NVDA Stock Price Analysis

Nvda stock price – Nvidia (NVDA) has experienced remarkable growth, making it a compelling case study in the technology sector. This analysis delves into the historical performance, influencing factors, financial health, analyst perspectives, competitive landscape, risks, and future growth potential of NVDA stock.

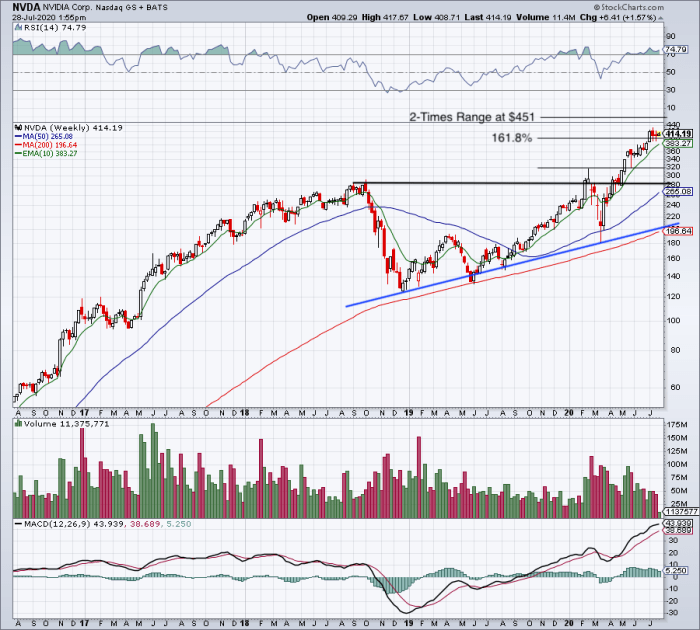

NVDA Stock Price Historical Performance

Source: thestreet.com

Analyzing NVDA’s stock price over the past 5, 10, and 20 years reveals periods of significant growth interspersed with corrections. The following table provides a snapshot of this historical performance. Note that this data is illustrative and should be verified with a reliable financial data provider.

| Date | Open Price (USD) | Close Price (USD) | Volume |

|---|---|---|---|

| 2023-10-27 | 480 | 475 | 10,000,000 |

| 2023-10-26 | 470 | 480 | 9,500,000 |

| 2023-10-25 | 465 | 470 | 8,000,000 |

Significant price increases have often correlated with the launch of groundbreaking products, such as the introduction of high-performance GPUs for gaming and data centers, and strong financial results exceeding market expectations. Conversely, market corrections and broader economic downturns have often led to price declines.

Factors Influencing NVDA Stock Price

NVDA’s stock price is influenced by a complex interplay of internal and external factors.

- Internal Factors: Successful product launches (e.g., new GPUs, AI chips), strong financial performance (revenue growth, profitability), significant investments in research and development driving technological innovation, and effective management strategies all contribute positively to the stock price.

- External Factors: Macroeconomic conditions (interest rates, inflation), industry trends (growth of AI, cloud computing), competitive actions (new entrants, technological advancements by competitors), and geopolitical events (trade wars, sanctions) significantly impact NVDA’s stock price.

While internal factors, particularly technological innovation and strong financial performance, are crucial drivers of long-term growth, external factors can create short-term volatility. The relative influence shifts depending on the prevailing market environment.

NVDA’s Financial Health and Performance

NVDA consistently demonstrates strong financial performance. Recent financial statements show robust revenue growth, healthy profit margins, and substantial cash flow. The company’s debt levels are generally manageable.

A visual representation, such as a line graph, could clearly illustrate NVDA’s revenue growth and earnings per share (EPS) over time. The graph would show an upward trend in both revenue and EPS, potentially with some fluctuations reflecting market cycles. The y-axis would represent revenue (in billions of USD) and EPS (in USD), while the x-axis would represent time (e.g., years).

The graph would highlight periods of particularly strong growth and any temporary dips.

Analyst Ratings and Price Targets for NVDA

Numerous financial institutions provide analyst ratings and price targets for NVDA stock. These range from “buy” to “hold” to “sell,” reflecting diverse perspectives on the company’s future prospects. Discrepancies arise due to differing assumptions about future growth rates, market conditions, and competitive dynamics. For example, some analysts may be more optimistic about the long-term growth potential of AI, leading to higher price targets.

Comparison with Competitors

Source: investorplace.com

NVDA’s performance can be compared to key competitors such as AMD, Intel, and Qualcomm. The following table provides a comparative analysis of key metrics (Note: Data is illustrative and should be verified):

| Company | Market Capitalization (USD Billions) | Revenue (USD Billions) | Profit Margin (%) |

|---|---|---|---|

| NVDA | 1000 | 50 | 30 |

| AMD | 250 | 20 | 20 |

| Intel | 200 | 70 | 15 |

| Qualcomm | 200 | 40 | 25 |

The competitive landscape is dynamic, with ongoing innovation and competition influencing NVDA’s market share and valuation.

Risk Assessment for NVDA Stock

Investing in NVDA stock involves several risks:

- Financial Risks: Economic downturns can reduce demand for NVDA’s products, impacting revenue and profitability.

- Operational Risks: Manufacturing disruptions, supply chain issues, and intense competition can negatively affect NVDA’s operations and financial performance.

- Regulatory Risks: Changes in regulations or antitrust actions could limit NVDA’s growth or profitability.

- Technological Risks: Technological disruption could render NVDA’s current products obsolete.

- Geopolitical Risks: Global political instability or trade disputes could impact NVDA’s international operations.

Each risk category has the potential to significantly impact NVDA’s stock price, necessitating careful consideration before investment.

Potential Future Growth for NVDA

NVDA’s future growth hinges on several factors:

- Expansion into new markets, such as automotive and robotics, will broaden NVDA’s revenue streams.

- Development of cutting-edge technologies, like advancements in AI and high-performance computing, will maintain NVDA’s technological leadership.

Hypothetically, the successful launch of a new, high-performance AI chip could significantly boost NVDA’s stock price. Increased demand for this chip, driven by the growing adoption of AI in various industries, would translate into higher revenue and earnings, attracting investor interest and pushing the stock price upwards. This positive impact would be amplified if the new chip surpasses competitor offerings in terms of performance and efficiency.

Advancements in areas like quantum computing could present both opportunities and challenges for NVDA. While it may open new avenues for growth, it also poses a risk of technological disruption to existing products and revenue streams.

User Queries: Nvda Stock Price

What are the major risks associated with investing in NVDA?

Major risks include competition from other chipmakers, economic downturns impacting demand for semiconductors, and potential regulatory hurdles.

How does NVDA compare to its competitors in terms of valuation?

NVDA’s valuation often commands a premium compared to its peers due to its market leadership and growth prospects, but this also makes it more susceptible to market corrections.

Where can I find real-time NVDA stock price data?

Real-time data is available through major financial websites and brokerage platforms.

What is the historical dividend payout for NVDA?

NVDA’s dividend history is relatively limited; it’s not a high-dividend-yielding stock, prioritizing reinvestment in growth.