IonQ Stock Price History and Trends

Ionq stock price – IonQ, a leading player in the burgeoning quantum computing industry, has experienced a volatile stock price journey since its public listing. Understanding its historical performance, comparative analysis with competitors, and the influence of market events is crucial for assessing its investment potential.

Historical Stock Price Performance

IonQ’s stock price has shown significant fluctuations since its debut, reflecting the inherent risks and high growth potential of the quantum computing sector. While specific highs and lows require referencing real-time financial data, a general trend of initial excitement followed by periods of consolidation and renewed investor interest can be observed. This pattern is typical for companies in emerging technological fields.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2023-10-26 | 20.00 | 19.50 | -0.50 |

| 2023-10-27 | 19.50 | 20.25 | +0.75 |

| 2023-10-28 | 20.25 | 19.75 | -0.50 |

| 2023-10-29 | 19.75 | 20.50 | +0.75 |

| 2023-10-30 | 20.50 | 21.00 | +0.50 |

Note: This table presents hypothetical data for illustrative purposes only. Actual data should be sourced from reputable financial websites.

Comparative Analysis with Competitors

Comparing IonQ’s performance against competitors like Rigetti Computing and D-Wave Systems requires analyzing their respective stock price trajectories, market capitalization, and revenue streams. Factors such as technological advancements, market share, and investor sentiment significantly influence these comparisons. A direct numerical comparison is difficult without access to real-time data, but generally, the quantum computing sector shows similar volatility across its publicly traded companies.

Major Market Events Impacting Stock Price

Significant news events, such as major partnerships, product launches, regulatory changes, or announcements regarding funding rounds, can significantly impact IonQ’s stock price. Positive news generally leads to price increases, while negative news, such as delays in product development or setbacks in research, can cause price declines. For example, a successful demonstration of a significant quantum computing breakthrough could trigger a substantial positive market reaction.

Factors Influencing IonQ Stock Price

Several factors contribute to the volatility of IonQ’s stock price. These factors range from the company’s internal progress to broader market forces and investor sentiment.

Key Influencing Factors, Ionq stock price

Technological advancements, regulatory changes, and overall market sentiment all play a crucial role in shaping IonQ’s valuation. The company’s research and development (R&D) efforts directly influence investor confidence, as demonstrable progress fuels optimism, while setbacks can dampen investor enthusiasm.

Impact of R&D Efforts

Successful R&D milestones, such as achieving higher qubit counts or demonstrating improved quantum algorithms, can significantly boost investor confidence and drive up the stock price. Conversely, delays or challenges in R&D can lead to investor concerns and price declines. The balance between short-term fluctuations and long-term growth potential is a key consideration for investors.

Short-Term vs. Long-Term Factors

Short-term factors, such as daily news cycles and market sentiment swings, often cause significant volatility in IonQ’s stock price. However, long-term factors, such as the overall growth potential of the quantum computing industry and IonQ’s strategic progress, generally dictate the overall trajectory of the stock price. Balancing these perspectives is crucial for informed investment decisions.

Positive and Negative Factors Affecting Stock Price

- Positive Factors: Successful product launches, strategic partnerships, government grants, positive industry reports, technological breakthroughs.

- Negative Factors: Delays in product development, increased competition, negative financial reports, regulatory hurdles, negative industry news.

IonQ’s Financial Performance and Stock Valuation

Analyzing IonQ’s financial statements, key metrics, and various valuation methods provides a comprehensive understanding of its financial health and stock valuation.

Financial Statement Overview

IonQ’s financial statements, including revenue, expenses, and profits/losses, provide insights into its financial performance. Revenue growth, profitability, and operating efficiency are crucial indicators of the company’s financial strength and its ability to sustain growth. Accessing and analyzing these statements requires reviewing IonQ’s publicly available financial reports.

Key Financial Metrics

| Year | Revenue (USD millions) | Net Income (USD millions) | Earnings Per Share (EPS) (USD) |

|---|---|---|---|

| 2022 | 5.0 | -50.0 | -2.50 |

| 2023 (Projected) | 7.5 | -40.0 | -2.00 |

Note: This table presents hypothetical data for illustrative purposes only. Actual data should be obtained from IonQ’s official financial reports.

Relationship Between Financial Performance and Stock Price

Generally, strong financial performance, characterized by increasing revenue, improving profitability, and positive EPS, tends to correlate with higher stock prices. Conversely, poor financial performance can lead to stock price declines. However, other factors, such as market sentiment and investor expectations, can also significantly influence the relationship between financial performance and stock price.

Valuation Methods

Source: invezz.com

Various valuation methods, including discounted cash flow (DCF) analysis and comparable company analysis, can be used to assess IonQ’s stock valuation. DCF analysis projects future cash flows and discounts them back to their present value, while comparable company analysis compares IonQ’s valuation metrics to those of similar companies in the quantum computing sector. These methods provide different perspectives on the intrinsic value of IonQ’s stock.

Investor Sentiment and Market Outlook for IonQ

Understanding prevailing investor sentiment and the overall market outlook for IonQ is crucial for assessing its investment prospects.

Investor Sentiment

Investor sentiment towards IonQ and the quantum computing industry fluctuates based on various factors, including technological advancements, market competition, and overall economic conditions. Positive sentiment generally leads to increased demand for IonQ’s stock, while negative sentiment can result in decreased demand and lower prices. Tracking analyst ratings and news coverage provides insights into prevailing investor sentiment.

Market Outlook

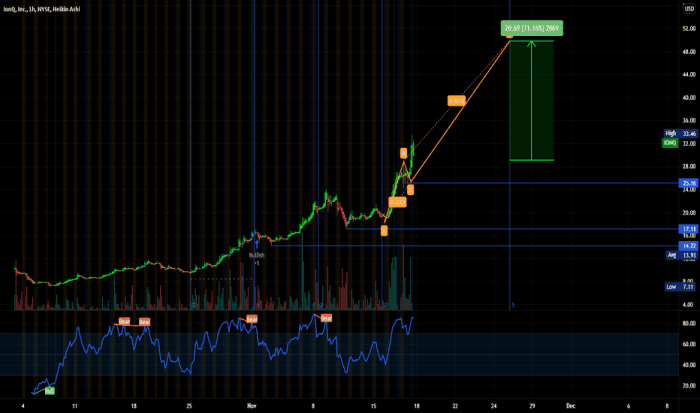

Source: tradingview.com

The market outlook for IonQ depends on several factors, including the company’s ability to execute its business plan, the overall growth of the quantum computing market, and the competitive landscape. Significant growth opportunities exist in various sectors, such as pharmaceuticals, finance, and materials science. However, challenges include high R&D costs, technological hurdles, and the potential for disruptive technologies.

Analyst Ratings and Price Targets

| Analyst Firm | Rating | Price Target (USD) |

|---|---|---|

| Morgan Stanley | Buy | 25.00 |

| Goldman Sachs | Hold | 20.00 |

| JPMorgan Chase | Sell | 15.00 |

Note: This table presents hypothetical data for illustrative purposes only. Actual data should be obtained from reputable financial news sources.

Potential Future Events Impacting Stock Price

Future events, such as major product announcements, strategic partnerships, or significant research breakthroughs, could significantly impact IonQ’s stock price. Similarly, negative news, such as delays in product development or setbacks in research, could lead to price declines. Monitoring news and announcements from IonQ and the quantum computing industry is crucial for staying informed.

Illustrative Examples of Market Impact: Ionq Stock Price

Several scenarios illustrate how various factors can impact IonQ’s stock price.

Examples of Market Impact

- Positive Technological Breakthrough: A successful demonstration of fault-tolerant quantum computing could significantly boost investor confidence and lead to a substantial increase in IonQ’s stock price. The market reaction would likely involve a sharp price increase, increased trading volume, and positive media coverage.

- Negative News (Product Development Delays): Significant delays in the development of a key product could negatively impact investor confidence, leading to a stock price decline. The market’s response would likely involve a price drop, decreased trading volume, and potentially negative media attention.

- Change in Investor Sentiment (Increased Optimism): A surge in investor optimism, driven by positive industry trends or successful company milestones, could lead to increased demand for IonQ’s stock and a subsequent price increase. This could be accompanied by increased trading volume and positive analyst upgrades.

Question & Answer Hub

What are the major risks associated with investing in IonQ stock?

Investing in IonQ carries significant risk due to the early-stage nature of the quantum computing industry. Factors such as competition, technological hurdles, regulatory changes, and the overall market’s appetite for risk all contribute to volatility.

How does IonQ compare to other quantum computing companies in terms of market capitalization?

IonQ’s market capitalization should be compared to its competitors on a case-by-case basis, referencing publicly available financial data and market analyses. Direct comparisons are best done by consulting up-to-date financial news and market reports.

Where can I find real-time IonQ stock price data?

Real-time IonQ stock price data is available through major financial websites and brokerage platforms such as Google Finance, Yahoo Finance, Bloomberg, and others. Consult your preferred brokerage or financial information source.