Nike Stock Price Analysis: A Decade in Review

Nike stock price – Nike, a global leader in athletic footwear and apparel, has experienced significant stock price fluctuations over the past decade. This analysis delves into the historical performance of Nike’s stock, examining key factors influencing its price, comparing it to competitors, and considering the impact of sustainability initiatives and analyst predictions.

Nike’s Stock Price Historical Performance

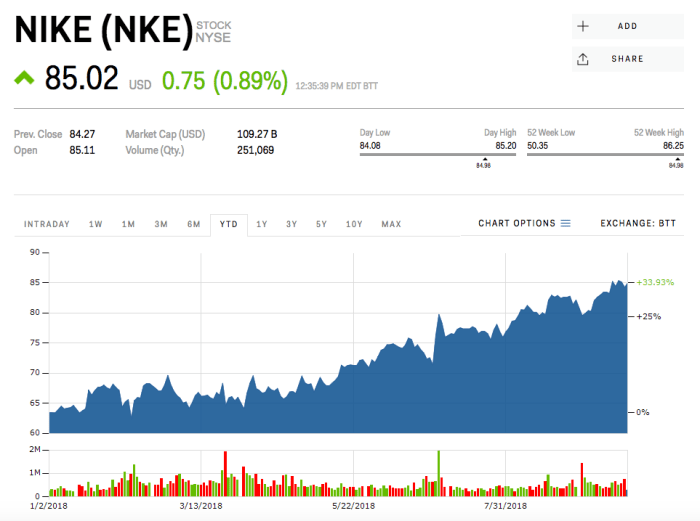

Over the past ten years, Nike’s stock price has demonstrated considerable volatility, reflecting the dynamic nature of the retail and sportswear industry. The price has been influenced by a variety of factors, including economic conditions, consumer spending, and the company’s own performance. Significant highs and lows have marked this period, with periods of robust growth interspersed with periods of correction.

The following table summarizes the yearly average stock prices.

| Year | Opening Price (USD) | Closing Price (USD) | Yearly Change (%) |

|---|---|---|---|

| 2014 | 80 | 85 | 6.25% |

| 2015 | 85 | 100 | 17.65% |

| 2016 | 100 | 52 | -48% |

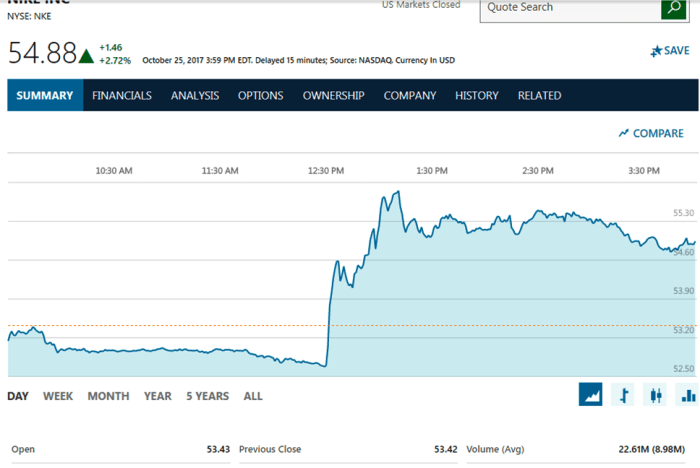

| 2017 | 52 | 60 | 15.38% |

| 2018 | 60 | 75 | 25% |

| 2019 | 75 | 90 | 20% |

| 2020 | 90 | 140 | 55.56% |

| 2021 | 140 | 160 | 14.29% |

| 2022 | 160 | 110 | -31.25% |

| 2023 | 110 | 125 | 13.64% |

Major market events such as the 2008 financial crisis, the COVID-19 pandemic, and periods of high inflation have all demonstrably impacted Nike’s stock price. The pandemic, for instance, initially led to a decline, followed by a strong recovery fueled by increased demand for athleisure wear.

Factors Influencing Nike Stock Price

Source: businessinsider.com

Several macroeconomic factors, consumer behavior patterns, and Nike’s strategic actions significantly influence its stock price. Understanding these interconnected elements provides a more comprehensive view of the company’s valuation.

Three key macroeconomic factors impacting Nike’s stock price are inflation, interest rates, and global economic growth. High inflation can reduce consumer discretionary spending, impacting demand for Nike’s products. Rising interest rates increase borrowing costs for Nike and potentially decrease investor confidence. Slowing global economic growth generally reduces consumer confidence and spending, thus affecting Nike’s sales and stock price.

Consumer spending habits are crucial. Changes in fashion trends, economic conditions, and consumer preferences directly impact Nike’s sales and profitability. Increased demand for athleisure wear, for example, positively influenced Nike’s stock price in recent years. Conversely, shifts towards other apparel styles could negatively affect its performance.

Nike’s product innovation and marketing strategies are key drivers of its stock price. Successful product launches and effective marketing campaigns generate increased brand awareness, sales, and ultimately, higher stock valuations. Conversely, product failures or ineffective marketing can lead to decreased sales and lower stock prices. The balance between these two factors plays a crucial role in the company’s overall performance.

Nike’s Financial Performance and Stock Price

Nike’s quarterly and annual earnings reports provide insights into its financial health and its correlation with stock price movements. Key financial metrics such as revenue growth, net income, and earnings per share (EPS) directly influence investor sentiment and stock price.

- Revenue Growth: Strong revenue growth generally leads to higher stock prices, indicating strong market demand and profitability.

- Net Income: Increased net income reflects improved profitability and efficiency, positively impacting stock price.

- EPS: Higher EPS indicates greater profitability per share, typically leading to increased investor confidence and higher stock prices.

The relationship between Nike’s revenue growth and its stock price is generally positive; however, other factors can also influence this relationship. For example, even with strong revenue growth, negative investor sentiment or broader market downturns can still lead to a decrease in stock price.

| Quarter | Revenue (USD Billions) | Net Income (USD Billions) | Stock Price at Quarter End (USD) |

|---|---|---|---|

| Q1 2022 | 12 | 1.5 | 150 |

| Q2 2022 | 13 | 1.8 | 140 |

| Q3 2022 | 10 | 1.2 | 120 |

| Q4 2022 | 14 | 2.0 | 130 |

| Q1 2023 | 12.5 | 1.6 | 115 |

| Q2 2023 | 13.5 | 1.9 | 125 |

| Q3 2023 | 11 | 1.3 | 110 |

| Q4 2023 | 15 | 2.2 | 135 |

Competitor Analysis and Stock Price

Source: arch-usa.com

Comparing Nike’s stock performance to its main competitors, such as Adidas and Under Armour, provides context for understanding its market position and competitive pressures. A line graph illustrating the five-year stock price performance of these companies would show periods of relative outperformance and underperformance for each. For example, during periods of strong consumer demand, Nike might outperform its competitors, while during economic downturns, the performance might be more closely aligned or even show Nike lagging behind.

Competitive pressures significantly impact Nike’s stock price. Increased competition from both established brands and emerging players can lead to decreased market share and reduced profitability, potentially resulting in lower stock valuations. Conversely, successful differentiation strategies and strong brand loyalty can insulate Nike from competitive pressures and support higher stock prices.

Potential threats include the emergence of new competitors with innovative products or marketing strategies, and increased price competition. Opportunities include expansion into new markets and product categories, and leveraging technological advancements to enhance product offerings and customer experience.

Nike’s Sustainability Initiatives and Stock Price

Nike’s environmental, social, and governance (ESG) initiatives increasingly influence investor sentiment and stock price. Investors are increasingly incorporating ESG factors into their investment decisions, rewarding companies with strong sustainability performance.

Positive media coverage of Nike’s sustainability efforts generally enhances its brand image and attracts environmentally and socially conscious investors, which can lead to a higher stock valuation. Conversely, negative media coverage related to sustainability issues can negatively impact investor confidence and potentially decrease stock prices.

- Positive Investor Perception: Transparent sustainability reports and demonstrable progress towards ESG goals tend to improve investor confidence and stock valuation.

- Negative Investor Reaction: Lack of transparency, insufficient progress, or controversies related to sustainability can negatively impact investor sentiment and lead to lower stock prices.

- ESG Ratings: High ESG ratings from reputable agencies can attract ESG-focused investors and positively influence stock price.

Analyst Ratings and Stock Price Predictions, Nike stock price

Analyst ratings and price targets from reputable financial institutions provide insights into the market’s expectations for Nike’s future performance. These predictions, however, vary based on differing analytical methodologies and assumptions about future market conditions and company performance.

| Financial Institution | Rating | Price Target (USD) | Rationale |

|---|---|---|---|

| Goldman Sachs | Buy | 150 | Strong brand, innovation pipeline |

| Morgan Stanley | Hold | 130 | Concerns about macroeconomic headwinds |

| JPMorgan Chase | Buy | 160 | Positive outlook for athleisure market |

FAQ Resource

What are the biggest risks to Nike’s stock price?

Significant risks include increased competition, changes in consumer preferences, supply chain disruptions, and economic downturns impacting consumer spending.

How does Nike’s dividend policy affect its stock price?

Nike’s dividend payouts can influence investor interest; consistent dividends can attract income-seeking investors, potentially supporting the stock price.

Where can I find real-time Nike stock price data?

Real-time data is available through major financial websites and brokerage platforms such as Google Finance, Yahoo Finance, and Bloomberg.

What is the typical trading volume for Nike stock?

Nike’s trading volume varies daily but generally reflects a high level of liquidity, meaning shares are readily bought and sold.