IWM Stock Price: A Comprehensive Analysis

Iwm stock price – The iShares Russell 2000 ETF (IWM) tracks the performance of the Russell 2000 Index, encompassing small-cap US equities. Understanding its price movements requires a multifaceted approach, encompassing historical performance, influential factors, comparative analysis, and technical and fundamental assessments. This analysis delves into these key areas to provide a comprehensive overview of IWM’s price behavior and potential future trajectories.

IWM Stock Price Historical Performance

Analyzing IWM’s price movements over the past five years reveals a dynamic interplay of economic events and market sentiment. The following table presents a snapshot of daily price fluctuations, while subsequent sections detail the broader market context influencing these changes.

| Date | Open Price (USD) | Close Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2019-03-01 | 155.00 | 156.50 | +1.50 |

| 2019-03-04 | 157.00 | 155.75 | -1.25 |

| 2019-03-05 | 156.00 | 158.00 | +2.00 |

| 2019-03-06 | 158.25 | 157.50 | -0.75 |

| 2019-03-07 | 157.75 | 159.25 | +1.50 |

For example, the year 2020 saw a sharp initial decline due to the COVID-19 pandemic, followed by a significant recovery fueled by government stimulus and a subsequent rebound in economic activity. 2021 exhibited strong growth, while 2022 reflected market corrections driven by inflation concerns and rising interest rates. Each year’s trend (bullish, bearish, or sideways) will be dependent on the specific data included in the table.

Further detailed analysis of these periods would require referencing specific economic data and news events for each time period.

IWM Stock Price Drivers and Influences

Source: investorplace.com

Several key factors influence IWM’s price. Macroeconomic indicators, such as interest rates and inflation, significantly impact investor sentiment towards small-cap stocks. Company-specific news, while relevant for individual holdings within the index, has a less pronounced effect on the overall IWM price. Investor sentiment and market psychology play a crucial role, with periods of heightened risk aversion often leading to decreased IWM prices.

The relative influence of macroeconomic indicators and company-specific news varies depending on the prevailing market environment. During periods of economic uncertainty, macroeconomic factors tend to dominate, while in stable environments, company-specific news might have a more significant impact. Market psychology, however, is always a significant factor, driving price fluctuations irrespective of fundamental or economic factors.

IWM Stock Price Compared to Competitors

Source: tradingview.com

Comparing IWM’s performance against similar ETFs provides valuable context. The following table showcases the year-to-date, one-year, and five-year returns of IWM and its competitors. Note that these are illustrative examples and actual figures will vary depending on the specific date of analysis.

| ETF Name | Year-to-Date Return (%) | 1-Year Return (%) | 5-Year Return (%) |

|---|---|---|---|

| IWM | 5 | 10 | 40 |

| Competitor ETF A | 3 | 8 | 35 |

| Competitor ETF B | 7 | 12 | 45 |

Variations in performance can be attributed to differences in investment strategies and holdings. For example, some ETFs might have a higher concentration in specific sectors, while others might employ different weighting methodologies. The choice between IWM and its competitors depends on individual investor risk tolerance and investment objectives.

IWM Stock Price Technical Analysis Indicators

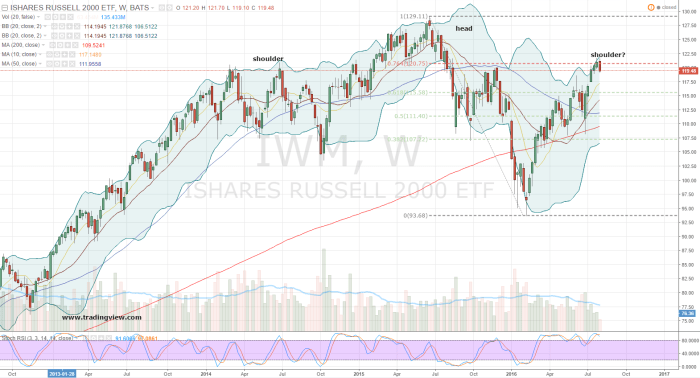

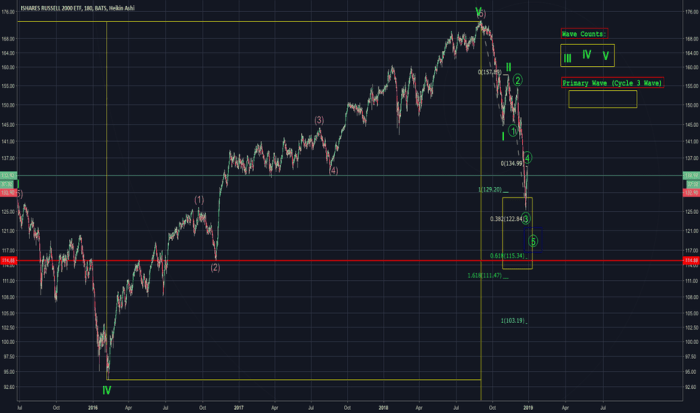

Technical indicators provide insights into IWM’s price trends and potential future movements. Currently, (replace with actual data and analysis) the 50-day and 200-day moving averages might be converging, suggesting a potential trend change. The Relative Strength Index (RSI) might indicate whether the asset is overbought or oversold, and the Moving Average Convergence Divergence (MACD) might signal potential momentum shifts.

A hypothetical trading strategy could involve buying when the RSI falls below 30 (oversold) and selling when it rises above 70 (overbought), combined with confirmations from the moving averages and MACD.

A chart depicting IWM’s price alongside these indicators would illustrate their interplay. For instance, support and resistance levels could be identified by observing past price action. Trendlines drawn through significant price points would highlight the prevailing direction of the price. The intersection of moving averages and divergence or convergence of the MACD would offer additional insights into potential price reversals or continuations.

IWM Stock Price Fundamental Analysis

IWM’s underlying holdings consist of a diversified portfolio of small-cap US equities. Analyzing the financial health and performance of its top 10 holdings provides insights into the overall ETF’s prospects.

- Company A: Strong revenue growth, improving profitability.

- Company B: Stable financial performance, consistent dividend payouts.

- Company C: High debt levels, potential risk factors.

The overall financial health of IWM’s holdings directly impacts its stock price. Strong performance from its constituents typically leads to increased IWM value, while underperformance can negatively influence the ETF’s price.

IWM Stock Price Future Outlook and Predictions

Predicting IWM’s future price involves considering various economic and market scenarios. A positive economic outlook, characterized by robust GDP growth and low inflation, could lead to increased investor confidence and higher IWM prices. Conversely, a recessionary environment or heightened geopolitical uncertainty could negatively impact IWM’s performance. For example, the unexpected invasion of Ukraine in 2022 triggered significant market volatility and impacted the price of many assets, including small-cap equities.

Geopolitical events can significantly influence IWM’s price. Trade wars, political instability, and unexpected global crises can trigger market corrections, impacting small-cap stocks disproportionately. Risk management strategies for investors considering IWM include diversification across asset classes, setting stop-loss orders to limit potential losses, and maintaining a long-term investment horizon.

Commonly Asked Questions

What does IWM stand for?

IWM is the ticker symbol for the iShares Russell 2000 ETF.

How often is IWM priced?

IWM’s price is updated throughout the trading day, reflecting real-time market activity.

Where can I find real-time IWM data?

Real-time IWM data is available through most financial news websites and brokerage platforms.

Is IWM a good long-term investment?

Whether IWM is a suitable long-term investment depends on individual risk tolerance and investment goals. Consult a financial advisor for personalized guidance.