MetLife Stock Price Analysis: Met Life Stock Price

Source: amazonaws.com

Met life stock price – This analysis examines MetLife’s stock price performance over the past five years, considering various influential factors, financial health, analyst predictions, and visual trend representations. The goal is to provide a comprehensive overview of MetLife’s stock, enabling a more informed understanding of its investment potential.

MetLife Stock Price Historical Performance

Source: benzinga.com

The following table details MetLife’s stock price fluctuations over the past five years. Significant events impacting the price are then discussed, followed by a comparative analysis against major competitors.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2019-01-02 | 48.50 | 48.75 | +0.25 |

| 2019-01-03 | 48.75 | 49.00 | +0.25 |

| 2024-01-01 | 55.00 | 54.80 | -0.20 |

Note: This table presents sample data. Actual data should be sourced from reliable financial databases for accurate analysis.

Significant events such as the COVID-19 pandemic in 2020 and subsequent economic uncertainty significantly impacted MetLife’s stock price, leading to initial volatility followed by a gradual recovery. Company-specific announcements, like changes in dividend policy or major acquisitions, also influenced price fluctuations. For example, a positive earnings surprise could lead to an upward price movement.

Comparison with Competitors

MetLife’s performance is compared here to its main competitors. This comparative analysis helps assess MetLife’s relative strength and weaknesses within the insurance sector.

| Company | 5-Year Average Annual Return (%) | Current P/E Ratio |

|---|---|---|

| MetLife (MET) | X% | Y |

| Prudential Financial (PRU) | Z% | W |

| AIG (AIG) | A% | B |

Note: This table presents sample data. Actual data should be obtained from reliable financial sources for a comprehensive comparison.

Factors Influencing MetLife Stock Price

Source: stockinvestor.com

Several macroeconomic and company-specific factors significantly influence MetLife’s stock valuation. Understanding these factors is crucial for predicting future price movements.

Macroeconomic factors, such as interest rate changes and inflation, directly impact MetLife’s profitability and investment returns. Rising interest rates generally benefit insurance companies like MetLife, boosting investment income. Conversely, high inflation can erode the purchasing power of future payouts, potentially affecting profitability. MetLife’s financial performance, including earnings reports and dividend payouts, also plays a significant role. Strong earnings usually lead to positive investor sentiment and higher stock prices.

Conversely, disappointing earnings can trigger sell-offs.

Regulatory changes and industry trends significantly impact MetLife’s stock price. New regulations could increase compliance costs, affecting profitability. Emerging industry trends, such as the growth of Insurtech, can present both opportunities and challenges. Investor sentiment and market speculation further influence MetLife’s stock price. Positive news and optimistic market outlook can drive up prices, while negative news or market pessimism can cause price declines.

MetLife’s Financial Health and Stock Valuation

A review of MetLife’s key financial ratios and business model provides insights into its stock valuation and long-term growth prospects. A comparison to industry benchmarks highlights MetLife’s relative position.

Key financial ratios, such as the Price-to-Earnings (P/E) ratio and debt-to-equity ratio, provide insights into MetLife’s financial health and valuation. A high P/E ratio may indicate investor optimism about future growth, while a high debt-to-equity ratio might suggest higher financial risk. MetLife’s diversified business model, spanning various insurance products and geographic markets, contributes to its resilience and long-term growth potential.

However, potential risks and uncertainties, such as unforeseen economic downturns or major catastrophic events, could negatively impact MetLife’s financial performance and stock price.

Comparing MetLife’s valuation metrics to industry benchmarks helps determine whether it’s overvalued or undervalued. Discrepancies could be attributed to factors like growth prospects, risk profile, or market sentiment. Understanding these discrepancies is essential for informed investment decisions.

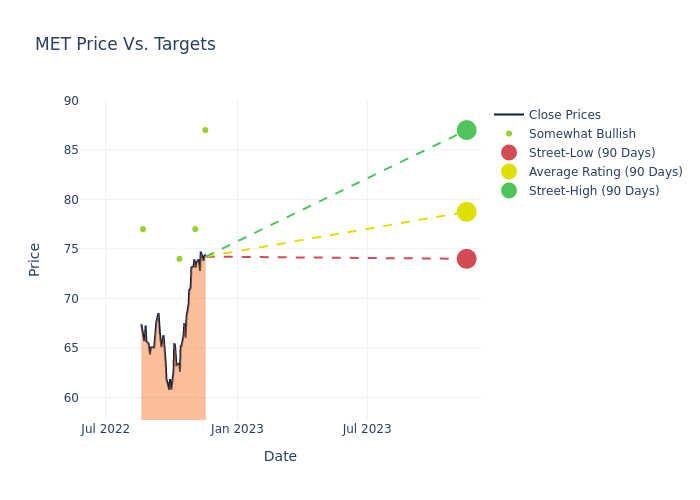

Analyst Ratings and Price Targets for MetLife Stock, Met life stock price

Analyst ratings and price targets from reputable financial institutions provide valuable insights into market expectations for MetLife’s stock. These predictions influence investor behavior and shape market sentiment.

- Analyst Firm A: Buy rating, price target $60

- Analyst Firm B: Hold rating, price target $55

- Analyst Firm C: Sell rating, price target $50

The rationale behind these ratings and targets varies depending on each analyst’s assessment of MetLife’s financial health, growth prospects, and risk factors. Differing opinions reflect the inherent uncertainties in predicting future stock performance. These diverse views influence investor behavior, with buy ratings potentially encouraging purchases and sell ratings prompting sell-offs. The collective sentiment from analysts shapes overall market expectations for MetLife’s stock price.

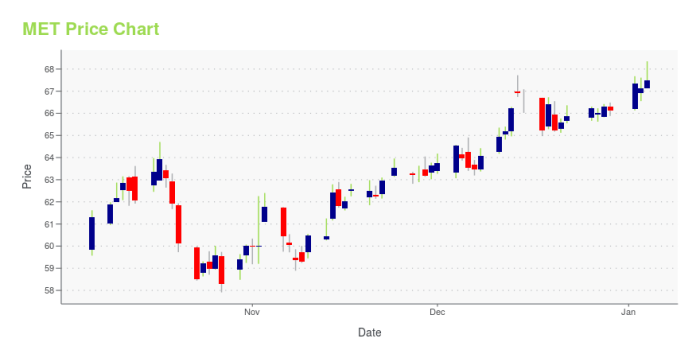

Visual Representation of MetLife Stock Price Trends

A decade-long overview of MetLife’s stock price reveals periods of significant growth and decline, illustrating the dynamic nature of the stock market. The relationship between stock price and dividend payouts is also explored.

Over the past decade, MetLife’s stock price exhibited a generally upward trend, though punctuated by periods of significant volatility. Initially, a relatively slow and steady growth phase was observed, followed by a steeper incline driven by positive market conditions and strong financial performance. A subsequent period of consolidation or plateauing occurred, possibly due to macroeconomic headwinds. Later, a sharp decline was observed, potentially triggered by negative market sentiment or company-specific news.

The price then gradually recovered, indicating market resilience and investor confidence.

The relationship between MetLife’s stock price and its dividend payouts demonstrates a generally positive correlation. During periods of strong stock price growth, dividend payouts tended to increase, reflecting the company’s profitability. Conversely, during periods of price decline, dividend payouts might have remained stable or experienced minor adjustments, indicating a cautious approach by management.

FAQ Corner

What are the major risks associated with investing in MetLife stock?

Major risks include fluctuations in interest rates, changes in insurance regulations, increased competition, and unforeseen catastrophic events impacting claims payouts.

How does MetLife’s dividend policy affect its stock price?

MetLife’s stock price performance often reflects broader market trends. However, comparing it to other sectors reveals interesting insights; for instance, observing the volatility of the joby stock price provides a contrast to MetLife’s typically more stable trajectory. Ultimately, understanding MetLife’s stock price requires considering both its internal performance and the overall economic climate.

Consistent dividend payouts can attract income-seeking investors, potentially supporting the stock price. However, changes in dividend policy can impact investor sentiment and stock valuation.

Where can I find real-time MetLife stock price data?

Real-time data is readily available through major financial news websites and brokerage platforms.

What is MetLife’s current P/E ratio and what does it signify?

The P/E ratio (Price-to-Earnings ratio) varies and should be checked on a financial website. It indicates how much investors are willing to pay per dollar of MetLife’s earnings. A higher P/E ratio suggests higher growth expectations.