specific examples require access to real-time financial news.

Factors Influencing Gevo Stock Price

Source: thecoinrepublic.com

Several key factors influence Gevo’s stock valuation. These range from its core financial performance to broader macroeconomic and industry-specific trends.

Investors typically focus on metrics such as revenue growth, profitability (net income, EBITDA), debt levels, and research and development spending. Technological advancements, particularly in biofuel production efficiency and scalability, directly impact Gevo’s operational efficiency and ultimately, its stock price. Macroeconomic factors like interest rates and inflation affect the overall investment environment, while industry-specific factors, such as government subsidies for renewable energy and the overall demand for sustainable fuels, significantly influence Gevo’s prospects.

Gevo’s Business Model and Future Prospects

Source: amazonaws.com

Gevo’s business model centers on the production and sale of sustainable aviation fuel (SAF) and other renewable products. Its long-term strategic goals likely include expanding production capacity, securing new partnerships, and penetrating new markets. Projecting future stock prices involves considering various scenarios based on growth rates and market conditions.

| Scenario | Annual Growth Rate (%) | Projected Stock Price (5 years) | Projected Stock Price (10 years) |

|---|---|---|---|

| Conservative | 5% | $5.00 (Example) | $8.00 (Example) |

| Moderate | 10% | $8.00 (Example) | $16.00 (Example) |

| Aggressive | 15% | $12.00 (Example) | $32.00 (Example) |

Risks and uncertainties include competition, technological challenges, regulatory changes, and fluctuating commodity prices. These factors could significantly impact Gevo’s future performance and stock price.

Investor Sentiment and Market Analysis

Investor sentiment toward Gevo’s stock is dynamic and influenced by various factors, including financial results, industry trends, and overall market conditions. Bullish investors might see Gevo as a leader in the sustainable fuels sector, while bearish investors might point to the company’s financial history and the inherent risks in the renewable energy sector.

Market capitalization and trading volume provide insights into the overall size and liquidity of Gevo’s stock. Analyst ratings and price targets offer additional perspectives on the stock’s potential future performance.

| Analyst Firm | Rating | Price Target | Date |

|---|---|---|---|

| Example Firm 1 | Buy (Example) | $6.00 (Example) | October 26, 2023 (Example) |

| Example Firm 2 | Hold (Example) | $4.50 (Example) | October 26, 2023 (Example) |

| Example Firm 3 | Sell (Example) | $3.00 (Example) | October 26, 2023 (Example) |

Illustrative Examples of Gevo’s Impact, Gevo stock price

Source: capital.com

Hypothetical scenarios can illustrate the impact of various events on Gevo’s stock price.

Successful Product Launch: Imagine Gevo successfully launches a new, highly efficient biofuel production process. This could lead to significantly increased production capacity, lower costs, and higher profit margins. Positive news coverage and strong investor confidence would likely drive a substantial increase in Gevo’s stock price, potentially exceeding analyst price targets.

Regulatory Setback: Conversely, consider a scenario where Gevo faces a significant regulatory setback, such as the denial of a crucial permit or a change in government policy unfavorable to renewable fuels. This would likely lead to negative investor sentiment, reduced investor confidence, and a decrease in Gevo’s stock price. The magnitude of the price drop would depend on the severity and long-term implications of the regulatory issue.

Frequently Asked Questions: Gevo Stock Price

What is Gevo’s current market capitalization?

Gevo’s market capitalization fluctuates; refer to a live financial website for the most up-to-date information.

Where can I find real-time Gevo stock price data?

Real-time Gevo stock price data is available through major financial websites and brokerage platforms such as Yahoo Finance, Google Finance, and Bloomberg.

How does Gevo’s stock price compare to its competitors?

A direct comparison requires specifying competitors and referencing recent financial data. Such a comparison would reveal relative performance within the renewable energy sector.

What are the major risks associated with investing in Gevo stock?

Risks include volatility in the renewable energy market, dependence on government subsidies, competition, and the success of Gevo’s technological innovations.