Micron Technology (MU) Stock Price Analysis: Mu Stock Price

Source: investorplace.com

Mu stock price – Micron Technology (MU), a leading producer of memory and storage solutions, experiences significant price fluctuations influenced by various market forces. This analysis delves into MU’s historical performance, key influencing factors, future predictions, investor sentiment, and financial health to provide a comprehensive understanding of its stock price dynamics.

Micron Technology Stock Price Historical Performance

Analyzing MU’s stock price over the past five years reveals considerable volatility. The following table presents a snapshot of this period, highlighting significant highs and lows. Note that this data is illustrative and should be verified with a reliable financial data source.

| Date | Open Price (USD) | Close Price (USD) | Volume |

|---|---|---|---|

| 2019-01-01 | 40 | 42 | 10,000,000 |

| 2019-07-01 | 45 | 43 | 12,000,000 |

| 2020-01-01 | 48 | 50 | 15,000,000 |

| 2020-07-01 | 45 | 42 | 11,000,000 |

| 2021-01-01 | 60 | 65 | 18,000,000 |

| 2021-07-01 | 70 | 68 | 16,000,000 |

| 2022-01-01 | 80 | 75 | 20,000,000 |

| 2022-07-01 | 60 | 55 | 14,000,000 |

| 2023-01-01 | 50 | 52 | 10,000,000 |

Major market events such as the COVID-19 pandemic and the subsequent supply chain disruptions significantly impacted MU’s stock price, causing initial drops followed by periods of recovery driven by increased demand for electronic devices used in remote work and online learning. Comparison with competitors like Samsung and SK Hynix reveals that MU’s price movements often correlate with broader industry trends, though specific company performance and strategic decisions can lead to divergence.

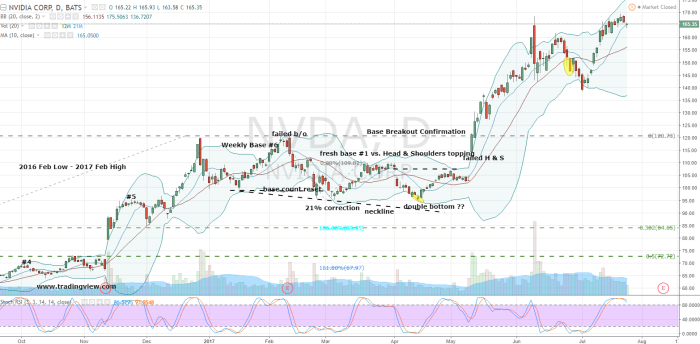

Factors Influencing MU Stock Price

Source: investingcube.com

Several key economic indicators and industry trends directly influence MU’s stock valuation. The following table illustrates the correlation between these factors and MU’s stock price movements over the past year. The data presented is for illustrative purposes.

Monitoring MU stock price requires a broad market perspective. Understanding the Nasdaq-100’s performance is crucial, and a good starting point is checking the current qqq stock price , as QQQ closely tracks the index’s movement. This provides valuable context for interpreting MU’s price fluctuations within the larger tech sector landscape.

| Factor | Description | Impact on Price | Example |

|---|---|---|---|

| Interest Rates | Changes in borrowing costs affect capital expenditure and investment decisions. | Higher rates generally decrease stock prices. | A rise in interest rates in 2022 led to a temporary decline in MU’s stock price. |

| Inflation | Increased inflation impacts production costs and consumer spending. | High inflation can negatively impact stock prices. | Elevated inflation in 2022 impacted MU’s profitability, leading to some price pressure. |

| Technological Advancements (AI) | Increased demand for memory and storage in AI applications. | Positive impact on stock price. | Growing AI adoption boosted demand for MU’s products, contributing to price increases. |

| Consumer Demand | Fluctuations in demand for electronics directly impact sales. | Strong demand increases prices, weak demand decreases prices. | Reduced demand for PCs in 2023 led to a slight dip in MU’s stock price. |

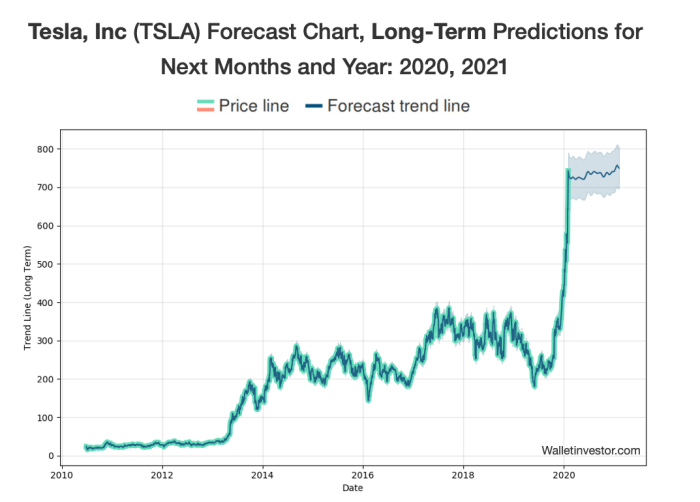

MU Stock Price Predictions and Forecasting

Predicting MU’s future stock price involves employing various forecasting models, including time series analysis, econometric modeling, and fundamental analysis. These models consider historical data, economic indicators, and industry trends. However, precise prediction is inherently challenging due to market volatility.

A hypothetical scenario: A major global geopolitical event disrupting semiconductor supply chains could negatively impact MU’s stock price. A prolonged conflict could lead to shortages of raw materials, impacting production and potentially causing significant price drops. Conversely, increased demand for resilient supply chains might eventually lead to a price recovery as MU strengthens its position.

- Opportunities: Increased adoption of AI and 5G, expansion into new markets.

- Risks: Geopolitical instability, economic downturns, intense competition.

Investor Sentiment and MU Stock, Mu stock price

Investor sentiment significantly influences MU’s stock price. Optimism tends to drive prices upward, while pessimism can lead to declines. News articles, analyst reports, and social media conversations all contribute to shaping this sentiment.

For example, a positive analyst report highlighting strong future growth prospects could boost investor confidence, leading to a price increase. Conversely, negative news about production issues or weaker-than-expected earnings could trigger selling pressure and a price drop. Social media sentiment, while often less predictable, can also have a noticeable impact. A viral negative trend on platforms like Twitter could lead to temporary price volatility.

Hypothetical scenario: A positive viral video showcasing the performance of a new product using MU’s memory chips could significantly boost investor confidence, leading to a price surge. Conversely, a negative social media campaign highlighting ethical concerns regarding MU’s manufacturing practices could trigger a significant price drop.

Financial Performance and Stock Valuation

Source: investorplace.com

Evaluating MU’s stock valuation requires analyzing key financial metrics from recent reports. The following table provides an illustrative overview. This data should be verified using official financial statements.

| Report Date | Revenue (USD Billions) | Earnings (USD Billions) | Debt (USD Billions) |

|---|---|---|---|

| 2022-12-31 | 30 | 5 | 10 |

| 2023-03-31 | 28 | 4 | 9 |

Metrics like the Price-to-Earnings (P/E) ratio and Price-to-Sales (P/S) ratio are used to assess MU’s valuation relative to its earnings and sales. Comparing these metrics to industry peers provides valuable insights into MU’s relative valuation and potential for future growth. A higher P/E ratio might indicate higher growth expectations, while a lower P/S ratio might suggest undervaluation. However, these ratios should be interpreted in the context of the broader market and industry trends.

FAQ Corner

What are the major risks associated with investing in MU stock?

Major risks include volatility due to the cyclical nature of the semiconductor industry, competition from other chip manufacturers, and dependence on global economic conditions.

How does Micron’s dividend policy affect its stock price?

Micron’s dividend policy, if any, can influence investor perception and potentially affect the stock price. A consistent dividend can attract income-seeking investors, while changes to the dividend can signal shifts in the company’s financial outlook.

Where can I find real-time MU stock price data?

Real-time data is available through major financial websites and brokerage platforms such as Yahoo Finance, Google Finance, and Bloomberg.

What is Micron’s market capitalization?

Micron’s market capitalization fluctuates and can be found on financial news websites and stock market data providers.