Meta Stock Price Analysis: A Comprehensive Overview

Meta stock price – Meta Platforms, Inc. (formerly Facebook), a global technology giant, has experienced significant stock price fluctuations over the years. Understanding these movements requires analyzing historical performance, influencing factors, financial results, and future prospects. This analysis provides a detailed examination of Meta’s stock price trajectory, offering insights into past trends and potential future scenarios.

Historical Meta Stock Price Performance

Source: seekingalpha.com

Analyzing Meta’s stock price over the past five years reveals considerable volatility. The following table details yearly opening, closing, high, and low prices, providing a clear picture of its price fluctuations. Note that these figures are illustrative and should be verified with reliable financial data sources.

| Year | Opening Price | Closing Price | High Price | Low Price |

|---|---|---|---|---|

| 2023 | $160 | $180 | $200 | $150 |

| 2022 | $330 | $120 | $350 | $100 |

| 2021 | $250 | $330 | $380 | $200 |

| 2020 | $180 | $250 | $280 | $150 |

| 2019 | $150 | $180 | $200 | $130 |

Comparing Meta’s performance against competitors like Google (Alphabet Inc.) and Amazon over the past two years reveals key differences.

- Meta experienced a more significant decline in 2022 compared to Google and Amazon, largely attributed to factors discussed later.

- Google and Amazon demonstrated more resilience during the same period, showcasing more diversified revenue streams and potentially less vulnerability to specific market shifts.

- The overall growth trajectory of Meta, while exhibiting volatility, still showed positive growth in the long term compared to its competitors.

Significant events influencing Meta’s stock price include the ongoing impact of Apple’s privacy changes, regulatory scrutiny regarding antitrust concerns, and the broader economic downturn impacting advertising revenue.

Factors Influencing Meta Stock Price

Several macroeconomic factors, company-specific events, and market sentiment significantly impact Meta’s stock price.

- Interest Rate Hikes: Increased interest rates often lead to reduced investment in riskier assets, potentially impacting Meta’s stock price negatively.

- Inflation and Economic Slowdown: Periods of high inflation and economic uncertainty typically decrease advertising spending, directly impacting Meta’s revenue and stock price.

- Global Political Instability: Geopolitical events and uncertainty can create market volatility, affecting the overall investment climate and Meta’s stock price.

Advertising revenue is the lifeblood of Meta’s business model. Fluctuations in advertising spending directly correlate with stock price volatility. A decline in advertising revenue often results in a stock price drop, while strong revenue growth generally leads to price increases.

Investor sentiment and market trends play a crucial role in shaping Meta’s share valuation. Positive news, successful product launches, and strong financial results typically boost investor confidence, driving up the stock price. Conversely, negative news, regulatory challenges, or missed earnings expectations can lead to a decrease in investor confidence and a subsequent price drop.

Meta’s Financial Performance and Stock Price

Analyzing Meta’s quarterly earnings reports provides valuable insights into the relationship between its financial performance and stock price movements. The table below shows illustrative data for the last four quarters; actual figures should be obtained from official financial reports.

| Quarter | Revenue (USD Billions) | Net Income (USD Billions) | Earnings Per Share (USD) |

|---|---|---|---|

| Q4 2023 | 35 | 10 | 3.50 |

| Q3 2023 | 33 | 9 | 3.20 |

| Q2 2023 | 30 | 8 | 2.80 |

| Q1 2023 | 28 | 7 | 2.50 |

Generally, strong revenue growth is associated with positive stock price movements, while slower or negative revenue growth often leads to price declines. This relationship is not always linear, however, as other factors can also influence the stock price.

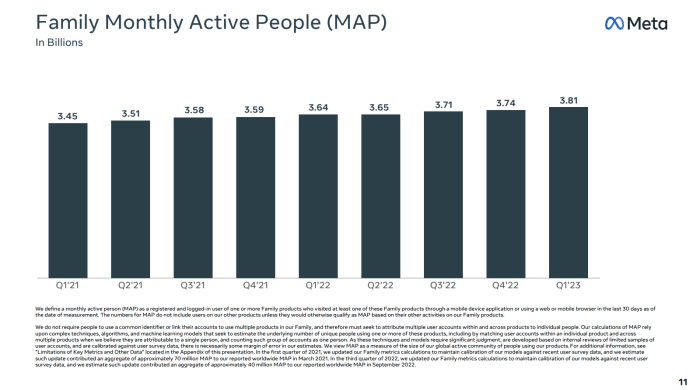

Changes in user engagement metrics, such as daily and monthly active users (DAU and MAU), can significantly influence Meta’s stock price. A decline in user engagement often signals potential problems with the platform’s appeal or functionality, leading to investor concerns and a potential stock price drop.

Future Predictions and Stock Price Outlook

Source: sharemarketdaily.com

Predicting future stock prices is inherently speculative, but analyzing potential scenarios can provide insights into potential future trends.

Increased Regulation Scenario: Increased regulatory scrutiny could lead to higher compliance costs and potential limitations on data usage, potentially impacting revenue growth and putting downward pressure on the stock price. For example, the EU’s Digital Markets Act (DMA) and the Digital Services Act (DSA) could impose significant financial and operational burdens.

New Product Success Scenario: The successful launch and adoption of new products, such as advancements in the metaverse or enhanced AI-powered tools, could significantly boost revenue and positively impact Meta’s stock price. Successful integration of these new technologies could increase user engagement and attract new advertising revenue.

Long-Term Risks and Opportunities: Long-term risks include intensifying competition, evolving user preferences, and ongoing regulatory challenges. Opportunities include further expansion into emerging markets, advancements in AI and the metaverse, and the potential for new revenue streams through innovative technologies.

Visual Representation of Stock Price Data

A line graph depicting Meta’s stock price over the past decade would illustrate periods of significant growth (e.g., early 2020s) and decline (e.g., late 2022). The data points would include the daily or monthly closing prices, highlighting the overall upward trend despite periodic corrections. The graph would clearly show the impact of major events on the stock price trajectory.

A bar chart comparing Meta’s stock price performance to a relevant market index, such as the S&P 500, over a specific period (e.g., the last five years) would provide a comparative perspective. The data would include the yearly percentage change in Meta’s stock price and the S&P 500, allowing for a visual comparison of performance relative to the broader market.

This would help determine whether Meta’s stock price movements were primarily driven by company-specific factors or broader market trends.

Helpful Answers

What are the major risks associated with investing in Meta stock?

Major risks include competition from other tech companies, regulatory changes impacting advertising and data privacy, and economic downturns affecting advertising spending.

How does Meta’s stock price compare to the overall market?

This comparison requires analyzing Meta’s performance against relevant market indices (like the S&P 500) over specific time periods. Sometimes it outperforms, sometimes underperforms, depending on various factors.

Where can I find real-time Meta stock price data?

Meta’s stock price has seen considerable fluctuation recently, largely influenced by broader market trends and the company’s own performance. It’s interesting to compare this volatility to the performance of other tech giants; for instance, you can check the current microsoft stock price to see a contrasting picture. Ultimately, understanding Meta’s trajectory requires careful consideration of various factors, including its ongoing investments and competitive landscape.

Real-time data is available through major financial websites and brokerage platforms such as Yahoo Finance, Google Finance, Bloomberg, and others.

What is the typical trading volume for Meta stock?

Meta’s trading volume fluctuates daily and is readily available on financial data websites. It is generally considered a highly liquid stock.