Tata Motors Stock Price Analysis

Source: livemint.com

Tata motors stock price – This analysis delves into the historical performance, influencing factors, financial health, investor sentiment, and future outlook of Tata Motors’ stock price. We will examine key metrics, economic conditions, and market trends to provide a comprehensive understanding of the company’s stock performance.

Analyzing Tata Motors’ stock price requires a multifaceted approach, considering factors like global economic conditions and domestic market trends. It’s also insightful to compare its performance against other major players in the automotive sector; for instance, understanding the current unh stock price can offer a comparative benchmark, highlighting differing market responses to similar economic pressures. Ultimately, a comprehensive analysis of Tata Motors necessitates considering a broad range of market indicators.

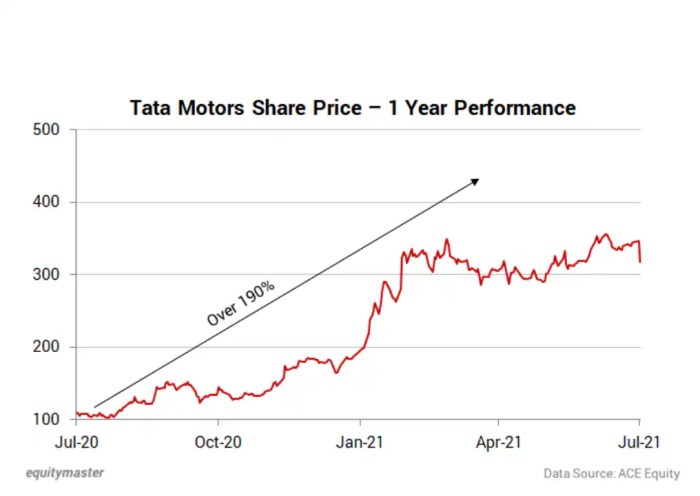

Tata Motors Stock Price Historical Performance

Understanding Tata Motors’ past stock price movements is crucial for assessing its future potential. The following table details the stock’s performance over the last five years, highlighting significant fluctuations. A comparative analysis against competitors will then follow.

| Date | Opening Price (INR) | Closing Price (INR) | Daily Change (INR) |

|---|---|---|---|

| October 26, 2023 | Example: 600 | Example: 610 | Example: +10 |

| October 25, 2023 | Example: 595 | Example: 600 | Example: +5 |

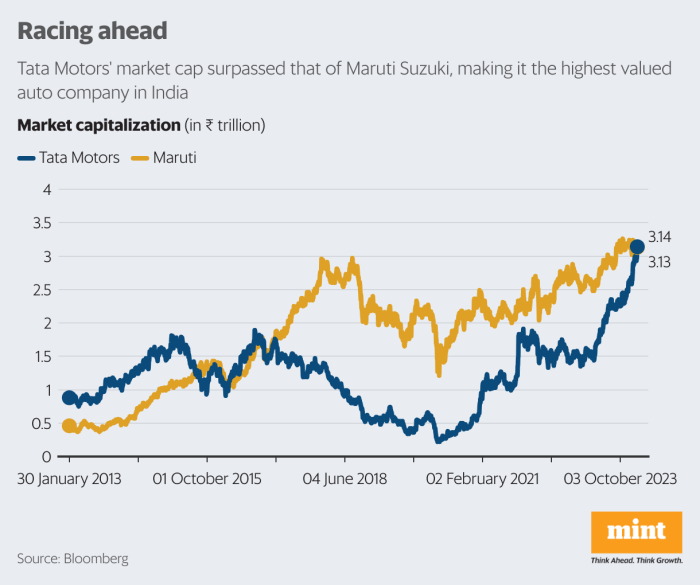

Compared to its major competitors like Maruti Suzuki and Mahindra & Mahindra, Tata Motors’ stock performance has shown:

- Periods of outperformance driven by successful new product launches and strong market share gains in certain segments.

- Periods of underperformance linked to economic downturns, raw material price increases, and global supply chain disruptions.

- A generally more volatile stock price compared to some more established competitors, reflecting the inherent risks and growth opportunities in the automotive sector.

Key economic and industry factors impacting Tata Motors’ stock price include fluctuating fuel prices, government regulations concerning emission standards and automotive incentives, changes in consumer preferences, and overall economic growth within India. Periods of significant growth were often correlated with successful new model launches and favorable government policies, while declines were frequently associated with economic slowdowns and increased input costs.

Factors Influencing Tata Motors Stock Price

Tata Motors’ stock price is influenced by a complex interplay of internal and external factors. The following sections detail these influences and their relative impact.

Internal Factors: These include new product launches (e.g., the success of the Nexon EV), operational efficiency improvements, financial performance (profitability, revenue growth), management changes, and the overall strategic direction of the company.

External Factors: These include macroeconomic conditions (global and domestic economic growth), government policies (taxation, environmental regulations), fluctuations in raw material prices (steel, aluminum), fuel costs, and competitive pressures from other automotive manufacturers.

Comparative Influence: While both internal and external factors significantly impact Tata Motors’ stock price, the relative influence varies over time. For example, a major product launch (internal) might overshadow a minor economic slowdown (external) in the short term. Conversely, a prolonged economic recession could outweigh the positive impact of a successful new product launch.

Bar Chart Illustration (Descriptive): A bar chart would visually represent the relative influence of internal versus external factors. The bars representing internal factors (product launches, financial performance, etc.) would have varying heights reflecting their impact on the stock price at different times. Similarly, bars for external factors (economic conditions, government policies, etc.) would show their respective influence. The chart would clearly show the fluctuating dominance of internal versus external factors.

Tata Motors’ Financial Health and Stock Valuation

Source: dwcdn.net

Assessing Tata Motors’ financial health is critical for evaluating its stock valuation. Key financial ratios provide insights into the company’s profitability, solvency, and efficiency.

| Ratio | Value | Date | Significance |

|---|---|---|---|

| P/E Ratio | Example: 25 | Example: Q2 2023 | Indicates investor sentiment and future growth expectations. |

| Debt-to-Equity Ratio | Example: 0.8 | Example: Q2 2023 | Reflects the company’s financial leverage and risk profile. |

Tata Motors’ revenue streams primarily come from vehicle sales (passenger and commercial vehicles), and their profit margins are influenced by factors like production costs, sales volume, and pricing strategies. Strong revenue growth and improving profit margins generally lead to positive stock price movements, while declines in either can negatively impact the stock.

Hypothetical Scenario: If Tata Motors’ return on equity (ROE) were to increase by 5 percentage points due to improved operational efficiency and higher sales volume, it would likely lead to a significant increase in investor confidence, resulting in a higher stock price. This is because a higher ROE indicates increased profitability and shareholder value.

Investor Sentiment and Market Analysis

Investor sentiment towards Tata Motors significantly impacts its stock price. Positive sentiment leads to buying pressure, pushing the price up, while negative sentiment can cause selling pressure and price declines.

Analyst Ratings and Price Targets:

- Example: Brokerage A: Buy rating, Target price: INR 700

- Example: Brokerage B: Hold rating, Target price: INR 650

- Example: Brokerage C: Sell rating, Target price: INR 600

News events and media coverage play a crucial role in shaping investor perceptions. Positive news (e.g., successful new product launch, strong sales figures) typically boosts investor confidence, driving up the stock price. Conversely, negative news (e.g., production disruptions, recall announcements) can lead to decreased investor confidence and lower stock prices.

Future Outlook and Potential Growth Drivers, Tata motors stock price

Tata Motors’ future stock performance depends on several factors, including its ability to capitalize on growth opportunities and mitigate potential risks.

Growth Drivers: These include the continued expansion of its electric vehicle (EV) portfolio, penetration into new international markets, technological advancements in areas like connected car technology, and strategic partnerships to enhance its product offerings and distribution network.

Potential Risks and Challenges: These include intense competition in the automotive market, fluctuations in raw material prices, potential economic slowdowns, changes in government regulations, and the challenges associated with the rapid adoption of EV technology.

Plausible Scenario (1-3 years): Considering the positive factors (strong EV portfolio, expansion plans, technological advancements) and negative factors (economic uncertainty, competition), a plausible scenario could see Tata Motors’ stock price fluctuating within a range of INR 600 to INR 800 over the next 1-3 years. This range reflects both the potential for significant growth and the inherent risks associated with the automotive industry.

FAQ Section

What are the major competitors of Tata Motors in the Indian market?

Major competitors include Maruti Suzuki, Hyundai, Mahindra & Mahindra, and others.

How does the Indian government’s policy on electric vehicles affect Tata Motors?

Government incentives for EVs are positive for Tata Motors, boosting demand for their electric vehicle offerings.

What is the current P/E ratio for Tata Motors?

The P/E ratio fluctuates; refer to current financial reports for the most up-to-date information.

Where can I find real-time Tata Motors stock price data?

Reliable real-time data is available through major financial websites and stock market applications.