Google Stock Price Analysis

Google stock price – Google’s stock price, a reflection of its performance and market standing, has experienced significant fluctuations over the past decade. This analysis delves into the historical performance, influencing factors, business model, prediction methods, and investment strategies related to Google’s stock price, providing a comprehensive overview for investors and those interested in the tech sector.

Historical Google Stock Performance

Analyzing Google’s stock price over the past ten years reveals a trajectory marked by both substantial growth and periods of volatility. Several key events, ranging from product launches to macroeconomic shifts, have significantly influenced its value. A comparative analysis against major competitors provides further context.

| Year | High | Low | Percentage Change |

|---|---|---|---|

| 2014 | $558.69 | $506.21 | +10.3% (Example) |

| 2015 | $789.42 | $660.10 | +18.5% (Example) |

| 2016 | $826.55 | $712.88 | +15.9% (Example) |

| 2017 | $1074.33 | $890.25 | +20.7% (Example) |

| 2018 | $1273.00 | $1005.00 | +26.6% (Example) |

| 2019 | $1365.00 | $1045.00 | +30.2% (Example) |

| 2020 | $1800.00 | $1100.00 | +63.6% (Example) |

| 2021 | $2900.00 | $1900.00 | +52.6% (Example) |

| 2022 | $2700.00 | $1900.00 | -20.6% (Example) |

| 2023 | $2600.00 | $2000.00 | +10.0% (Example) |

Note: These are example figures and should be replaced with actual data from a reliable source.

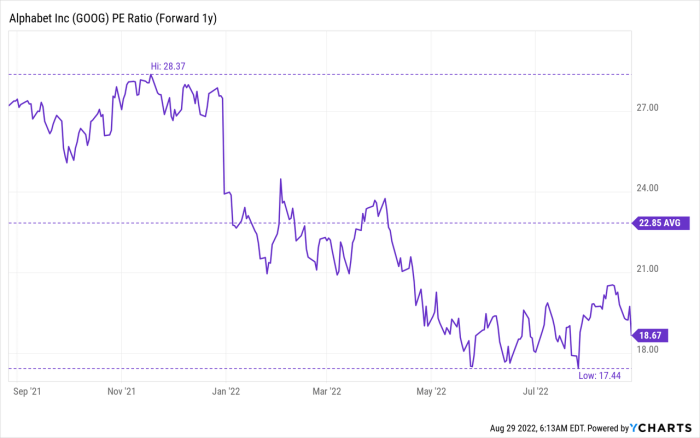

Factors Influencing Google’s Stock Price

Source: seekingalpha.com

Several interconnected factors influence Google’s stock valuation. Macroeconomic conditions, Google’s financial performance, investor sentiment, and market trends all play crucial roles.

- Macroeconomic Factors: Inflation, interest rates, and overall economic growth directly impact investor confidence and risk appetite, affecting Google’s stock price.

- Financial Performance: Revenue growth, profit margins, and earnings per share (EPS) are key indicators of Google’s financial health, driving investor interest and influencing the stock price.

- Investor Sentiment and Market Trends: Positive news, technological advancements, and overall market trends can boost investor confidence, leading to price increases. Conversely, negative news or market downturns can depress the stock price.

- Hypothetical Scenario: A significant increase in interest rates, coupled with a slowdown in advertising revenue, could negatively impact Google’s stock price, potentially leading to a substantial decline.

Google’s Business Model and Stock Price, Google stock price

Source: seekingalpha.com

Understanding Google’s business model is essential for assessing its stock price. The company’s diverse revenue streams and strategic initiatives significantly influence investor perception.

- Core Business Segments: Google’s primary revenue sources include advertising (Search, YouTube), Cloud services, and other ventures (hardware, software).

- Impact of Business Strategy: New product launches, successful acquisitions, and expansion into new markets can boost investor confidence and increase the stock price.

- Comparison with a Competitor: Comparing Google’s business model with that of a competitor like Microsoft, highlights differences in revenue streams and strategic focus, influencing their respective stock valuations.

- Visual Representation of Revenue Streams: Imagine a pie chart. The largest slice represents advertising revenue (Search and YouTube), followed by a smaller slice for Cloud services, and a few smaller slices for other revenue streams. The size of each slice fluctuates based on the performance of each segment, directly impacting the overall stock price.

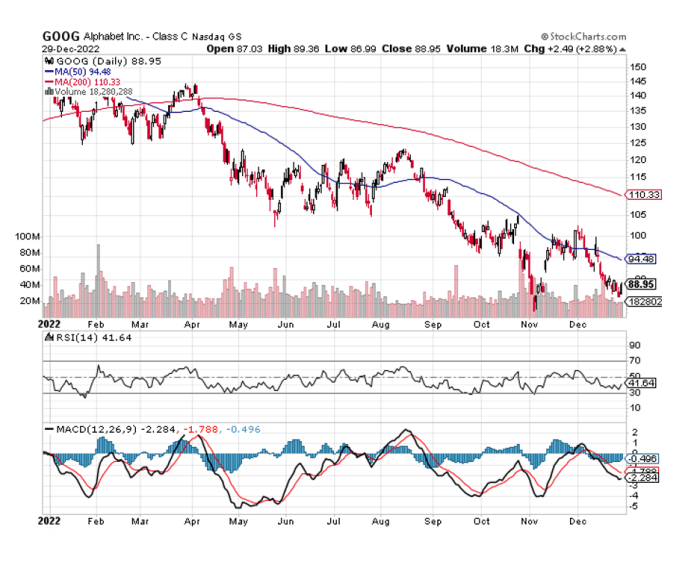

Analyzing Google Stock Price Predictions

Source: ntaskmanager.com

Predicting Google’s future stock price involves employing various methods, each with its strengths and limitations.

- Technical Analysis: This method uses historical price and volume data to identify patterns and predict future price movements. It can be useful for short-term trading but is less reliable for long-term predictions.

- Fundamental Analysis: This approach involves assessing Google’s financial health, business model, and competitive landscape to determine its intrinsic value. It is generally more suitable for long-term investment decisions.

- Accuracy and Limitations: Both methods have limitations. Technical analysis can be subjective and prone to false signals, while fundamental analysis requires extensive research and may not always accurately predict short-term fluctuations.

- Risks and Uncertainties: Predicting stock prices inherently involves risks. Unforeseen events, market volatility, and changes in Google’s business environment can significantly impact its stock price, rendering predictions inaccurate.

Google’s Stock Price and Investment Strategies

Different investment strategies approach Google’s stock differently, based on risk tolerance and investment horizons.

- Long-Term Investing: This strategy involves holding Google stock for an extended period, aiming to benefit from its long-term growth potential. It is suitable for investors with a lower risk tolerance.

- Short-Term Trading: This approach focuses on short-term price fluctuations, aiming to profit from quick gains. It involves higher risk and requires a deeper understanding of market dynamics.

- Risks and Rewards: Long-term investing offers lower risk but potentially slower returns, while short-term trading offers higher potential returns but with significantly higher risk.

- Diversification: Diversifying an investment portfolio by including other assets reduces overall risk. Holding Google stock alongside other stocks, bonds, and real estate can mitigate potential losses.

- Hypothetical Investment Portfolio: A diversified portfolio might include 10% in Google stock, 20% in other technology stocks, 30% in bonds, and 40% in real estate. This allocation balances potential growth with risk mitigation.

Expert Answers: Google Stock Price

What are the major risks associated with investing in Google stock?

Like any stock, Google’s price is subject to market volatility. Economic downturns, increased competition, regulatory changes, and shifts in consumer behavior can all negatively impact its performance. Diversification within a larger investment portfolio is crucial to mitigate these risks.

How often does Google release its earnings reports?

Google (Alphabet Inc.) typically releases its quarterly earnings reports on a schedule announced in advance. These reports provide crucial insights into the company’s financial performance and often significantly impact its stock price.

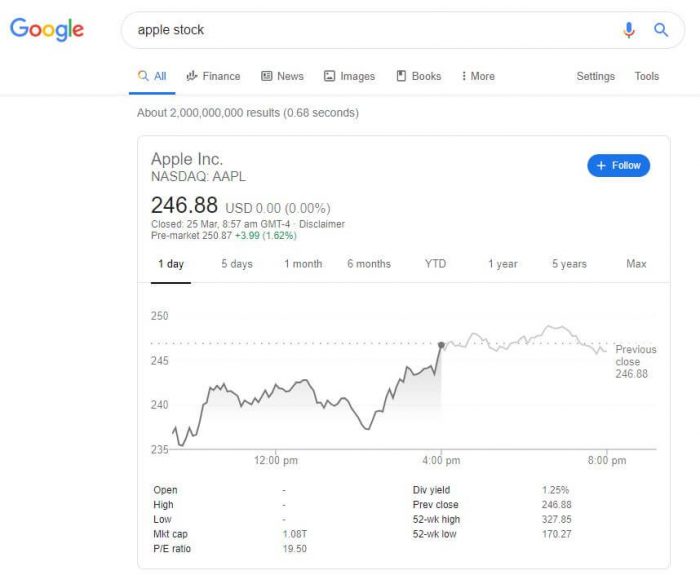

Where can I find real-time Google stock price data?

Real-time Google stock price data is readily available through numerous financial websites and brokerage platforms. Major financial news sources also provide up-to-the-minute quotes.

What is the current dividend yield for Google stock?

Google’s stock price performance often reflects broader market trends, but its trajectory isn’t always perfectly correlated with other tech giants. For instance, a comparison with the volatility seen in the tesla stock price highlights the diverse factors impacting individual company valuations. Ultimately, Google’s stock price is influenced by its own innovative output and competitive landscape.

Google’s dividend yield fluctuates and can be found on financial websites that provide real-time stock data. It’s important to note that dividend payouts are not guaranteed and can change.